Sterling Infrastructure (STRL): A Fresh Look at Valuation After Recent Share Price Gains

Most Popular Narrative: 11.7% Undervalued

Based on the most widely followed narrative, Sterling Infrastructure is viewed as undervalued relative to its projected financial future, with its consensus fair value coming in above recent share prices.

The upcoming acquisition of CEC Facilities Group will enable Sterling to deliver integrated, higher-value electrical and mechanical services alongside site development. This acquisition is expected to support geographic expansion, project cycle efficiency, and more durable customer relationships while positioning the company for margin and earnings growth that potentially exceeds historical trends over time.

Curious what’s fueling such a bullish outlook? Get a look inside the complex calculation. The narrative hinges on eye-catching earnings, bold profitability forecasts, and forward multiples that outpace industry heavyweights. Want to see what surprising financial targets justify this underappreciated price target? Find out what assumptions are making the market rethink Sterling’s true worth.

Result: Fair Value of $355 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks remain, including potential slowdowns in data center project awards and the winding down of infrastructure stimulus. Both factors could pressure future margins.

Find out about the key risks to this Sterling Infrastructure narrative.Another View

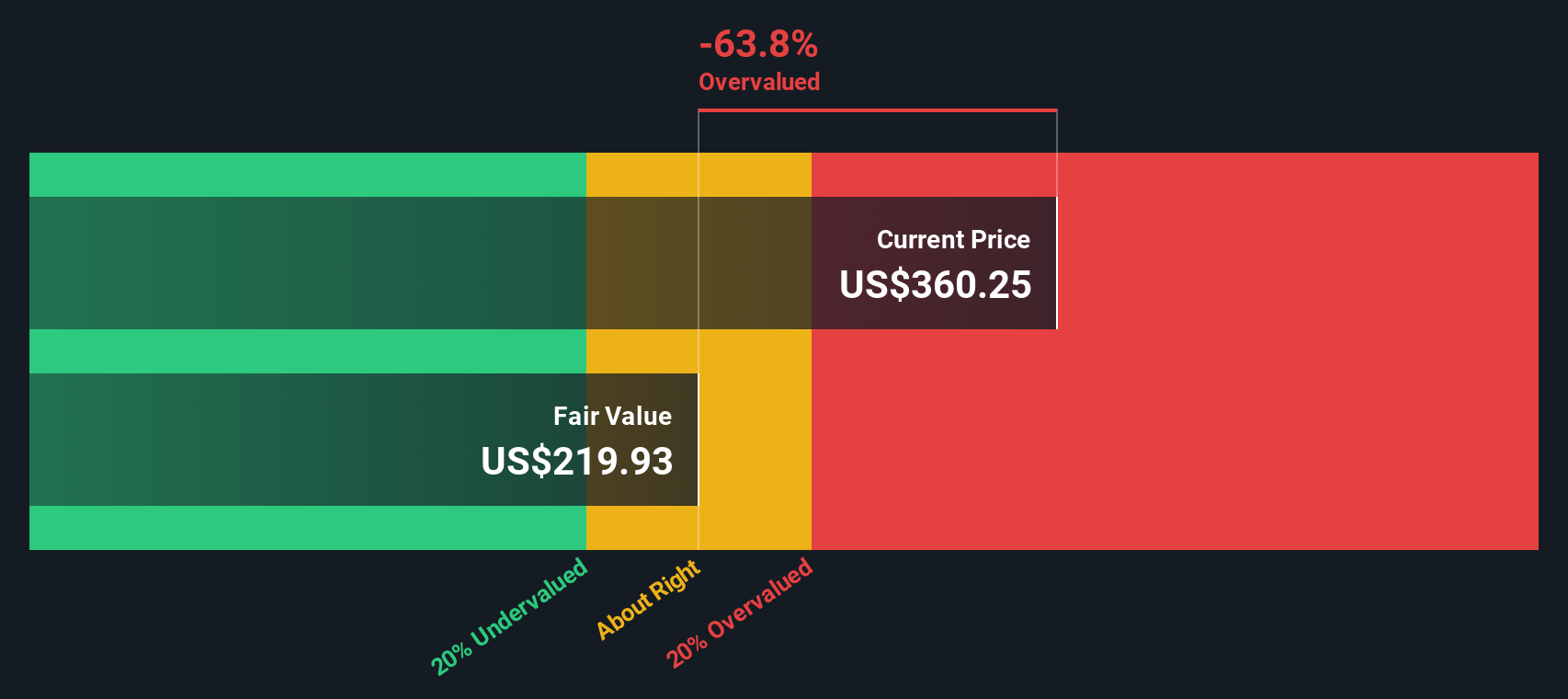

Taking a closer look with our DCF model, the story changes. The result flips to suggest Sterling Infrastructure may be overvalued instead. Can the fundamentals back up the bullish narrative, or is caution warranted?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Sterling Infrastructure Narrative

If you have a different perspective or want to verify the numbers for yourself, it only takes a few minutes to craft your own view and run the numbers. Do it your way

A great starting point for your Sterling Infrastructure research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your portfolio to just one story. Powerful opportunities are waiting if you check out these handpicked trends. Take action before others catch on!

- Tap into steady income streams and resilience by checking out companies boasting attractive dividend stocks with yields > 3%.

- Supercharge your strategy by scouting fast-growing innovators shaping tomorrow’s economy, all through our exclusive AI penny stocks list.

- Strengthen your edge in the market with stocks that might be trading for less than their true value, revealed by our smart undervalued stocks based on cash flows findings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal