A Look at Air Products (APD) Valuation Following Cleveland Facility Launch and Regional Expansion

If you have been tracking Air Products and Chemicals (APD), the news that the company’s new air separation facility in Cleveland is officially up and running may have caught your attention. With the plant now supplying a key onsite customer under a long-term contract, and extending its reach into the regional merchant market, APD is clearly signaling a push for deeper roots in a strategic industrial area. This expansion, paired with fresh reinvestment in the site’s existing assets, represents a concrete operational upgrade that investors cannot easily ignore.

Stack this latest development alongside APD’s longer-term trajectory, and it tells a story of measured progress. The company has generated steady returns, with shares up 5.6% over the past year and delivering 27.7% over three years, while its most recent quarter showed single-digit revenue growth but a solid jump in net income. The stock’s momentum has picked up in the past three months, pointing to a potentially renewed sense of optimism as the Cleveland investment comes online and complements other recent business moves.

So where does that leave investors? Is Air Products and Chemicals attractively valued after this new expansion, or is the market already factoring in all of the future gains ahead?

Most Popular Narrative: 9.7% Undervalued

According to the most widely followed narrative, Air Products and Chemicals appears undervalued by nearly 10%, suggesting notable upside based on future earnings power.

Heavy investments in large-scale hydrogen, blue/green ammonia, and carbon capture projects, supported by multi-decade power and supply agreements in growth regions (such as the Middle East, Asia, and the U.S. Gulf Coast), are set to come online over the next several years. These projects are expected to provide robust and stable earnings while supporting a trajectory of consistently higher operating margins.

What is behind this bullish thesis? Hints of dramatic earnings acceleration, margin expansion, and a future market multiple borrowed from top-tier stocks are all core to this bold fair value. Interested in the quantitative assumptions analysts are using to make this case? The detail could change how you view this market leader’s next act.

Result: Fair Value of $324.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, slower progress on major hydrogen and ammonia projects, or helium market volatility, could dampen earnings and pose challenges to the current bullish outlook.

Find out about the key risks to this Air Products and Chemicals narrative.Another View: Market Multiple Paints a Different Picture

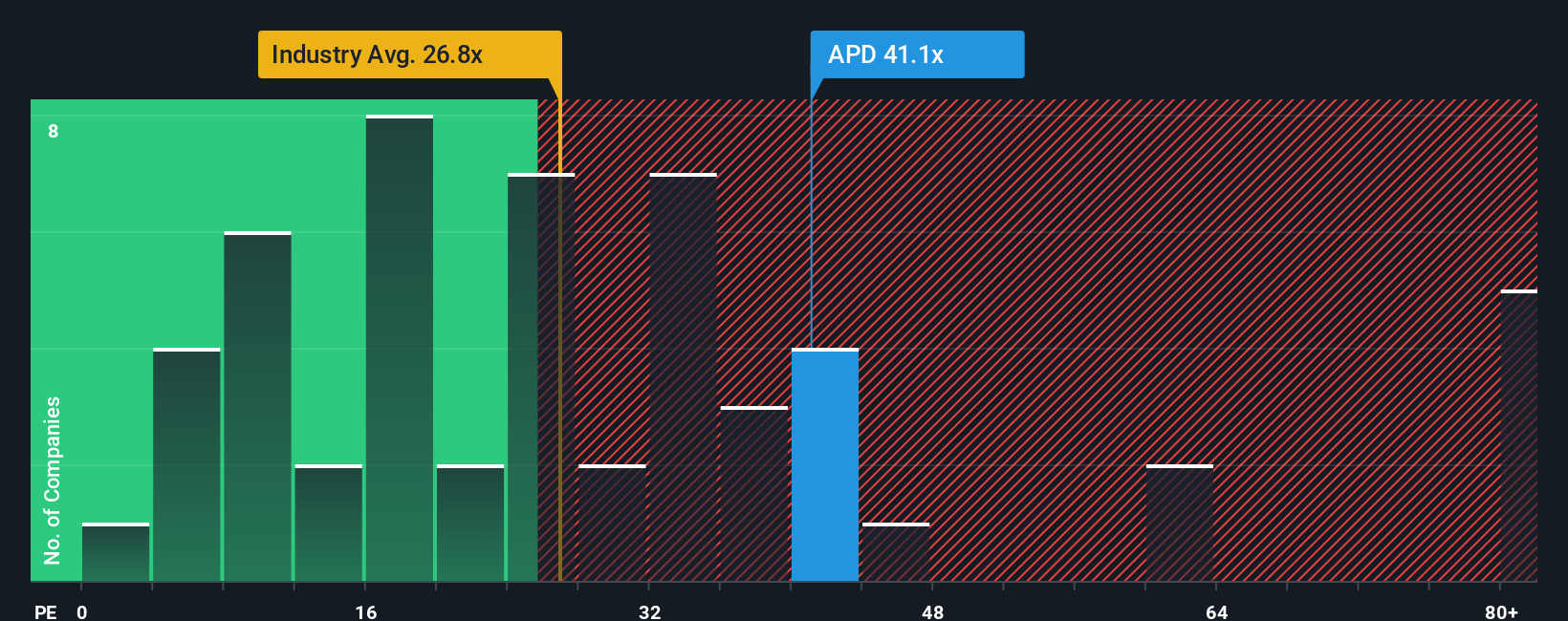

Looking at Air Products and Chemicals through a common market comparison, things look less optimistic. Using this approach, the company appears more expensive than other industry players, raising questions about how much upside is left. Could recent optimism already be priced in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Air Products and Chemicals Narrative

If you see things differently, or want to dig into the numbers yourself, you can build your own perspective in just a few minutes. Do it your way

A great starting point for your Air Products and Chemicals research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't let exceptional opportunities slip by. Use the Simply Wall Street Screener to target the next wave of winners designed for your strategy and future goals.

- Capture income potential by scanning the market for companies offering dividend stocks with yields > 3% that consistently yield over 3% and can bolster your portfolio’s cash flow.

- Navigate tomorrow’s breakthroughs by focusing on the most ambitious AI penny stocks at the forefront of the artificial intelligence revolution.

- Seize hidden value with our tool for identifying the most undervalued stocks based on cash flows opportunities based on robust cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal