Is Ormat Technologies’ (ORA) Lower Rio Launch and Tax Equity Deal Reshaping Its Long-Term Growth Outlook?

- Ormat Technologies announced the commencement of commercial operations at its Lower Rio energy storage facility in Texas, a 60MW/120MWh battery project supported by a seven-year tolling agreement and a US$25 million tax equity partnership with Morgan Stanley Renewables to monetize the 40% Investment Tax Credit.

- This move expands Ormat's total U.S. energy storage capacity to 350MW/778MWh and highlights the company's ability to secure long-term revenue streams while leveraging federal incentives for project development.

- We'll explore how the Lower Rio facility’s launch and tax equity deal may shape Ormat's investment outlook and future growth prospects.

Find companies with promising cash flow potential yet trading below their fair value.

Ormat Technologies Investment Narrative Recap

To believe in Ormat Technologies as a shareholder, you need to see long-term value in clean energy infrastructure, particularly its geothermal and battery storage portfolio. The Lower Rio storage facility’s launch reinforces Ormat’s ability to capture federal incentives and secure predictable revenues, but it doesn’t materially shift the biggest short-term risk: ongoing dependence on China-sourced batteries and regulatory transitions that could affect U.S. eligibility for future tax credits.

Among recent updates, Ormat’s May 27 Hybrid Tax Equity partnership with Morgan Stanley stands out. This development underpins Ormat’s ability to raise non-dilutive financing for battery storage projects and directly aligns with the catalyst of maximizing federal ITC benefits, as seen again in the Lower Rio deal. Consistent execution in this area will be crucial to offsetting cost pressures and supporting project economics if regulatory headwinds increase.

However, if U.S. rules on battery sourcing change more rapidly than anticipated, investors should be aware that...

Read the full narrative on Ormat Technologies (it's free!)

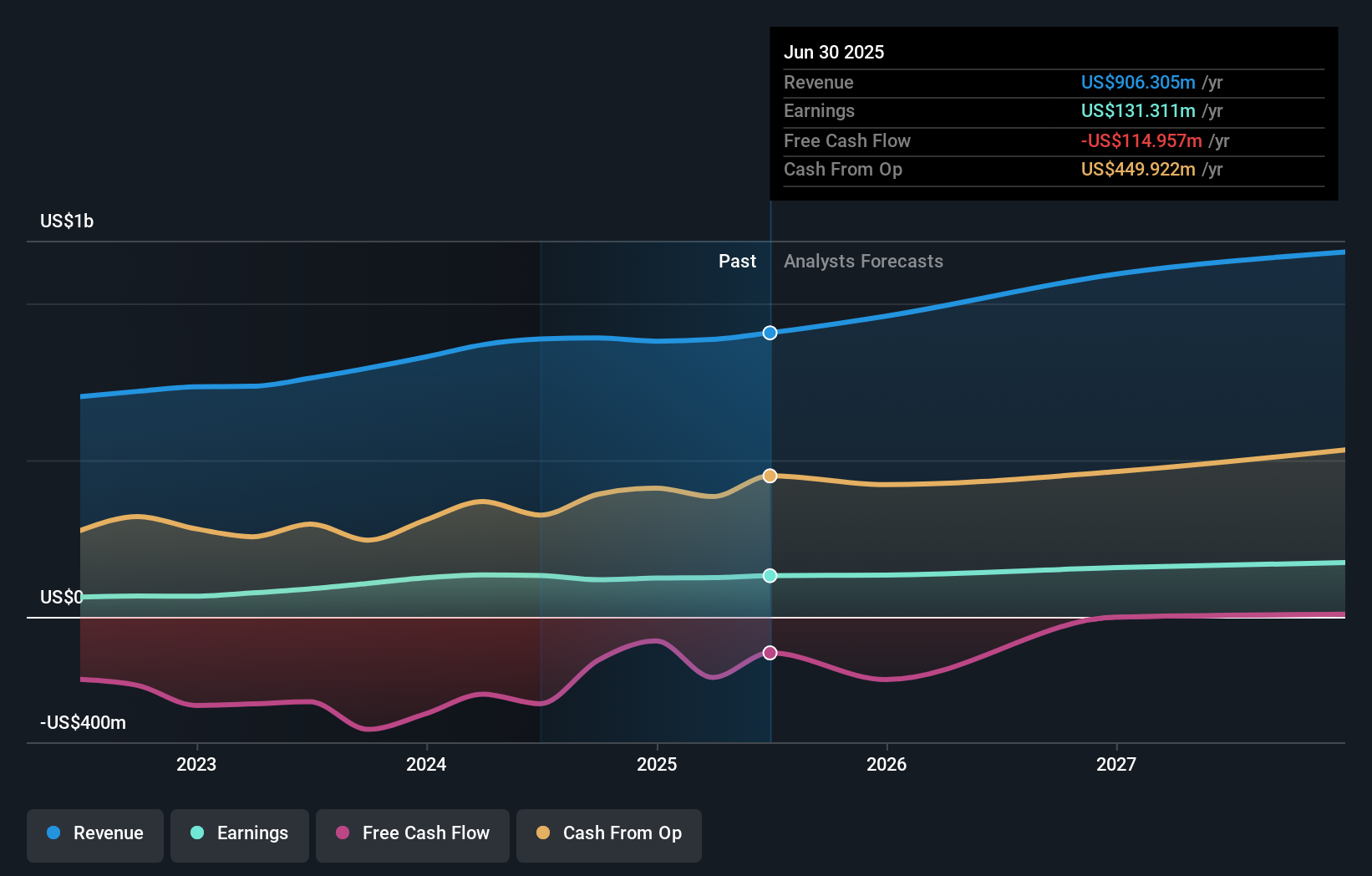

Ormat Technologies' outlook points to $1.2 billion in revenue and $171.7 million in earnings by 2028. Achieving this requires 9.4% annual revenue growth and a $40.4 million increase in earnings from the current $131.3 million.

Uncover how Ormat Technologies' forecasts yield a $94.60 fair value, a 3% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community members offered fair value estimates for Ormat Technologies stock, ranging from US$37.93 to US$236.13 per share. While federal incentives and policy support have been expanding the company’s growth runway, you can investigate multiple viewpoints and see how they connect to both risks and opportunities for Ormat’s future performance.

Explore 3 other fair value estimates on Ormat Technologies - why the stock might be worth less than half the current price!

Build Your Own Ormat Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ormat Technologies research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Ormat Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ormat Technologies' overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 29 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal