Taking a Fresh Look at Ashland (ASH) Valuation After Recent Market Weakness

Most Popular Narrative: 18.4% Undervalued

According to the most widely followed narrative, Ashland appears markedly undervalued, with an estimated fair value well above its current share price.

The global shift toward sustainable and bio-based materials, driven by regulatory requirements and consumer preference, continues to gain momentum. This benefits Ashland's specialty chemicals portfolio, which is now more focused on high-value, sustainable, and compliant solutions. This focus is expected to support top-line revenue growth and margin resilience over the long term.

Curious about the forces powering this undervaluation? Unlock the story behind Ashland's projected transformation, where bold growth expectations and rapid financial turnaround combine for a bigger payoff than the market seems to expect. Want to know the numbers analysts are betting on, and what could make Ashland a sleeper pick? Dive deeper to see the pivotal forecasts hiding just beneath the surface.

Result: Fair Value of $64.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent weak demand in key markets or shifts in consumer trends could challenge Ashland's growth outlook and limit its margin improvement story.

Find out about the key risks to this Ashland narrative.Another View: Market Multiples Paint a Different Picture

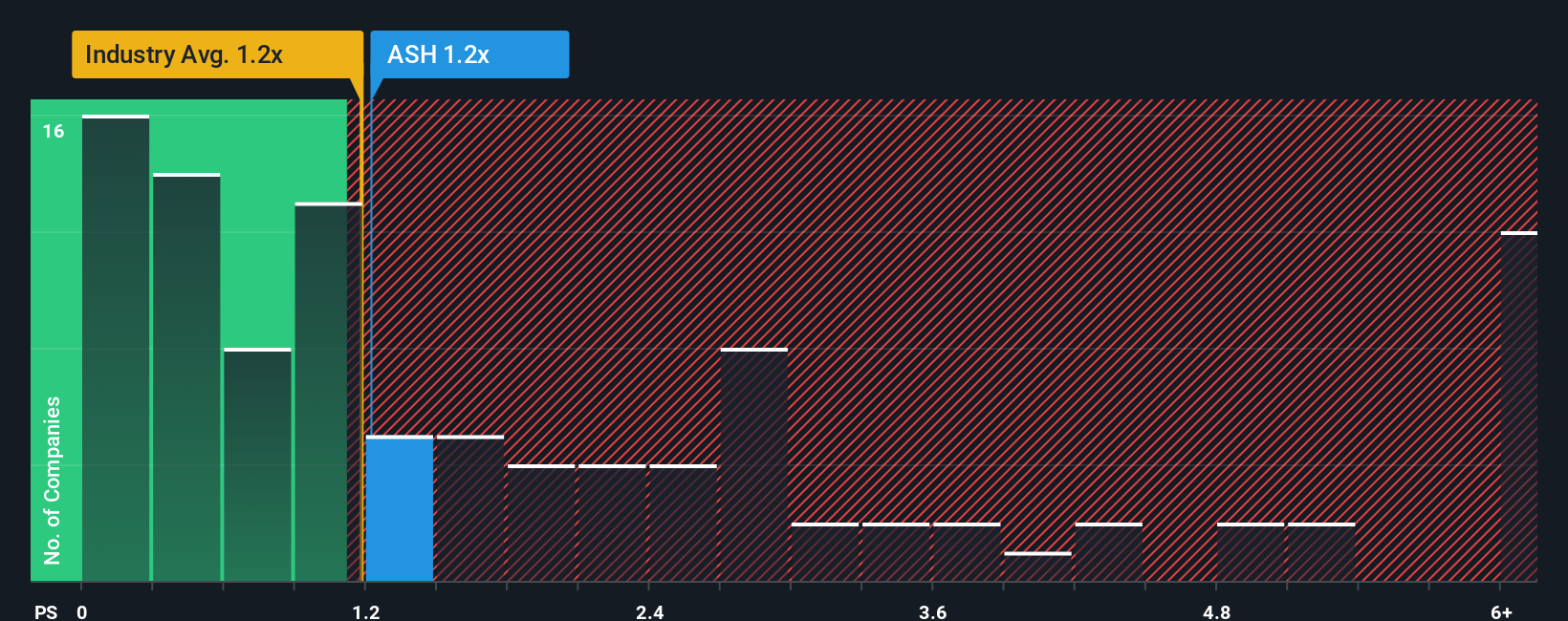

Taking a look through the lens of market ratios, Ashland comes across as expensive when stacked up against the wider US Chemicals sector. This challenges the more optimistic fair value outlook given by analysts. Which angle will the market trust?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ashland Narrative

If you see things differently or want to put the data under your own microscope, shaping a custom narrative is straightforward and takes just minutes. Do it your way.

A great starting point for your Ashland research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep an eye out for fresh opportunities. Don’t get left behind—expand your search with unique, data-driven stock picks tailored to your interests right now.

- Tap into future-defining breakthroughs when you browse high-potential companies making waves in artificial intelligence by checking out AI penny stocks.

- Unlock value by finding promising stocks that are flying under the radar but may be significantly undervalued. Browse them right here: undervalued stocks based on cash flows.

- Multiply your income streams with a handpicked selection of companies offering robust, above-average dividend yields at dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal