Taylor Morrison Home (TMHC): Assessing Valuation After Economic Uncertainty and Mixed Growth Outlook

If you’ve been keeping an eye on Taylor Morrison Home (TMHC) lately, you’re not alone. The homebuilder’s stock has been in the spotlight after a mix of troubling economic news and company-specific challenges sparked renewed debate among investors. A sharp downward revision in U.S. job market data shook confidence in the economic outlook. Meanwhile, fresh forecasts for declining revenue and negative earnings growth at Taylor Morrison Home have left many wondering just how much risk is already built into the stock price.

Despite these headwinds, TMHC’s story isn’t one-sided. Over the past year, shares have drifted only modestly higher, notching a 1% gain. At the same time, the stock managed a quiet but meaningful 20% rally over the past three months. Recent developments, including completion of rental projects and continued strength in covering its debt obligations, add more layers to what is shaping up as a complex investment picture. However, persistent concerns about slumping demand and shrinking backlogs are weighing on the company’s outlook and could explain the relatively muted stock performance over a longer timeframe.

After this combination of mixed economic signals and a surprise rally, the big question is whether Taylor Morrison Home is quietly setting up as a value opportunity, or if investors should be cautious because future challenges are not fully reflected in today’s price.

Most Popular Narrative: 8.4% Undervalued

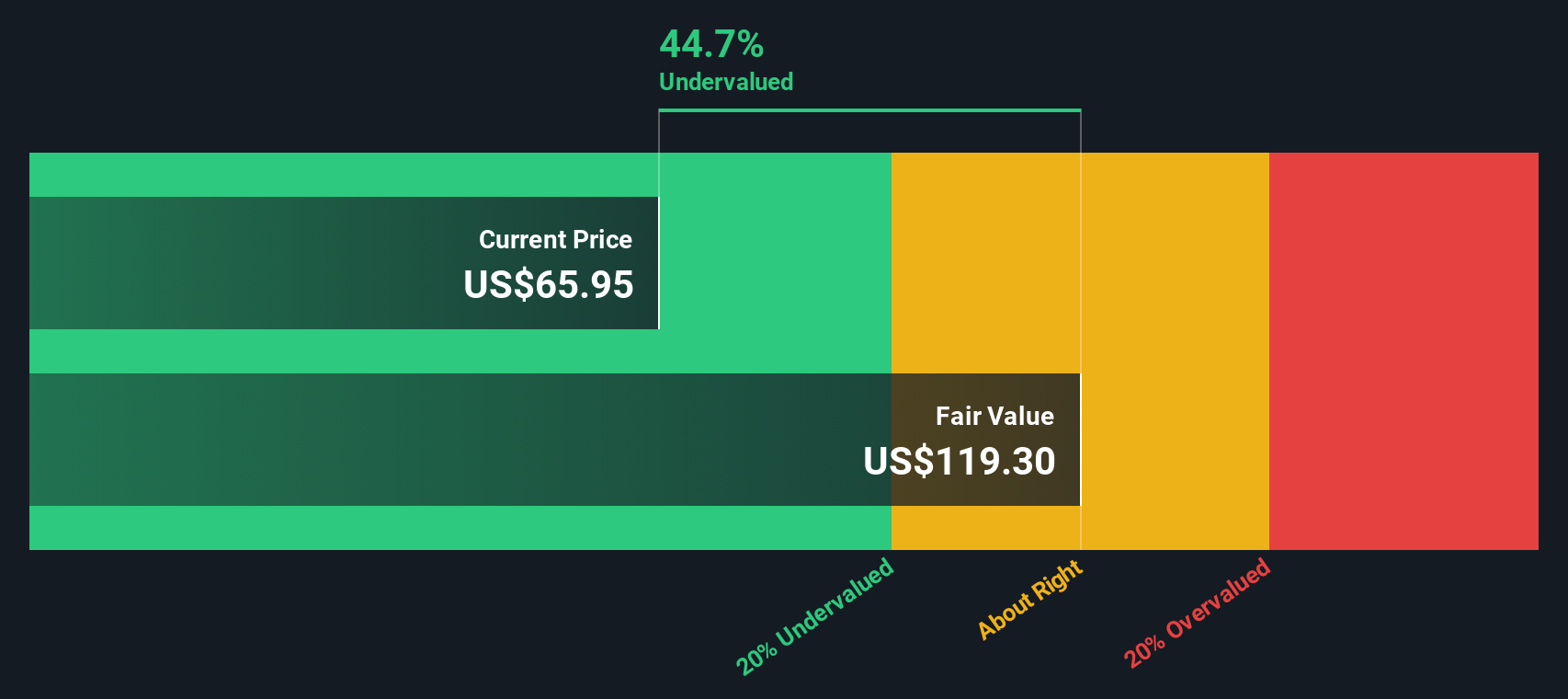

According to the most widely followed narrative, Taylor Morrison Home is currently undervalued by 8.4% based on consensus analyst assumptions and a discount rate of 8.41%. The narrative brings together forecasts of future earnings, revenue, and profit margins to arrive at this valuation.

"The company's well-diversified product portfolio (entry-level, move-up, resort lifestyle/Esplanade, and build-to-rent), focused in core submarkets, positions it to capitalize on broad consumer trends and migration/demographic shifts. This supports stable or growing revenue streams.

Significant investment in digital sales environments, cost controls, and operational/data analytics is driving SG&A leverage and reducing costs. These efforts support continued improvement in profit margins and return on equity over time."

Want to know what’s fueling this undervaluation call? There is a bold bet on the company’s future earnings power and a surprisingly optimistic take on profitability, yet only one crucial set of numbers really drives the price target higher. Curious how revenue declines and shifting profit margins are being squared with higher value? See what shock assumptions are built into the narrative’s final fair value.

Result: Fair Value of $76.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, resilient margins and a broadly diversified portfolio could still surprise on the upside if housing demand and operational efficiency are better than current expectations.

Find out about the key risks to this Taylor Morrison Home narrative.Another View: SWS DCF Model in Focus

Looking at Taylor Morrison Home through our SWS DCF model, the picture shifts. This approach suggests the stock could be significantly undervalued compared to where it trades now. Could hidden value be waiting for investors to discover?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Taylor Morrison Home Narrative

If you want to dig deeper or trust your own process, the tools to craft your own analysis are right at your fingertips: Do it your way.

A great starting point for your Taylor Morrison Home research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Why limit your opportunities? Uncover a world of companies that fit your investing style and capture tomorrow’s potential. Don’t let great ideas slip by while you focus on just one stock.

- Boost your hunt for strong returns with undervalued stocks based on cash flows, highlighting businesses currently priced below their true worth.

- Tap into future breakthroughs by using quantum computing stocks to track firms at the cutting edge of quantum computing innovations.

- Maximize your passive income potential with dividend stocks with yields > 3%, featuring companies consistently delivering attractive dividend yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal