Domino’s Pizza (DPZ): Examining Valuation After New Bread Bite Flavors Join Popular Promotion

If you are wondering what’s next for Domino's Pizza (DPZ) after today’s news, you are not alone. The company just revealed two new Bread Bite flavors, Cinnamon and Garlic, and has folded them into its fan-favorite Mix & Match Deal. By expanding its oven-baked lineup and keeping them at a compelling $6.99 price point, Domino's is clearly aiming to tempt both regulars and newcomers to try more items per visit. For investors, this signals a strategic approach to boosting store traffic and unit economics, especially as consumers are seeking more value from their dining choices.

Unpacking the stock’s recent journey, Domino's Pizza has posted a 13.5% total return for shareholders over the past year, with a modest 3.9% gain year-to-date. Shorter-term momentum, however, has been essentially flat in the past quarter, and a slight move down this month hints at mixed sentiment. Yet, over a longer three-year span, Domino's shares have delivered a 37% return, which suggests that the business’s underlying compounding power remains steady, even if the latest product launches have yet to move the needle on their own.

With the new menu offerings in play and shares oscillating in a tight range, is Domino's Pizza a tasty value pick right now, or is the market already factoring in this next leg of growth?

Most Popular Narrative: 11% Undervalued

According to the widely followed narrative, Domino’s Pizza stock is currently trading at a notable discount to its consensus fair value, suggesting potential upside for investors based on expected financial performance and industry dynamics.

"The recent full national rollout on DoorDash, building on last year's Uber Eats integration, is expected to be a multiyear growth driver. This allows Domino's to tap into a broader, digitally native customer base and meet rising consumer preference for at-home dining and off-premise consumption. These factors could drive higher delivery segment revenues and increased market share."

Curious what really fuels this bullish outlook on Domino’s? The narrative hinges on bold growth predictions and ambitious financial targets, backed by strategies you might not expect from a pizza giant. Which numbers are carrying all this optimism, and what kind of market multiples do analysts believe Domino’s can command in a fiercely competitive industry? Dig into the details to see how much further this slice might rise.

Result: Fair Value of $509.24 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, renewed pressure on international store growth or sluggish demand in the global pizza segment could challenge Domino’s strong case for sustained gains.

Find out about the key risks to this Domino's Pizza narrative.Another View: Industry Valuation Puts a Higher Bar

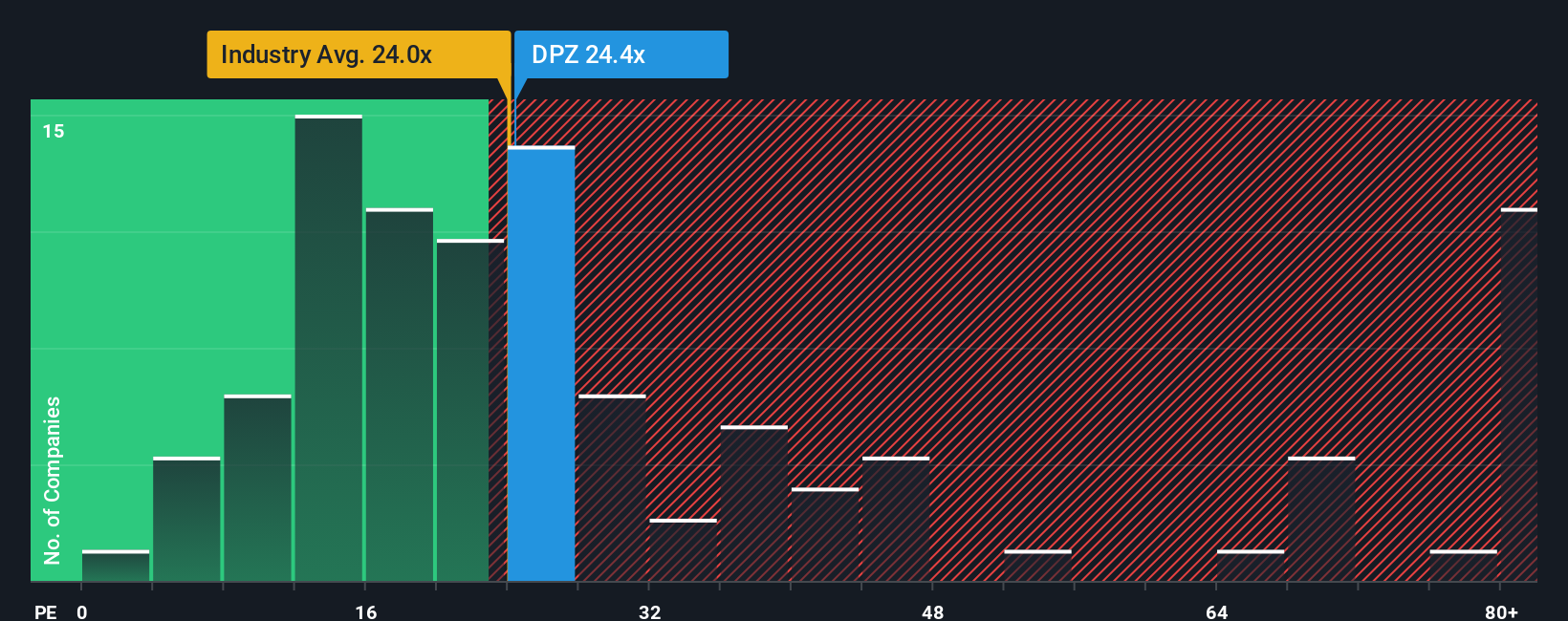

Looking through the industry lens, Domino’s shares currently trade at a noticeably higher earnings multiple than the average for the US Hospitality sector. This challenges the notion that the stock is deeply undervalued. Could the market be factoring in premium expectations, or is there still untapped upside ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Domino's Pizza Narrative

If you want to take a fresh look or dig into the numbers yourself, you can put together your own version in just a few minutes. Do it your way.

A great starting point for your Domino's Pizza research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Maximize your strategy and stay ahead of the curve by tracking top stocks chosen for real financial potential, innovation, and income growth. Don’t let opportunity pass you by. These unique screens could reveal your next winning pick.

- Unlock hidden value by targeting fast-growing companies currently trading below their true worth with our undervalued stocks based on cash flows insight embedded right in your analysis.

- Jump into the frontier of future tech by using the shortcut to AI penny stocks. See which innovative businesses are setting the pace in artificial intelligence.

- Boost your passive income strategies by pinpointing strong performers offering yields above 3% thanks to the proven picks inside our dividend stocks with yields > 3% selection.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal