Sophia Learning’s Growth Might Change the Case for Investing in Strategic Education (STRA)

- In recent days, Truist Financial and BMO Capital both reiterated their positive outlooks for Strategic Education following strong subscriber and revenue growth in the company's Sophia Learning segment, despite declines in student enrollment in the U.S. and Australia/New Zealand.

- An interesting development from these reports is that Sophia Learning's continued expansion is attracting analyst attention even as other core segments face headwinds.

- We will now explore how renewed analyst confidence, especially driven by Sophia Learning's growth, may reshape Strategic Education's investment narrative.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Strategic Education Investment Narrative Recap

To be a shareholder in Strategic Education right now, you need to believe that the company’s bet on innovative digital learning platforms like Sophia Learning will do more than make up for enrollment declines in its traditional segments. While the strong subscriber and revenue growth in Sophia Learning has buoyed short-term analyst confidence, the long-standing risk from regulatory pressures in Australia and revenue per student challenges in the U.S. remain unresolved; the news does not fundamentally change these business risks or catalysts at this point.

The recent announcement of a quarterly dividend of US$0.60 per share, set for payment on September 15, 2025, underscores management’s message of capital return and balance sheet stability. For income-focused investors, this policy could support confidence in the face of ongoing volatility across certain operating segments, reinforcing a key consideration alongside the underlying performance of Sophia Learning as a growth driver.

However, even with these growth spots, investors should pay close attention to how regulatory shifts overseas could ...

Read the full narrative on Strategic Education (it's free!)

Strategic Education's narrative projects $1.4 billion in revenue and $164.9 million in earnings by 2028. This requires 4.7% yearly revenue growth and a $52.2 million earnings increase from $112.7 million today.

Uncover how Strategic Education's forecasts yield a $102.67 fair value, a 24% upside to its current price.

Exploring Other Perspectives

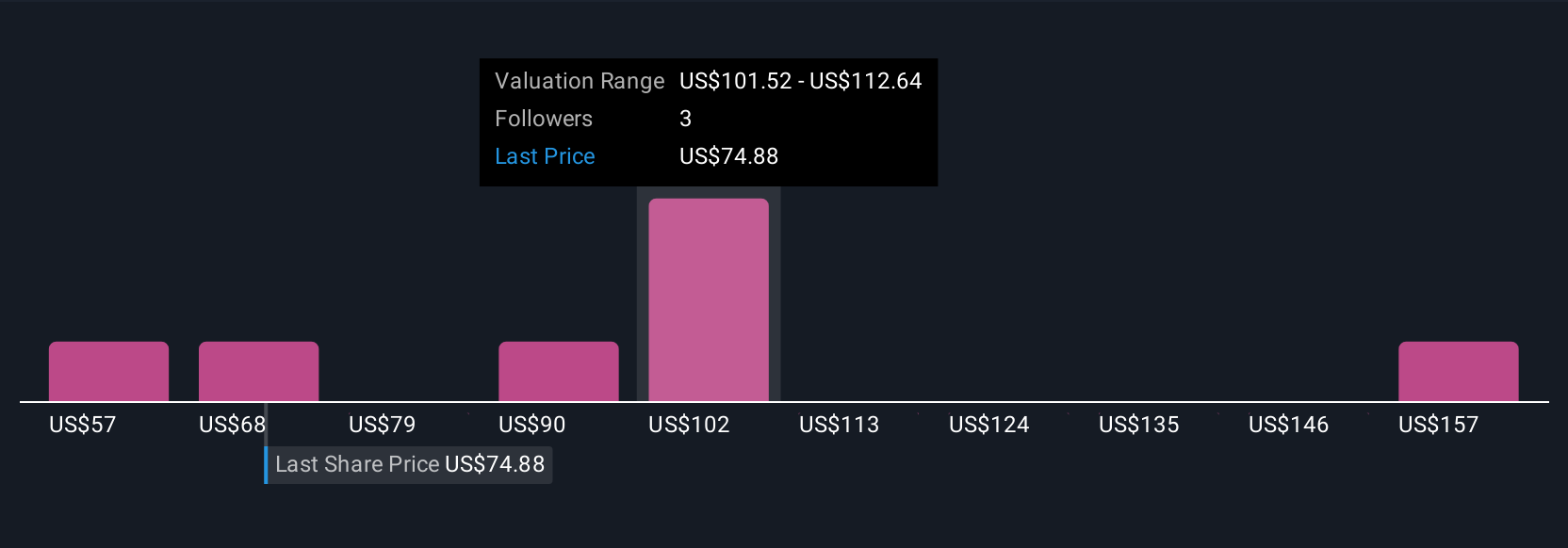

Five private investor fair value estimates for Strategic Education from the Simply Wall St Community currently range from US$57.04 to US$162.29 per share. Continued Australian government regulation risk could weigh on the most optimistic scenarios, so reviewing several viewpoints may be worthwhile.

Explore 5 other fair value estimates on Strategic Education - why the stock might be worth 31% less than the current price!

Build Your Own Strategic Education Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Strategic Education research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Strategic Education research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Strategic Education's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal