Can Fortive’s (FTV) AI Push Redefine Its Customer Insight and Capital Allocation Strategy?

- At the recent Morgan Stanley Laguna Conference, Fortive management presented a confident strategic outlook, emphasizing a balanced capital allocation plan spanning share buybacks, dividends, and targeted M&A, while highlighting ongoing AI integration and a normalization of sector-specific headwinds.

- A unique takeaway is Fortive’s renewed focus on leveraging artificial intelligence to better understand customer needs, which aims to support the company’s innovation pipeline and future operational efficiency.

- We’ll examine how Fortive’s emphasis on AI-driven customer insight could influence its investment narrative and outlook going forward.

Find companies with promising cash flow potential yet trading below their fair value.

Fortive Investment Narrative Recap

To be a Fortive shareholder today is to believe in its ability to drive growth and margin expansion via recurring revenues, operational discipline, and digital innovation, even as the business becomes more concentrated post-spin-off. The company’s upbeat messaging at the Morgan Stanley conference doesn’t materially change the immediate short-term catalysts or the biggest near-term risk: successful execution of its innovation and M&A plans versus ongoing sensitivity to sector-specific volatility, including healthcare and government exposure.

Among recent developments, Fortive’s completion of the Precision Technologies spin-off and creation of Ralliant is most relevant. This shift leaves the company more focused, but also increases its exposure to concentration risk and potential earnings swings, heightening the importance of diversification and execution as it pursues operational excellence and new growth opportunities.

By contrast, investors should be aware that increased concentration in fewer business segments could leave Fortive more sensitive to...

Read the full narrative on Fortive (it's free!)

Fortive's narrative projects $4.5 billion revenue and $741.9 million earnings by 2028. This requires a 9.8% annual revenue decline and a $27 million decrease in earnings from $768.9 million currently.

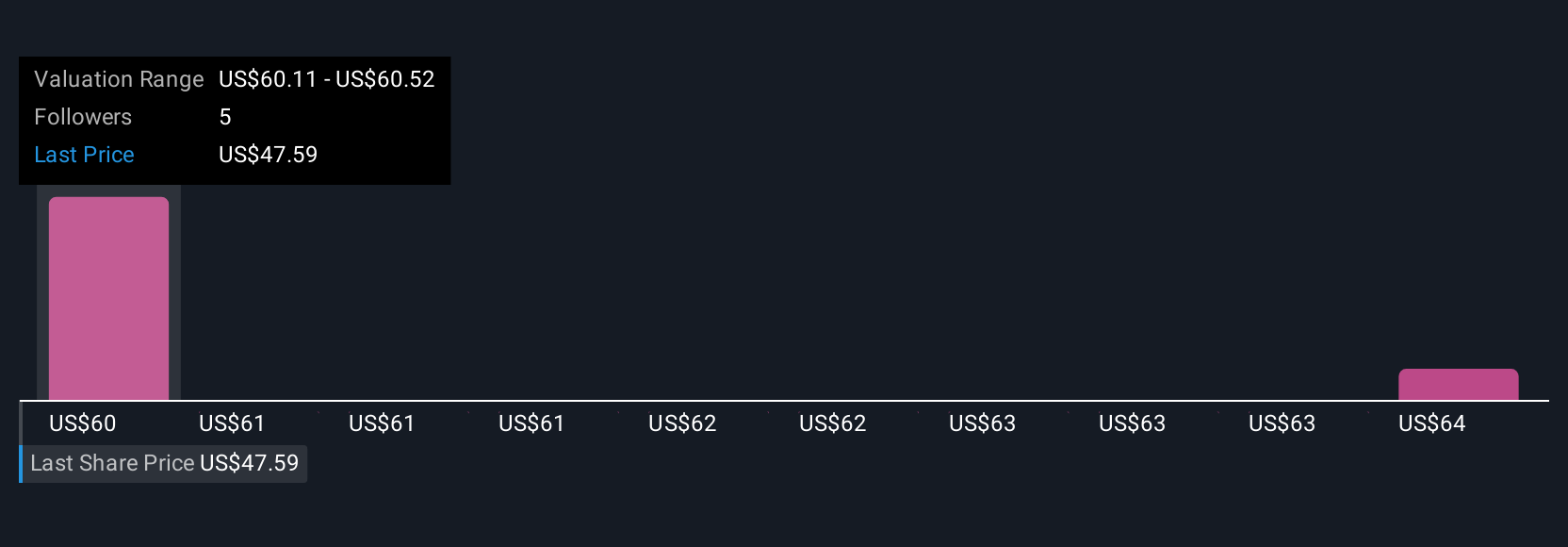

Uncover how Fortive's forecasts yield a $60.50 fair value, a 24% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members set fair value for Fortive shares in a tight US$60.50 to US$60.91 range, based on two unique viewpoints. With execution risk heightened after the Precision Technologies spin off, diverging opinions invite you to explore how different assumptions about business concentration may shape your outlook.

Explore 2 other fair value estimates on Fortive - why the stock might be worth just $60.50!

Build Your Own Fortive Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fortive research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Fortive research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fortive's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal