ACI Worldwide (ACIW) Restructures Leadership As Chief Revenue Officer Position Eliminated

ACI Worldwide (ACIW) experienced a notable shift in its executive structure with the elimination of the Chief Revenue Officer position, marking a strategic move towards operational efficiency. During the last quarter, the company's stock saw a positive movement of 11%, potentially influenced by internal changes and broader favorable market conditions. The tech-heavy Nasdaq closing at a record high may have buoyed ACI Worldwide alongside other technology stocks. Additionally, the company’s partnership with iNet in Saudi Arabia, the repurchase under its buyback program, and the revenue guidance increase add context to this upward trajectory despite mixed earnings results.

We've spotted 1 possible red flag for ACI Worldwide you should be aware of.

The recent changes in ACI Worldwide's executive structure, particularly the removal of the Chief Revenue Officer role, aim to enhance operational efficiency. This shift could positively influence the company's narrative of improving sales execution and financial flexibility, as highlighted by its strategic focus on cloud-native solutions and AI-powered payment systems. These factors, coupled with strong performance in new ARR bookings, support the potential for enhanced revenue streams and market expansion opportunities.

Over the past three years, ACI Worldwide's total shareholder return, including both share price appreciation and dividends, has been 129.2%. This performance indicates significant value creation for investors over the period. However, in comparison to its recent performance, the company underperformed the broader US Software industry over the past year. The stock price's current level of US$50.15 reflects a 28.81% discount to the consensus price target of US$64.6, indicating analyst optimism regarding future price appreciation.

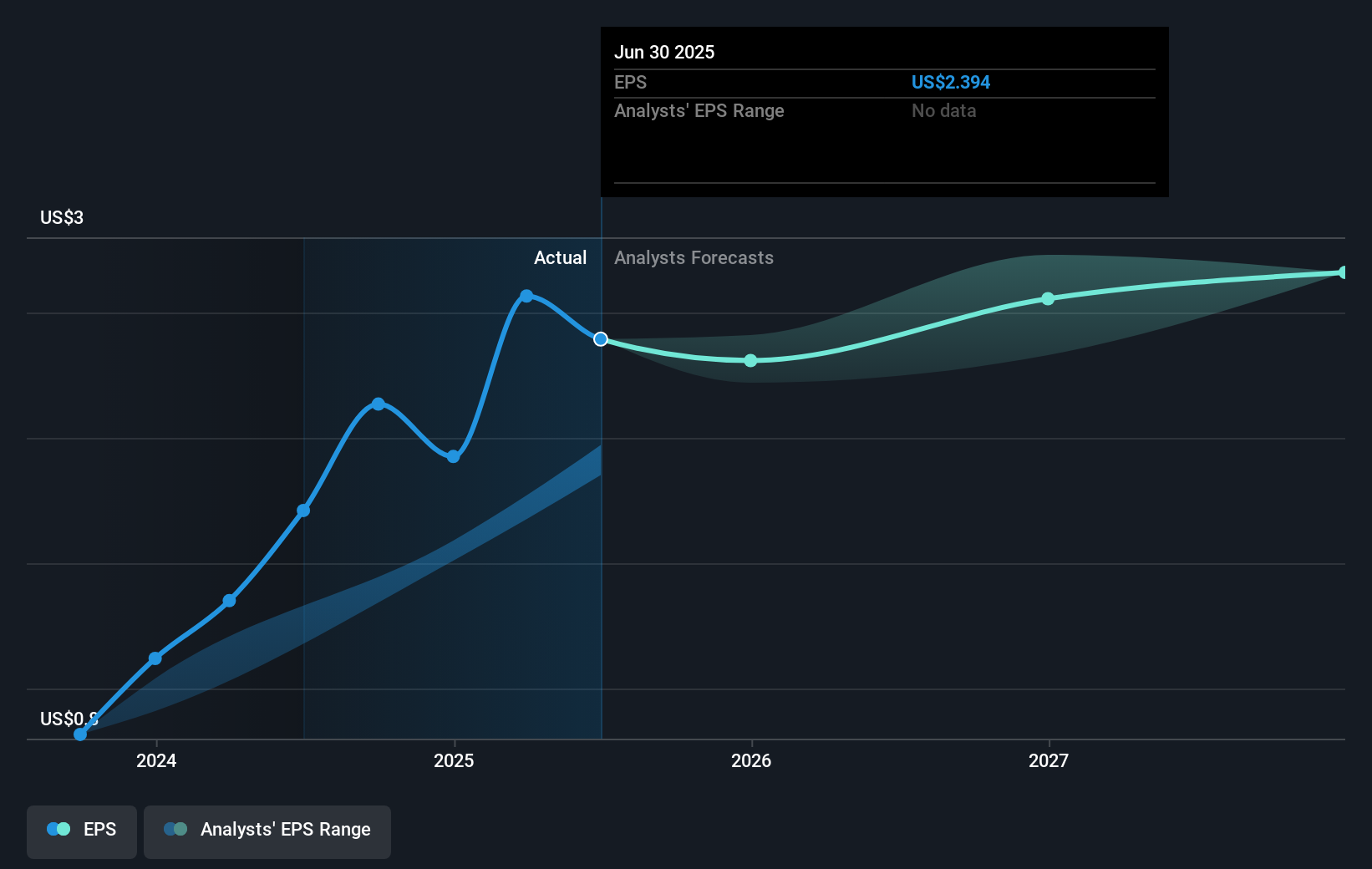

The implications of ACI Worldwide's recent developments on revenue and earnings forecasts suggest a tempered optimism. Analysts predict a 5.1% annual revenue growth and a slight margin contraction over the next few years. Such forecasts stem from the company's strategic innovations and operational adjustments, including its partnerships and buyback programs. Despite these positive indicators, ongoing competition and regulatory shifts could influence ACI's future market positioning and long-term growth prospects.

Examine ACI Worldwide's past performance report to understand how it has performed in prior years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal