Did Record Q2 Results and the Silvus Deal Just Shift Motorola Solutions' (MSI) Growth Narrative?

- Recently, Motorola Solutions reported record revenue, earnings, and orders for Q2, driven by strong software and services growth, and finalized the US$4.4 billion acquisition of Silvus, which is expected to enhance future revenue without impacting 2025 earnings per share.

- A significant insight from these developments is the company's upward revision of its full-year guidance, reflecting management's expectations for continued robust demand and positive contributions from its software and services segment.

- We'll look at how the Silvus acquisition and raised guidance further shape Motorola Solutions' ongoing transformation and growth outlook.

Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

Motorola Solutions Investment Narrative Recap

Owning shares in Motorola Solutions means believing in the company’s shift towards high-margin software and services, the resilience of its government-focused communications business, and its ability to integrate acquisitions like Silvus successfully. The recent Q2 results, acquisition completion, and upward guidance reinforce optimism around growth catalysts, but do not materially reduce the biggest present risk: pressure on core legacy product revenue and exposure to government budget cycles, which still drive a sizable portion of Motorola’s business.

Among company announcements, the closure of the US$4.4 billion Silvus acquisition stands out most in this context. Silvus is expected to immediately lift revenue yet not impact 2025 EPS, making the focus on seamless integration and the realization of new revenue streams especially relevant as investors watch how Motorola balances acquisition-related risks against growth opportunities.

On the other hand, not all government contracts or product cycles are easily insulated from tightening budgets or evolving public safety tech, a risk investors should know more about if they’re considering...

Read the full narrative on Motorola Solutions (it's free!)

Motorola Solutions' outlook projects $13.8 billion in revenue and $2.8 billion in earnings by 2028. This is based on a 7.5% annual revenue growth rate and a $0.7 billion increase in earnings from the current $2.1 billion.

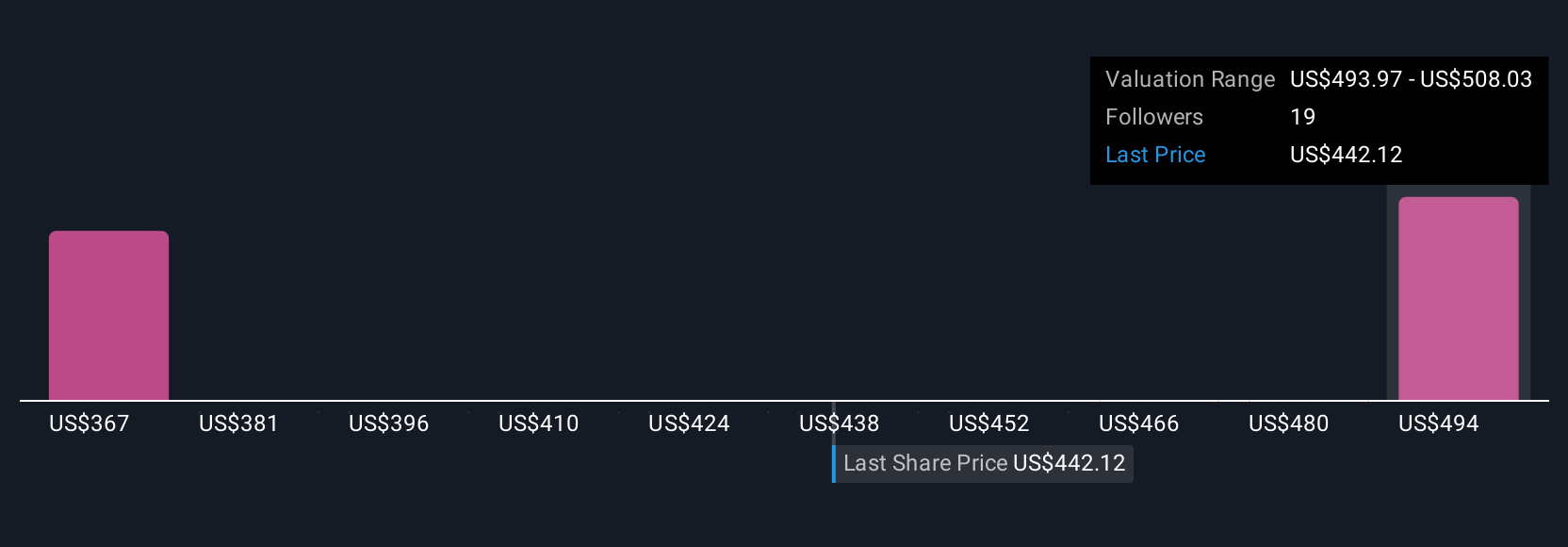

Uncover how Motorola Solutions' forecasts yield a $503.75 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Four Simply Wall St Community members provided fair value estimates for Motorola Solutions ranging from US$342.72 to US$503.75 per share. With such varied outlooks, consider that competition from emerging public safety and communications providers could shape the company’s results in ways these forecasts have not yet captured.

Explore 4 other fair value estimates on Motorola Solutions - why the stock might be worth 29% less than the current price!

Build Your Own Motorola Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Motorola Solutions research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Motorola Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Motorola Solutions' overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 25 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal