DorianG (LPG): Assessing Valuation as Earnings Projections Fuel Rising Market Interest

If you have been watching DorianG (NYSE:LPG) lately, you have likely noticed the buzz swirling around its upcoming earnings report. The company is expected to post a striking 300% jump in earnings per share, supported by nearly 48% year-over-year revenue growth for the quarter. With such strong forecasts in play and a top-tier Zacks Rank adding fuel, it is no surprise that investors are wondering what these next results might mean for the stock's trajectory.

While the spotlight is firmly on future earnings, DorianG’s share price has already been on the move. The stock climbed about 5% over the past month and surged 27% in the past 3 months, adding to a longer-term gain of over 235% in three years. However, its total return over the past year has lagged at just over 2%, suggesting a cooling period after sustained momentum. These numbers highlight both short-term excitement and a more tempered recent performance as the market digests the company’s prospects.

After the run-up fueled by optimistic forecasts, the key question is whether DorianG still offers genuine upside for new investors or if the promise of future growth has already been factored into the share price.

Most Popular Narrative: 12% Undervalued

The most widely followed narrative sees DorianG trading below its fair value, suggesting room for upside if projections hold.

The increasing role of LPG as a lower-carbon "transition fuel" and as an economically attractive marine fuel, especially for dual-fuel vessels, is expected to support steady or rising shipping volumes and favorable charter rates. This may bolster long-term earnings and net margins. DorianG's ongoing investments in enhancing fleet energy efficiency, retrofitting vessels for ammonia carriage, and early compliance with IMO decarbonization targets position the company to benefit from tightening environmental regulations. This may support improved margins and lower compliance costs.

Could this undervalued stock be the market’s next surprise? Analysts are betting on a financial formula powered by steady top-line growth and ambitious margin expansion. The true catalyst behind this bullish outlook is hiding in the forecast numbers. Want to unlock the projections fueling that elevated price target? The math behind this narrative is more aggressive than you might think.

Result: Fair Value of $36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, shifts in U.S. export policy or rising compliance costs could disrupt DorianG’s forecasted momentum. These factors pose real challenges to this optimistic narrative.

Find out about the key risks to this DorianG narrative.Another View: Market Comparison Sends a Different Signal

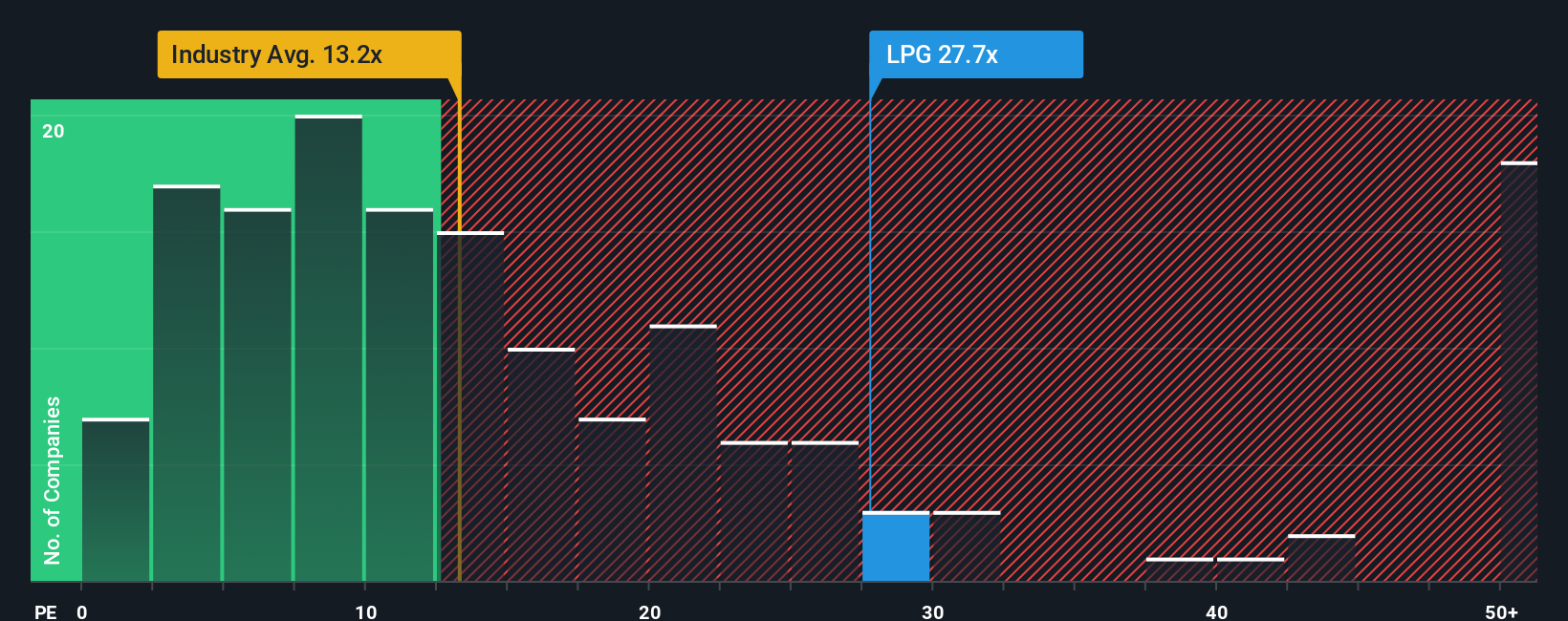

Looking through a different lens, the company appears expensive compared to others in its industry based on a common market ratio. This casts doubt on how much upside is truly left. Which perspective will play out?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DorianG Narrative

If you see things differently or want to dig deeper into DorianG’s numbers, you can craft your own perspective in just a few minutes. Do it your way

A great starting point for your DorianG research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t limit yourself to a single stock when other promising trends are taking shape. Tap into growing opportunities and move ahead of the crowd with these dynamic investment angles:

- Uncover tomorrow’s growth leaders with undervalued stocks based on cash flows. Undervalued businesses may be primed for a comeback and can reward investors who spot hidden gems early.

- Capture game-changing potential in healthcare innovation by starting your search with healthcare AI stocks. This features companies pushing boundaries in medical artificial intelligence and transformative technology.

- Secure steady returns by zeroing in on dividend stocks with yields > 3%. This approach focuses on companies delivering robust dividend yields and consistent income through every market cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal