How Himax’s New Automotive Display Solutions Could Shape the Outlook for HIMX Investors

- Earlier this month, Himax Technologies announced the launch of a new automotive timing controller and unveiled several advanced display solutions at major industry conferences, including the SID Vehicle Displays and Interfaces Symposium in Detroit.

- This focused push highlights Himax's leadership in automotive display ICs and its drive to address automakers' demand for smarter, safer, and more versatile in-car technologies.

- We'll explore how Himax's showcase of next-generation automotive display solutions may influence the company's investment outlook and growth opportunities.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Himax Technologies Investment Narrative Recap

To own shares in Himax Technologies today, you need faith in the company’s push to define the future of automotive displays and smart cockpit systems. Recent product announcements reinforce this theme, but with sluggish near-term revenue visibility and ongoing macro uncertainties, the launch of new display innovations may do little to immediately shift the core catalyst, automotive demand recovery, or offset the immediate earnings risks from cautious customer inventory management and global trade tensions.

Among the news, Himax’s introduction of the HX8882-F13 timing controller stands out. This integrated solution offers unique local dewarping capabilities for automotive head-up displays, directly supporting safety-centric requirements in next-generation vehicles, a technology aligned with the company’s efforts to capture premium market share as digital cockpit adoption accelerates.

Yet, amid new product momentum, investors should be aware that persistent weak order flows and...

Read the full narrative on Himax Technologies (it's free!)

Himax Technologies is anticipated to reach $1.1 billion in revenue and $139.3 million in earnings by 2028. This forecast is based on an annual revenue growth rate of 7.4%, with earnings rising by $65.1 million from the current $74.2 million level.

Uncover how Himax Technologies' forecasts yield a $9.31 fair value, a 13% upside to its current price.

Exploring Other Perspectives

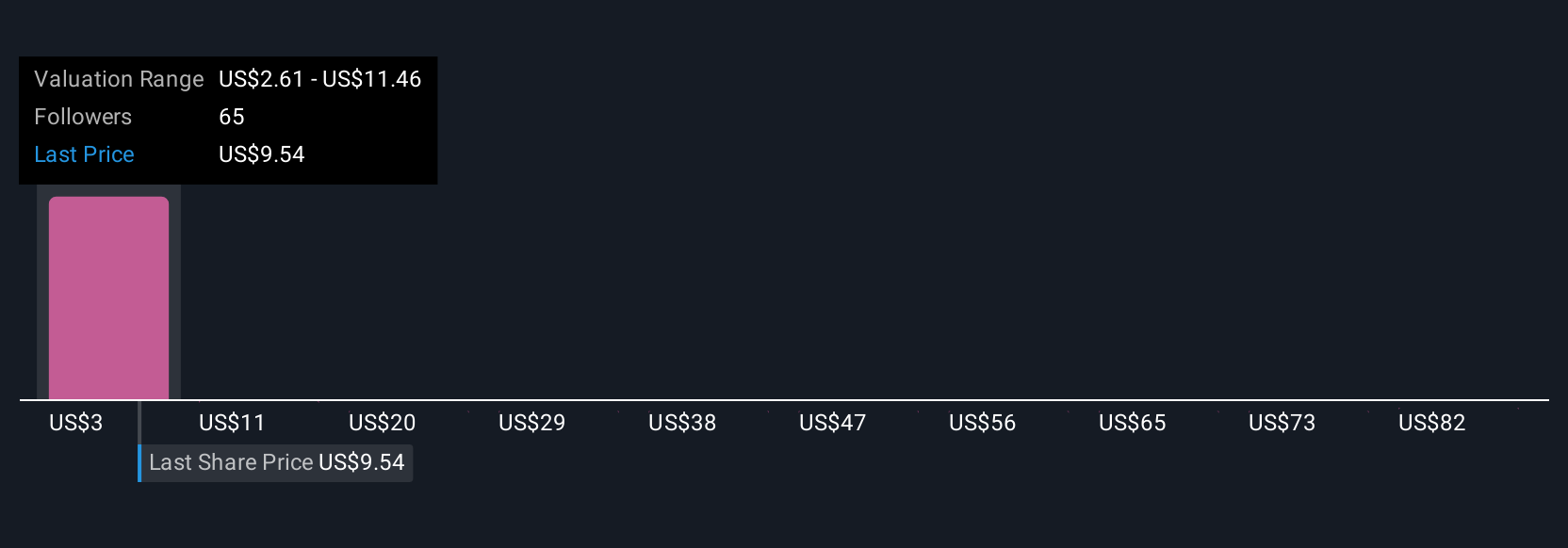

Fair value estimates from eight Simply Wall St Community members span from US$1.55 to US$91.18 per share. While views about future automotive market adoption drive wide expectations, today's visibility on order trends remains a key issue to watch. Explore their contrasting opinions for added insights.

Explore 8 other fair value estimates on Himax Technologies - why the stock might be worth less than half the current price!

Build Your Own Himax Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Himax Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Himax Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Himax Technologies' overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal