Frontdoor (FTDR): Evaluating Valuation After Quarterly Earnings Beatings and Upgraded Analyst Forecasts

Frontdoor (FTDR) has just hit a new 52-week high, and for investors weighing their next move, this momentum probably feels like more than just another bounce. The latest catalyst is hard to ignore: Frontdoor has outperformed on earnings for four straight quarters, recently delivering another report that beat expectations. This, along with positive shifts in earnings forecasts and a strong reputation among growth-focused analysts, has put the company squarely in the spotlight for those hunting for both upside and stability.

Looking at the bigger picture, the numbers tell a story of building confidence. Over the past month alone, Frontdoor’s stock price has risen 16.5%. That adds up to a 39% gain over the year, with its long-term returns also outpacing broader indices. The company has delivered consistent annual sales and profit growth, and recent gains have been supported by improving Wall Street sentiment and a track record of delivering above-forecast results. This positions Frontdoor as one of the standout growth stories in its sector right now.

Given this strong run, the key question is whether there is still a buying opportunity here, or if the market has already reflected all of that anticipated growth in the price.

Most Popular Narrative: 10% Overvalued

According to the most widely followed narrative, Frontdoor is now trading above what analysts view as its fair value. This suggests a degree of optimism has been priced in after the latest rally.

Expansion of non-warranty offerings, specifically the rapidly scaling HVAC upgrade program—which is seeing both rising member uptake and growing contractor participation—provides a runway for diversified revenue streams with potential margin upside as penetration increases.

Want to know the numbers driving this overvaluation call? This story is built on bold assumptions about future profit growth, aggressive revenue targets, and margin bets that could surprise the market. Curious what analysts are counting on for Frontdoor’s next chapter? Find out which financial projections make this price target possible.

Result: Fair Value of $60.25 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks remain, such as continued declines in home warranty memberships and rising customer acquisition costs. Either of these factors could pressure margins moving forward.

Find out about the key risks to this Frontdoor narrative.Another View: The DCF Angle

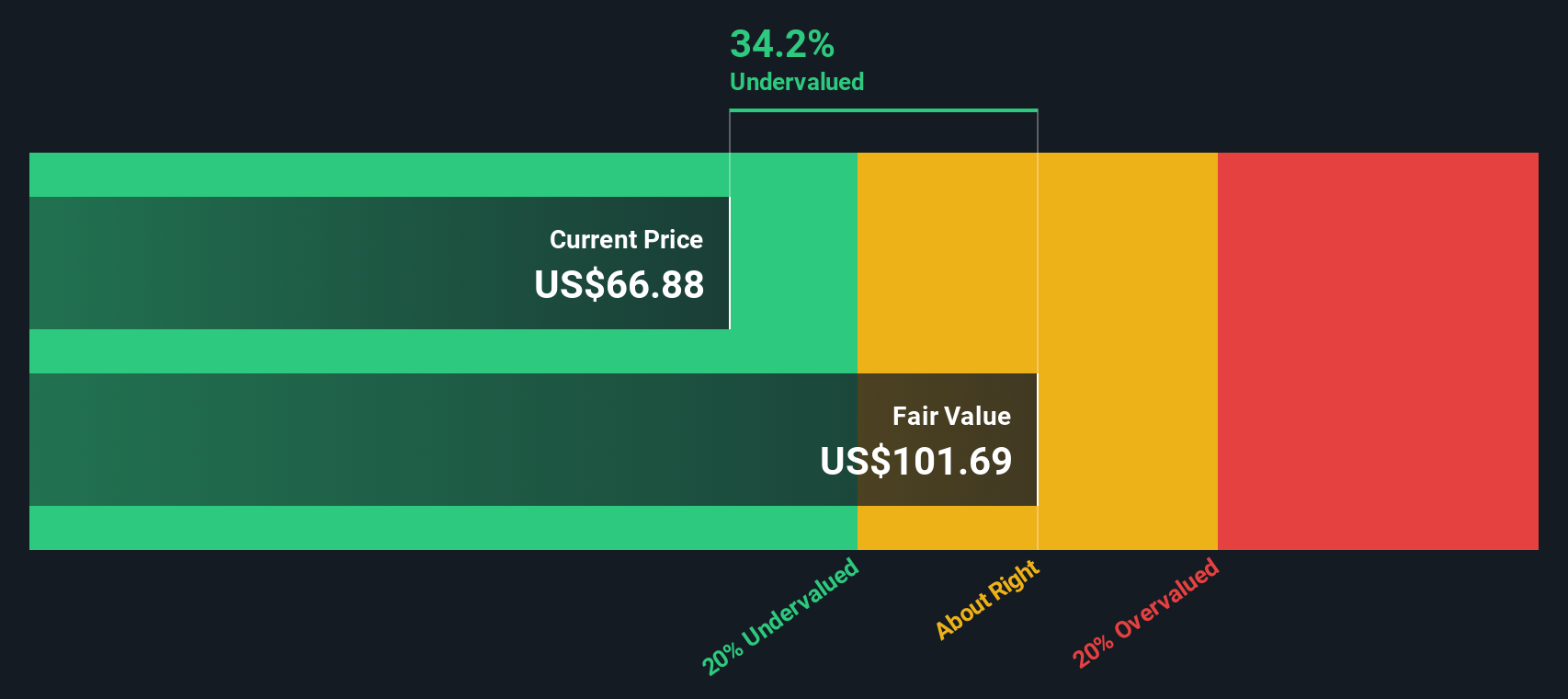

While analysts see Frontdoor as overvalued using traditional industry comparisons, our SWS DCF model offers a starkly different perspective. This approach suggests the stock could be undervalued based on its long-term cash flow outlook. Which view wins out in the end?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Frontdoor Narrative

If you see things differently or want to dig into the numbers yourself, crafting your own take on Frontdoor’s story is quick and straightforward. The process often takes less than three minutes. Do it your way

A great starting point for your Frontdoor research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Winning Opportunities?

Smart investing means staying ahead. Open the door to new possibilities and find tomorrow’s top performers now with screens built for ambitious investors.

- Scan for undervalued gems with strong potential by using our undervalued stocks based on cash flows to target stocks that have room to run.

- Jump into the AI-powered company wave and spot bold innovators with our AI penny stocks, connecting you with market leaders in artificial intelligence.

- Unlock steady income streams and future-proof your wealth by checking out our picks for dividend stocks with yields > 3% offering attractive yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal