NV5 Global (NVEE): Evaluating Valuation Following Strong Earnings, Acquisitions, and Updated Outlook

NV5 Global (NVEE) just posted quarterly results that are turning heads. The company’s revenue climbed 10.1% year on year, surpassing what analysts expected, and management doubled down on confidence by reaffirming its 2025 full-year guidance for revenue and earnings per share. Add in three fresh acquisitions early in the year, which extend NV5 Global’s footprint in important geographies, and this event speaks to real momentum rather than just a passing headline.

So, how has all this activity shown up in the stock so far? After NV5 Global delivered its better-than-expected quarter and outlined a healthy pipeline, shares jumped 22.6%. That marks a sharp reversal from earlier in the year, when the price drifted lower, and puts the stock’s recent momentum in contrast with a longer-term one-year slide of 6%. Over a five-year span, however, the returns are considerably more positive, signaling that the recent moves might be breathing new life into a name that had lost some luster.

With that in mind, are buyers getting in early on renewed growth, or is the recent jump a sign that the market is already pricing in NV5 Global’s brighter outlook?

Most Popular Narrative: 6% Undervalued

The prevailing narrative sees NV5 Global as undervalued by 6% relative to its fair value. This perspective is grounded in robust projected earnings growth, margin expansion, and ambitious international expansion plans.

NV5 is targeting cash flow conversion rates to rise from 40% in 2024 to 60% in 2025 through contract renegotiations and optimized billing cadence, thereby improving cash flow and potentially driving earnings growth.

Curious how NV5 Global’s equity story could hinge on unique growth levers and future profit milestones? The narrative teases a path to scale that stretches profit margins and doubles down on big financial bets. Want the inside track on what assumptions drive this fair value before the crowd catches on?

Result: Fair Value of $24.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, high administrative costs or challenges expanding into new international markets could undermine NV5 Global's ambitious growth and margin improvement narrative.

Find out about the key risks to this NV5 Global narrative.Another View: What Do Earnings Multiples Say?

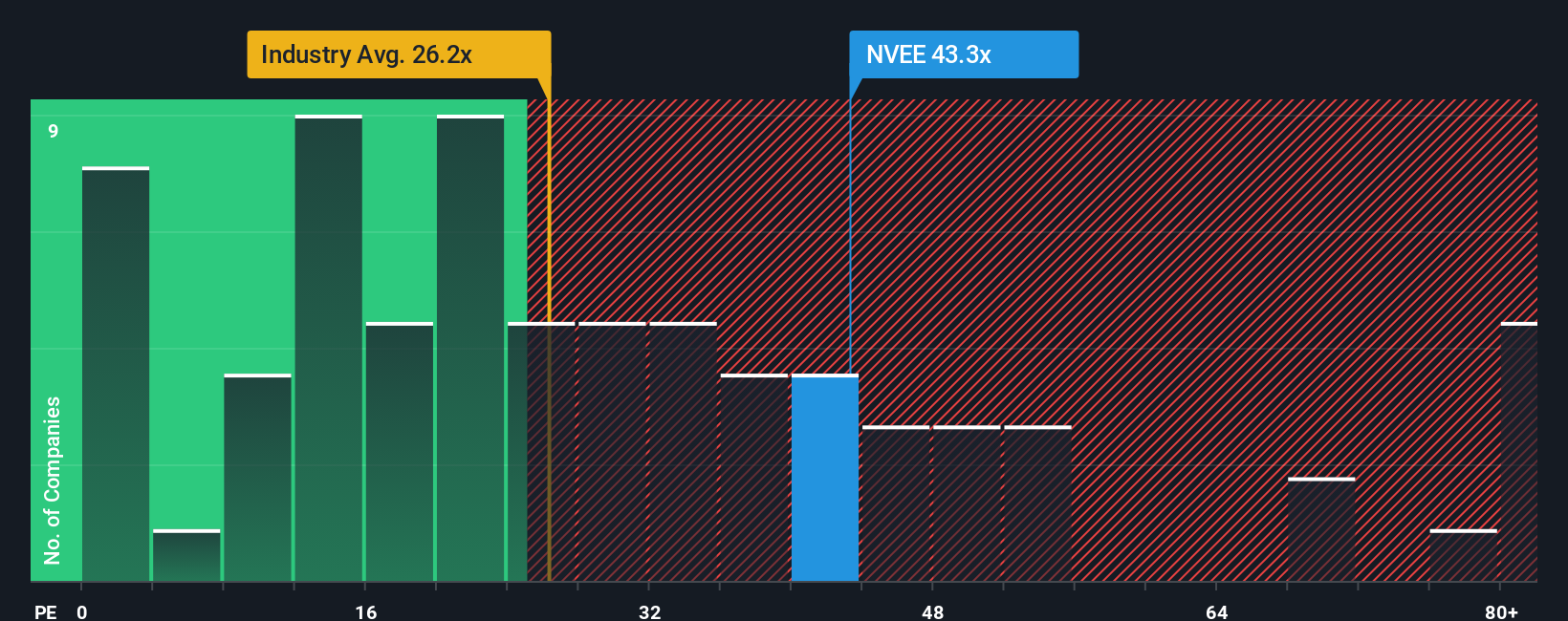

Not everyone values NV5 Global the same way. Compared to the broader US Professional Services sector, the company actually looks expensive based on its latest earnings multiple. This could indicate that the market is already ahead of itself.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own NV5 Global Narrative

If you see things differently or want to dig into the numbers yourself, you can build your own take on NV5 Global in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding NV5 Global.

Looking for More Smart Investment Ideas?

Spotting NV5 Global’s momentum is just the start. Boost your investing edge by targeting unique market themes you never want to overlook.

- Power up your search for strong-yield plays and meet top performers in the income space with our selection of dividend stocks with yields > 3%.

- Capitalize early on tomorrow’s breakthrough technologies by seeking out companies paving the way in next-generation computing with quantum computing stocks.

- Hunt undervalued opportunities equipped with strong cash flow fundamentals and see which stocks might be hidden gems by exploring undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal