ManpowerGroup (MAN): Assessing Valuation After CPI-Driven Rally and Latest Employment Outlook Survey

ManpowerGroup (MAN) just caught investor attention following a 3.6% jump in afternoon trading, triggered by the latest Consumer Price Index report that has markets betting more confidently on a Federal Reserve rate cut. In addition, the company’s fresh Employment Outlook Survey shows global employers are sticking with current staff levels at rates not seen since early 2022. The hiring mood is cautious, with businesses signaling measured optimism amid ongoing but modestly improving talent shortages.

This episode caps off a challenging run for ManpowerGroup. Over the past year, shares have trended lower, reflecting investor nerves around persistent inflation and uneven demand for staffing services. There have been bright spots, such as the small uptick in net income growth, but the big picture remains one of cautious sentiment, as the stock’s longer-term performance has not matched the broader market’s momentum.

After this latest surge, is ManpowerGroup finally turning a corner, or is the buzz already priced in and the runway for future gains looking a bit short?

Most Popular Narrative: 21.7% Undervalued

According to the most widely followed analyst narrative, ManpowerGroup shares are viewed as undervalued by over 20%, suggesting meaningful upside potential if company targets are met.

"ManpowerGroup's ongoing investment in AI-driven digital platforms like PowerSuite and Sophie AI is accelerating operational efficiency, enabling more precise sales targeting and automation of recruiting workflows. This should drive scalable revenue growth and net margin expansion as these tools are deployed across more regions and business lines."

Curious how ManpowerGroup’s transformation could reshape its future? The narrative hints at aggressive efficiency gains, global market expansion, and a shift toward higher-margin business. What specific numbers are fueling this bullish valuation? The blueprint behind this projection could change how you think about the company’s potential.

Result: Fair Value of $49 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent weakness in key European markets and rising competition from tech-based disruptors could easily derail ManpowerGroup’s recovery story.

Find out about the key risks to this ManpowerGroup narrative.Another View: Our DCF Model Perspective

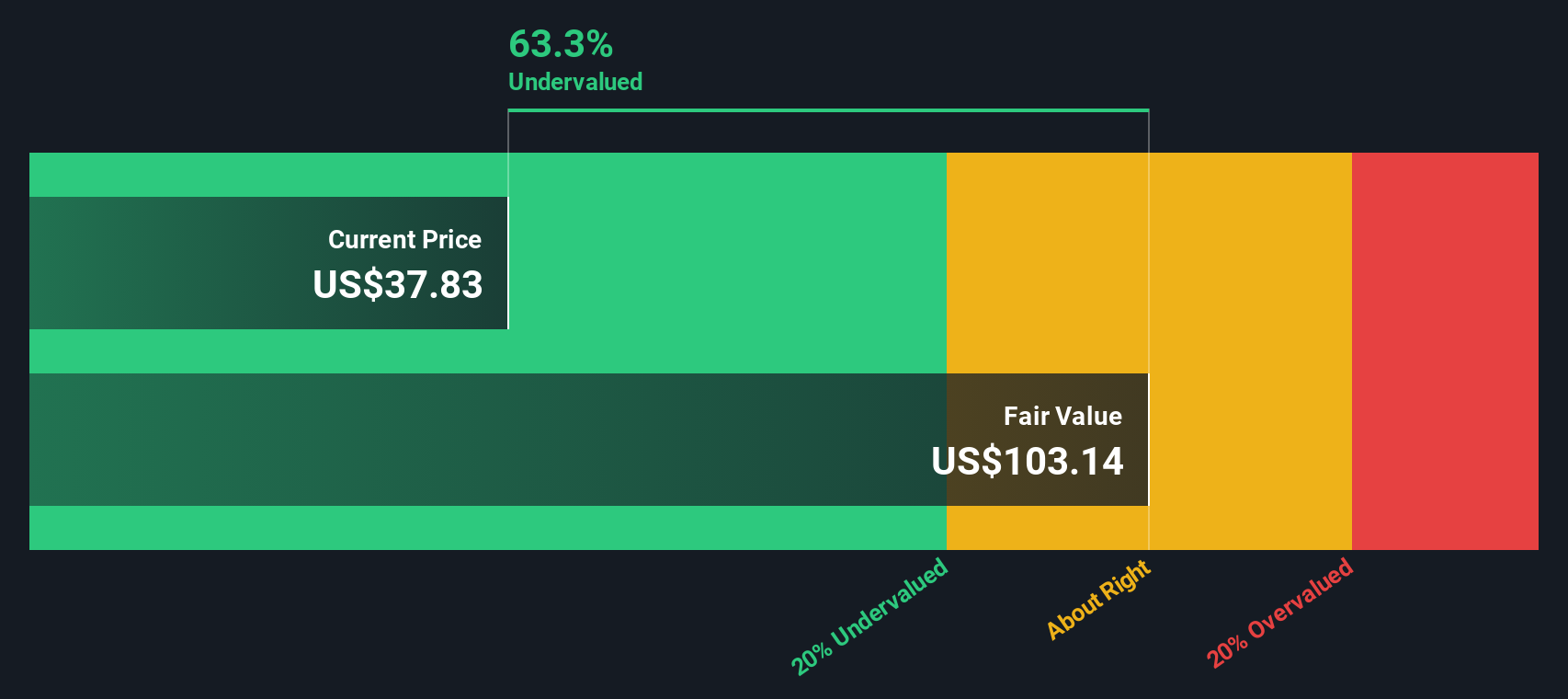

Looking through the lens of the SWS DCF model, the story takes a twist. This approach sees ManpowerGroup as still trading well below its intrinsic value and challenges whether the market has fully caught on yet.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own ManpowerGroup Narrative

If our analysis sparks a different conclusion or you want to shape your own forecast, you can craft your narrative using the latest numbers in just minutes. Do it your way

A great starting point for your ManpowerGroup research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Why limit yourself to just one stock? Take charge of your financial journey and uncover hidden winners that match your goals using the Simply Wall Street Screener.

- Unlock growth by targeting companies leading in next-generation computing and propel your portfolio with breakthroughs through quantum computing stocks.

- Boost your cash flow and confidence by focusing on market movers offering dividend stocks with yields > 3% and building income streams that stand the test of time.

- Spot bargains that could surprise the market by pinpointing undervalued companies with robust fundamentals, starting with undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal