Cactus (WHD): Assessing Valuation Following Earnings Miss and Insider Sale

If you have been watching Cactus (NYSE:WHD) lately, the recent flurry of events could give you pause before making your next move. The company just released its latest quarterly results, missing both earnings per share and revenue projections. In addition, William D. Marsh, its General Counsel and Executive Vice President, sold over 10,000 shares right after the report. With these developments unfolding together, it is no surprise that investors are taking a closer look at where the company stands.

Over the past year, Cactus shares have dropped nearly 28%. Much of that decline has occurred in recent months as momentum has stalled following the disappointing quarterly report. The recent insider sale added to the cautious mood, despite company moves such as completing its merger with FlexSteel Holdings and planning to acquire Baker Hughes Company’s surface pressure control business. While the long-term track record shows a slight gain for long-term shareholders, short-term performance and sentiment remain under pressure.

With this shakeout, investors may be questioning whether Cactus is trading at a bargain or if the market is simply bracing for tougher days ahead and factoring in limited growth potential.

Most Popular Narrative: 19.5% Undervalued

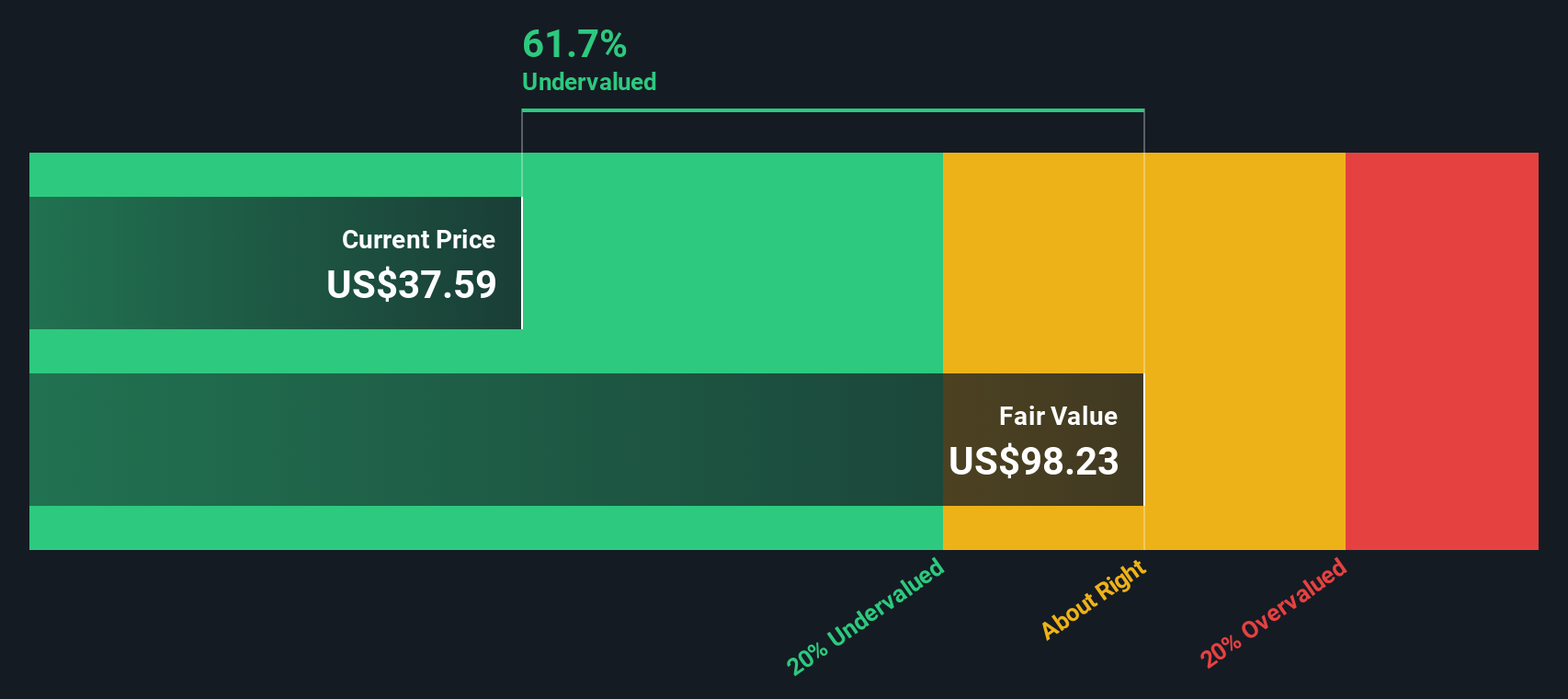

According to the most widely followed narrative, Cactus shares are trading below what analysts estimate to be their fair value. This suggests notable upside potential if company projections hold.

“The acquisition of a majority interest in Baker Hughes' Surface Pressure Control business will significantly expand Cactus' geographic footprint and customer base into the Middle East, an area poised for long-term energy infrastructure investment and supply security. This is likely to drive sustained revenue growth and higher earnings resiliency.”

Curious what is fueling this bullish price target? There is a bold formula underpinning this valuation, blending higher future profits, expansion ambitions, and assumptions about profit multiples that might surprise you. Want to know which financial levers are set to power the next phase? The answer is in the details behind this narrative.

Result: Fair Value of $49.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent weak demand in core markets and challenges integrating major acquisitions could threaten Cactus’ growth story and undermine bullish analyst projections.

Find out about the key risks to this Cactus narrative.Another View: Discounted Cash Flow Perspective

A different angle comes from our DCF model, which also signals that Cactus is trading below its calculated fair value. However, can any valuation truly capture Cactus' shifting fundamentals and market risks?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Cactus Narrative

If you see things differently or want a deeper dive into the numbers, you can easily shape your own narrative in just a few minutes. Do it your way.

A great starting point for your Cactus research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Winning Opportunities?

Don’t let smart investment ideas slip by while you focus on just one stock. Supercharge your portfolio by targeting the trends and sectors shaping tomorrow’s markets.

- Spot undervalued potential by using undervalued stocks based on cash flows to seek companies showing strong cash flow and attractive value signals that others might miss.

- Uncover future healthcare leaders by checking out healthcare AI stocks. Tap into breakthroughs where artificial intelligence is transforming patient outcomes and medical technology.

- Accelerate your search for high-yield opportunities with dividend stocks with yields > 3%. Focus on companies consistently rewarding investors with robust dividends above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal