Tyson Foods (TSN): Evaluating Valuation After Leadership Shifts and New Product Launches

If you are tracking Tyson Foods (NYSE:TSN) for your portfolio, this week brought a mix of fresh headlines. Some could shake up operations, while others hint at creative growth bets. The company just welcomed Devin Cole as its new chief operating officer, recognizing his track record of boosting volume and profitability. However, not all news was positive. The sudden departure of chief supply chain officer Brady Stewart due to a code of conduct violation raised some questions about continuity at the top. Meanwhile, Tyson grabbed attention on the consumer front with new chicken nuggets inspired by beloved football teams, further energizing their poultry line right in time for football season.

The market’s reaction to these developments has been mixed. Over the past year, Tyson Foods shares have slipped by 7%, reflecting the company’s recent struggles and swings in sentiment. While momentum picked up earlier this year with a brief uptick in the past quarter, the broader trend has been downward, even as annual revenue climbed slightly and net income grew at a faster pace. It is clear that investors remain cautious, sizing up the impact of both executive transitions and the attempt to reinvigorate branded products.

After these leadership changes and new launches, is the current share price discounting too much risk, or is there real value if Tyson’s new strategy gains traction?

Most Popular Narrative: 12.6% Undervalued

The leading narrative contends that Tyson Foods is currently trading well below its estimated fair value. This suggests there could be significant upside if current expectations play out.

"The company is capitalizing on strong, resilient consumer demand for protein across beef, pork, and chicken, with volume and dollar share gains in top brands such as Tyson, Hillshire Farm, and Jimmy Dean. This leverages growing global consumption of animal protein and is expected to support sustained revenue growth and earnings expansion."

Curious why analysts see Tyson as a sleeper value play in today’s market? Dive into the projections that have bulls fired up, including ambitious growth in profitability, a margin turnaround, and strategic brand momentum that could redefine Tyson’s earnings game. Want to know which assumptions have set this valuation well above the current stock price? Uncover the details driving this bold target.

Result: Fair Value of $63.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing cattle supply shortages and stubborn input cost inflation could undermine Tyson’s bullish outlook if these pressures persist longer than analysts expect.

Find out about the key risks to this Tyson Foods narrative.Another View: Are Shares Priced a Bit Too High?

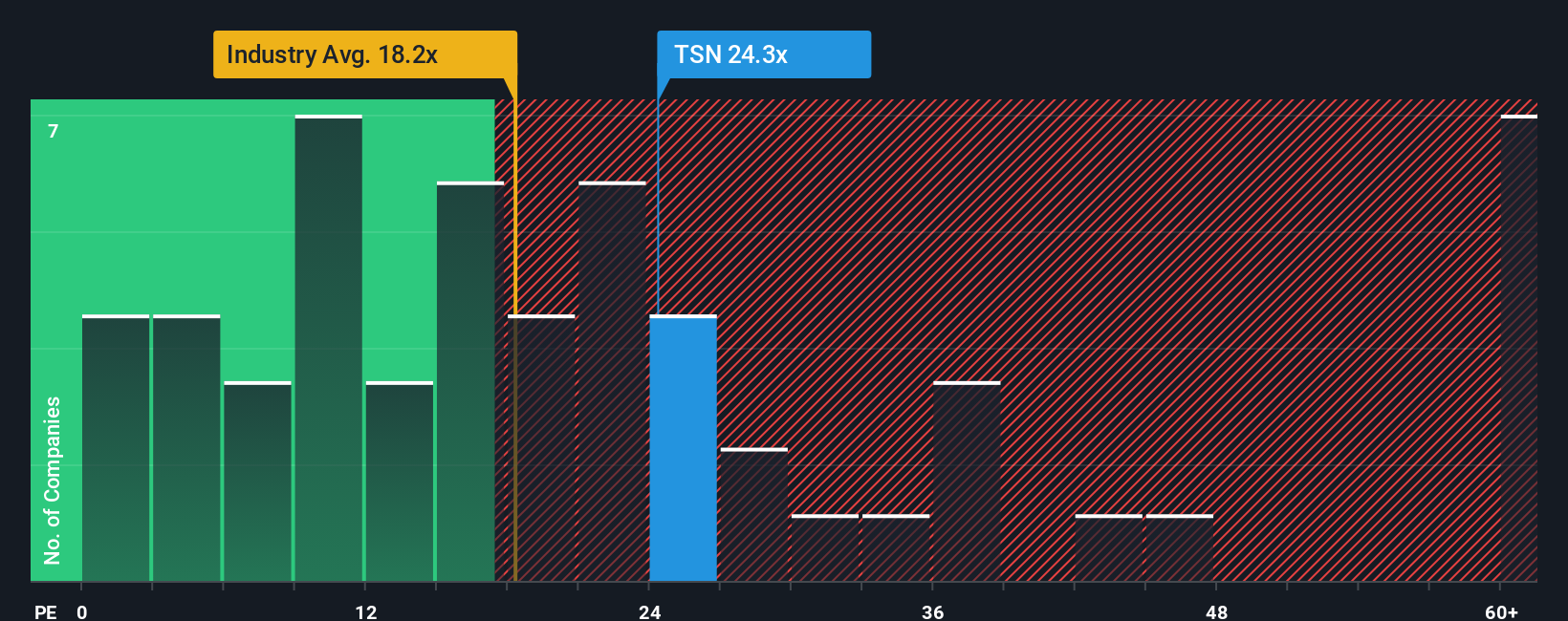

Looking at Tyson Foods through the lens of its current price-to-earnings ratio tells a different story. By this measure, the market may be placing a higher value on Tyson than the broader US food sector. Could this signal too much optimism today?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tyson Foods Narrative

If you see the story differently or want to dive into the numbers on your own terms, you can quickly shape your own narrative. Do it your way: Do it your way.

A great starting point for your Tyson Foods research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let your watchlist get stale. Take action and uncover stocks that fit your strategy by leveraging powerful screeners trusted by investors like you.

- Pinpoint undervalued opportunities by using our tool for stocks priced below their intrinsic value with strong growth potential, found here: undervalued stocks based on cash flows.

- Supercharge your search for companies that are well positioned in artificial intelligence advancements within healthcare, starting with this resource: healthcare AI stocks.

- Hunt for high-yield opportunities among top dividend-paying stocks, perfect for building robust income streams, right at this link: dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal