EXL and InsureMO’s AI Insurance Modernization Partnership Could Be a Game Changer for ExlService Holdings (EXLS)

- On September 10, 2025, EXL announced a new collaboration with InsureMO aimed at speeding core system modernization, AI integration, and digital transformation for global insurers by combining both firms' industry expertise and technology platforms.

- This agreement allows insurers to quickly modernize legacy systems and adopt advanced AI-enabled functions without operational disruption, reflecting the escalating demand for flexible, modular insurance technology solutions worldwide.

- We'll examine how EXL's partnership with InsureMO to enable rapid insurance innovation may shape its long-term investment outlook.

This technology could replace computers: discover 25 stocks that are working to make quantum computing a reality.

ExlService Holdings Investment Narrative Recap

To own ExlService Holdings, I believe you need to trust in the shift toward AI-driven, modular digital services across insurance and regulated industries. The InsureMO collaboration reinforces EXL’s strength as a modernization partner, but in my view, it doesn’t fully address near-term pressures from intense competition and the need to keep innovating to protect operating margins.

Recent news like EXL’s alliance with Genesys, which also centers on AI-enabled solutions to improve customer engagement, highlights a consistent focus on expanding digital offerings. Such moves may support EXL’s earnings mix and help sustain revenue visibility, but share price performance will continue to be shaped by cost management and margin resilience.

Yet, if competitors rapidly replicate these new offerings or price aggressively, investors should pay close attention to how quickly this could erode EXL’s competitive moat and...

Read the full narrative on ExlService Holdings (it's free!)

ExlService Holdings is projected to reach $2.7 billion in revenue and $326.3 million in earnings by 2028. This outlook assumes a 10.9% annual revenue growth rate and a $90 million increase in earnings from the current level of $236.3 million.

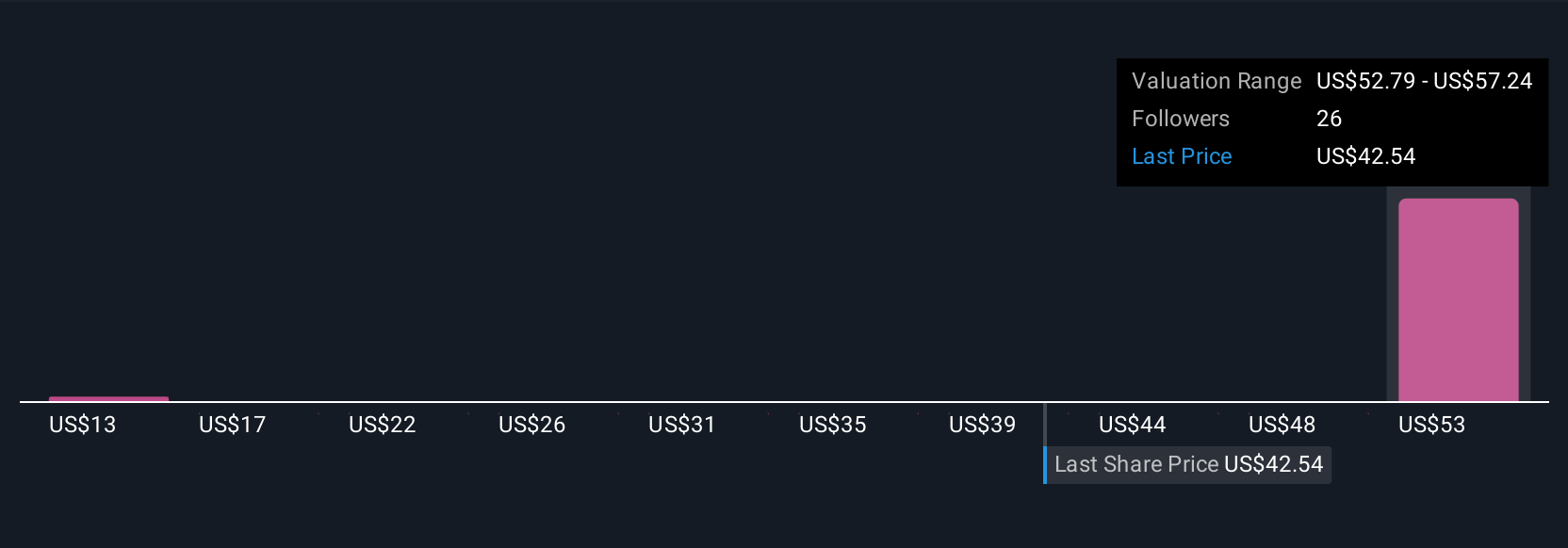

Uncover how ExlService Holdings' forecasts yield a $54.14 fair value, a 24% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community fair value estimates for EXLS fall between US$12.70 and US$54.87, revealing sharply divergent perspectives. With competition intensifying from both global and AI-centric firms, it’s clear there are many ways to evaluate EXL’s prospects, consider comparing multiple viewpoints to inform your own outlook.

Explore 3 other fair value estimates on ExlService Holdings - why the stock might be worth as much as 26% more than the current price!

Build Your Own ExlService Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ExlService Holdings research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free ExlService Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ExlService Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal