PulteGroup (PHM): Valuation in Focus as Analyst Sentiment Shifts Ahead of Earnings

PulteGroup (PHM) caught investors’ attention this week as its stock slid 3.32% in the latest trading session, even as the broader market moved higher. This dip comes on the heels of a routine dividend announcement, but the real story is shaping up around analyst expectations. With the next earnings release on deck later this month, forecasts are signaling year-over-year declines in both revenue and earnings. The Zacks Rank downgrade to a #4 (Sell) rating only adds more fuel to concerns about the near-term outlook.

Stepping back, PulteGroup’s performance has been a mixed bag. The stock has posted impressive gains of 35% over the past three months and is up 27% year-to-date, showcasing some serious momentum leading into the late summer. However, over the past year, shares have slipped less than 1%, and returns from earlier years have tapered off. The latest analyst caution looks like a clear pivot from the enthusiasm that has fueled recent rallies, raising questions about how much risk may now be on the table.

With the next earnings report looming and analyst sentiment sliding, is this recent pullback a chance to buy into longer-term strength, or is the market simply starting to price in fading growth prospects?

Most Popular Narrative: Fairly Valued

The dominant narrative considers PulteGroup to be trading right around fair value, with analysts seeing a balance between upside and downside at current levels. This perspective is based on a blend of future earnings estimates, expected margin pressures, and assigned risk premiums unique to the housing sector.

PulteGroup's strategic expansion and strong performance in active adult communities (Del Webb and Del Webb Explorer), which command higher prices and margins, positions the company to benefit from sustained demand among aging but financially strong demographics. This is likely to support both revenue growth and margin expansion, particularly as these communities come online more fully in 2026.

This narrative hinges on forward-thinking projections, not just past results. Want to know why analysts believe today’s price is justified? The calculation banks on surprising assumptions about future profit margins and long-term growth in a key homebuyer segment. Curious about which financial levers really support this valuation? The answer lies in a blend of demographic trends, forward PE ratios, and calculated risk premiums that could reshape expectations for the next three years.

Result: Fair Value of $135.85 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent affordability concerns or a sharp slowdown in key regions could quickly put pressure on PulteGroup’s margins and challenge this balanced outlook.

Find out about the key risks to this PulteGroup narrative.Another View: Deep Discount or Something More?

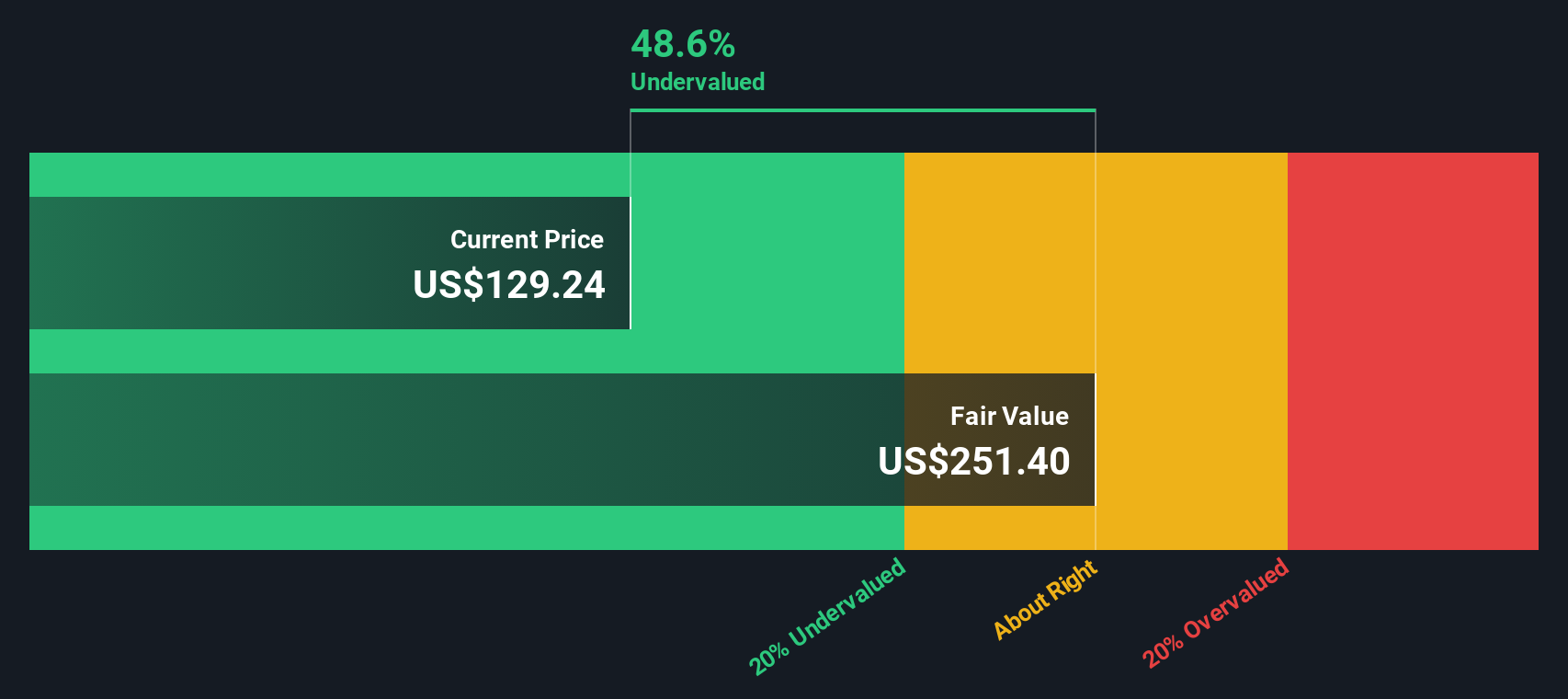

While analyst targets suggest PulteGroup is fairly valued, our DCF model offers a much more optimistic outlook. This signals the shares may be significantly undervalued today. Which perspective provides a clearer signal to investors?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own PulteGroup Narrative

If you have a different perspective or want to dive into the numbers personally, you’re free to craft your own narrative in just minutes. Do it your way.

A great starting point for your PulteGroup research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Stay ahead of the market by expanding your horizons and acting on fresh trends. The right strategies can position you for the next big move, so don’t just watch from the sidelines.

- Catch the momentum with companies at the forefront of artificial intelligence breakthroughs by using the AI penny stocks.

- Tap into strong, steady returns by screening for top picks providing yields over 3% with the dividend stocks with yields > 3%.

- Seize unique value opportunities others might miss by searching for attractively priced businesses through the undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal