DRDGOLD (DRD) Is Up 5.7% After Earnings Estimates Jump 80 Percent Has The Bull Case Changed?

- DRDGOLD recently received a Zacks Rank of #1 (Strong Buy) after analysts raised full-year earnings estimates by 80% in the past quarter.

- This upward revision comes as DRDGOLD has delivered a return significantly higher than the average for the Basic Materials sector so far this year.

- We'll explore how heightened optimism about DRDGOLD's earnings outlook may impact the company's longer-term investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is DRDGOLD's Investment Narrative?

Owning DRDGOLD means buying into the long-term story of a company that aims to turn lower-grade gold tailings into profitable production, all while maintaining strong cash flows and a high return on equity. The recent surge in analyst optimism, with earnings estimates sharply upgraded and a record-setting return year-to-date, clearly marks a shift in sentiment. While the jump in forecasted earnings is significant and could support short-term momentum, underlying questions remain about sustainability: gold production volumes have dipped, and yields are trending lower despite greater ore throughput. Dividend payouts continue, but past dividend consistency has been patchy, which might weigh on some investors’ minds. With earnings growth well above its historical average and industry peers, the recent news sharpens the short-term catalyst, yet the main risks, production volatility and gold price sensitivity, still deserve close attention as they remain central to the DRDGOLD investment thesis.

But with gold output volumes down and yield slipping, there are risks investors should know about.

Exploring Other Perspectives

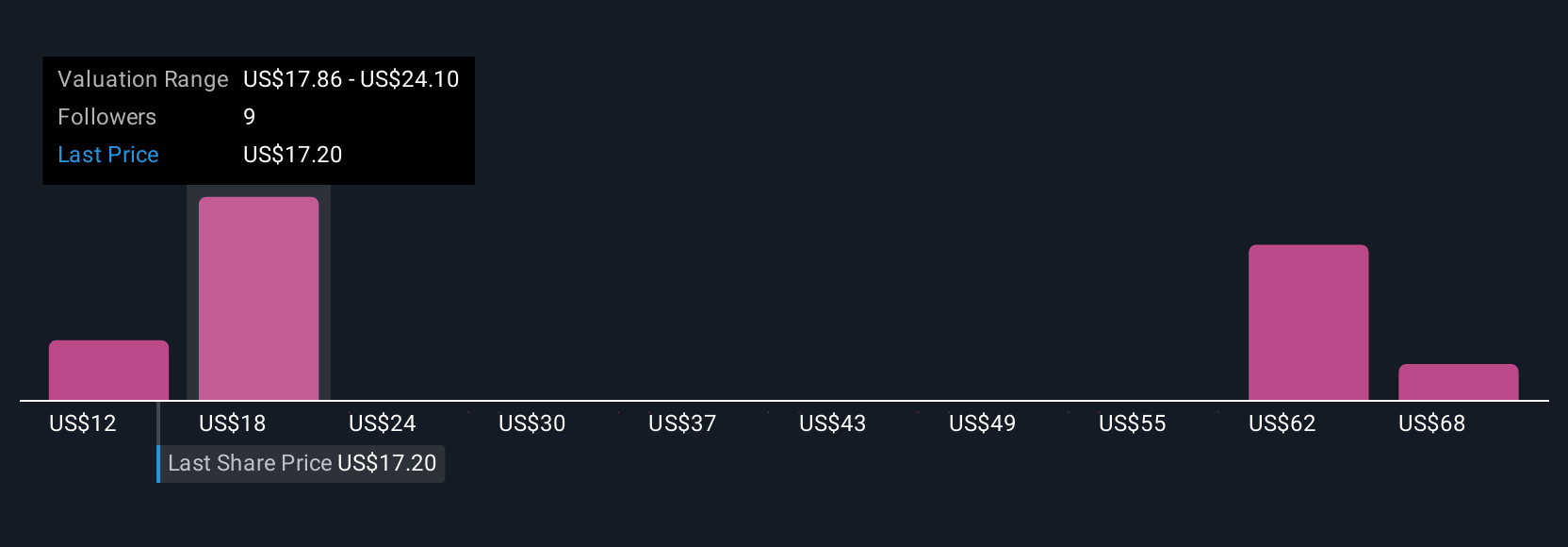

Explore 7 other fair value estimates on DRDGOLD - why the stock might be worth 48% less than the current price!

Build Your Own DRDGOLD Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DRDGOLD research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free DRDGOLD research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DRDGOLD's overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal