What Does Credit Acceptance's (CACC) Recent Insider Sale Reveal About Its Capital Strategy?

- Earlier this month, Credit Acceptance reported second-quarter 2025 earnings per share below analyst forecasts, despite revenue coming in slightly ahead of expectations, and disclosed a sale of 350 shares by Chief Alignment Officer Nicholas J. Elliott for approximately US$182,605 on September 5, 2025.

- The company has continued to actively repurchase shares while maintaining strong liquidity and was recognized for the eleventh consecutive year among the top workplaces in financial services, reflecting a consistent focus on employee culture and operational stability.

- With the earnings miss and recent insider share sale standing out, let's examine how these developments shape Credit Acceptance's investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 29 best rare earth metal stocks of the very few that mine this essential strategic resource.

Credit Acceptance Investment Narrative Recap

To be a shareholder in Credit Acceptance, you need to believe that the company’s long-term growth in the non-prime auto lending sector, driven by ongoing demand and improvements in risk analytics, will outweigh challenges from credit performance volatility and rising competition. The recent earnings miss and insider share sale draw attention but do not materially alter the primary short-term catalyst of collections stabilization, nor do they impact the existing risk of sustained underperformance in recent loan vintages. Among recent developments, the company’s acceleration of its share buyback program stands out. Management repurchased roughly 4.5% of outstanding shares in the latest quarter, signaling confidence in the business amid challenges and reinforcing the focus on delivering value even as the company faces credit quality and origination headwinds. In contrast, investors should be aware that even with stronger liquidity and buybacks, the risk tied to underperforming 2022 to 2024 loan vintages could still ...

Read the full narrative on Credit Acceptance (it's free!)

Credit Acceptance's narrative projects $4.5 billion revenue and $504.0 million earnings by 2028. This requires 56.2% yearly revenue growth and a $79.6 million earnings increase from $424.4 million.

Uncover how Credit Acceptance's forecasts yield a $467.50 fair value, in line with its current price.

Exploring Other Perspectives

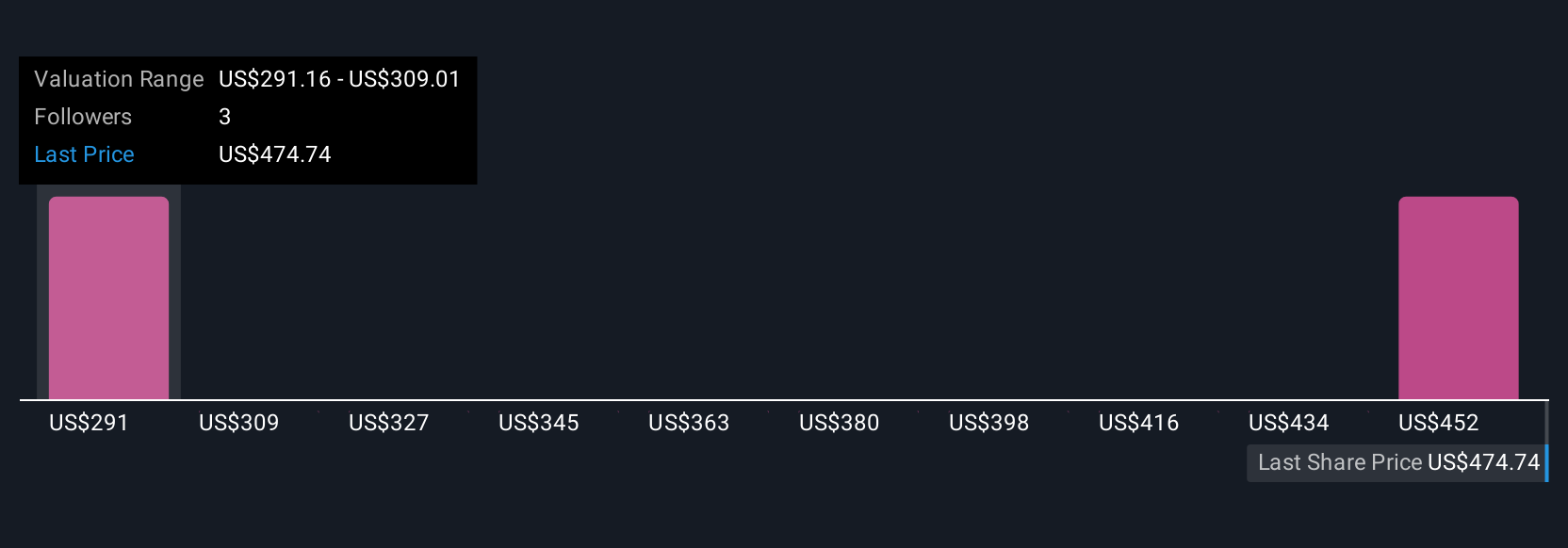

Three members of the Simply Wall St Community estimate Credit Acceptance’s fair value between US$296.52 and US$469.67 per share. Opinions vary widely, especially as persistent credit risk from past loan vintages remains a central concern for future performance; you may want to review more viewpoints on what this could mean for Credit Acceptance’s outlook.

Explore 3 other fair value estimates on Credit Acceptance - why the stock might be worth as much as $469.67!

Build Your Own Credit Acceptance Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Credit Acceptance research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Credit Acceptance research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Credit Acceptance's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 25 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal