Albemarle (ALB): Evaluating Valuation Following CATL Lithium Mine Restart and Fresh Supply Challenges

Albemarle (ALB) is firmly in the spotlight after shares dropped over 11% in response to news that CATL, a major Chinese battery maker, is restarting its Yichun lithium mine. This event could push global lithium supply higher, raising questions about future pricing power for lithium producers like Albemarle. Compounding this, investors are also watching a recent leadership transition, with Mark Mummert stepping in as COO during this critical period for the market, while a scheduled dividend payout remains on the horizon.

Looking at the bigger picture, Albemarle’s share price momentum has been mixed. After a double-digit year-to-date decline and a loss over the past year, the stock still caught a jolt of upward movement in the past three months. It is a company that has seen significant swings, reflecting the volatility in global lithium markets, while recent operational shifts and earnings forecasts suggest both ongoing risks and potential new directions for growth.

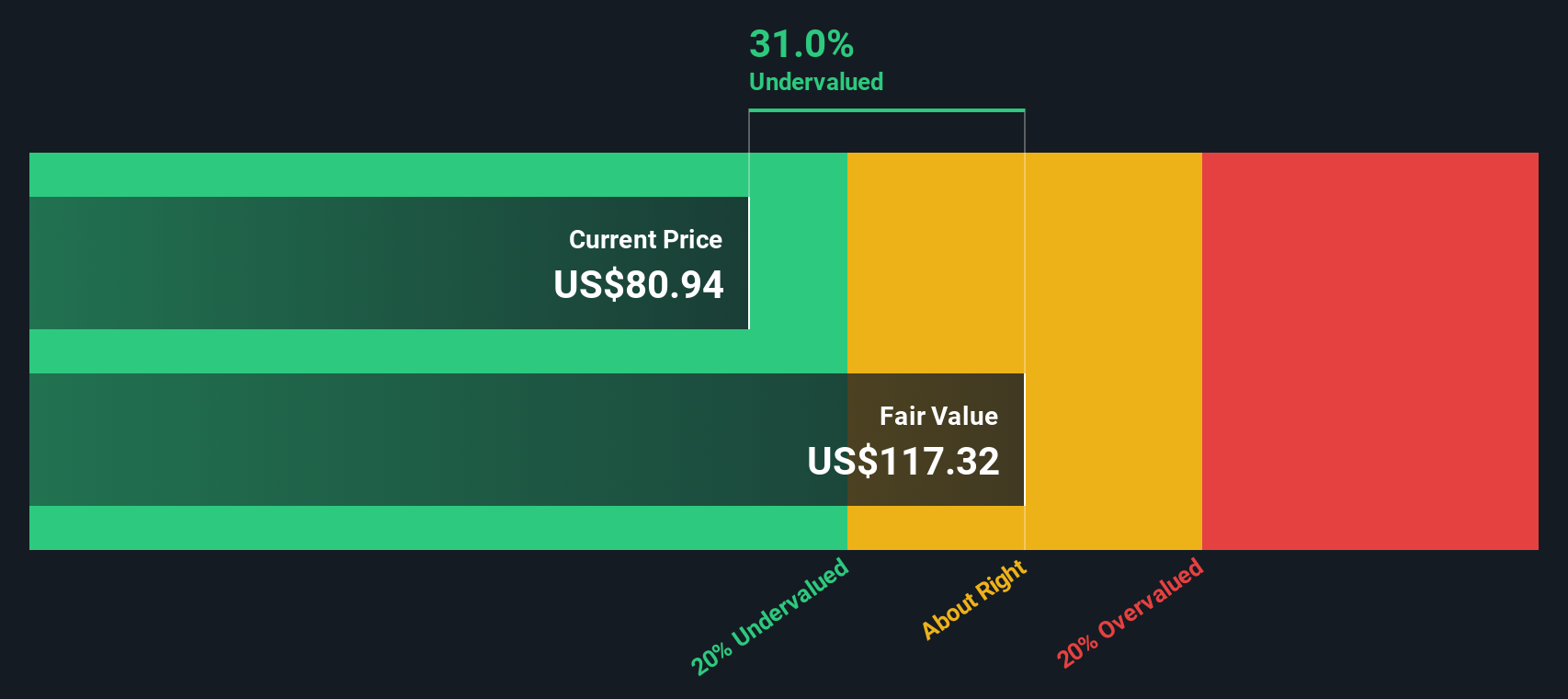

The key question now is whether Albemarle’s current valuation is reflecting the downside from this supply shock, or if the slide in share price could set the stage for a buying opportunity if markets are overlooking longer-term upside.

Most Popular Narrative: 11% Undervalued

According to the most widely followed narrative, Albemarle's shares are trading well below their estimated fair value. This consensus points to significant upside potential, shaped by analyst expectations for improved earnings, rising profit margins, and long-term demand tailwinds.

"The company is executing aggressive cost reduction and productivity initiatives (achieving a $400M annual run-rate in savings, 6 months ahead of plan), ramping low-cost asset expansions, and optimizing its conversion network, which is likely to structurally reduce operating costs and increase net margins in a lower price environment."

What if Albemarle could turn its latest cost-saving drive and productivity plans into a powerful profit engine? The analyst narrative quietly hinges on a set of bold growth bets, future cash flow improvements, and a profitability turnaround that could completely reshape how investors value this stock. Wondering which surprising financial targets are fueling this bullish outlook? The full story reveals which numbers and changing profit multiples are at the heart of Albemarle’s fair value calculation.

Result: Fair Value of $85.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing lithium oversupply or prolonged weak prices could undermine these bullish forecasts. This may put pressure on Albemarle’s margins and dampen the expected profitability turnaround.

Find out about the key risks to this Albemarle narrative.Another View: What Do the Numbers Say?

Taking a different approach, the SWS DCF model also suggests Albemarle remains undervalued, even after considering market uncertainties and future cash flows. Could these two perspectives both be missing an unseen risk or an emerging opportunity?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Albemarle Narrative

If you have a different perspective or want to investigate Albemarle from your own angle, you can quickly develop your own view and test your assumptions. Do it your way.

A great starting point for your Albemarle research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Ready to seize an advantage? Don’t stop at Albemarle. Give yourself the edge by tapping into investment ideas many overlook. Let the Simply Wall Street screener help you discover what others miss and position your portfolio for tomorrow’s big moves.

- Tap into future-defining breakthroughs by checking out the pioneers shaping artificial intelligence innovation through AI penny stocks.

- Find resilient income streams with companies offering high-yield payouts thanks to dividend stocks with yields > 3%.

- Catch undervalued opportunities others are ignoring by unlocking hidden gems with undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal