Can Celanese's (CE) Cost Discipline Offset Softer Demand in an Uncertain Market?

- Celanese presented at Morgan Stanley’s 13th Annual Laguna Conference in Dana Point, California, after disclosing second quarter results that beat analyst expectations on both earnings and sales despite experiencing lower prices and volumes.

- Management stated the company anticipates softer demand in the second half of the year but is focused on cost reductions and maximizing cash flow amid an uncertain market environment.

- We'll explore how Celanese's ability to exceed quarterly earnings expectations despite end-market weakness influences its overall investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Celanese Investment Narrative Recap

To be a Celanese shareholder, you need to believe the company can restore earnings power as demand eventually normalizes and margin pressures ease, leveraging its cost control measures and product innovation. The recent quarterly outperformance has not materially changed the biggest short-term catalyst, an improvement in global end-market demand, nor has it lessened the key risk of persistent margin compression and weak volumes, particularly in Asia and the acetyl chain, which remain critical concerns. Among recent announcements, Celanese’s new US$1.75 billion revolving credit facility stands out, reinforcing its liquidity position and flexibility as it continues to manage through uncertain demand conditions. This move is directly relevant as sustaining financial resilience is fundamental when balancing near-term operational risks with the leverage needed to capture future recovery. Yet, despite these positives, it is important for investors to remember that ongoing margin compression in key regions could still...

Read the full narrative on Celanese (it's free!)

Celanese's narrative projects $10.2 billion revenue and $799.9 million earnings by 2028. This requires a 1.0% yearly revenue decline and an earnings increase of $2.4 billion from current earnings of -$1.6 billion.

Uncover how Celanese's forecasts yield a $54.69 fair value, a 20% upside to its current price.

Exploring Other Perspectives

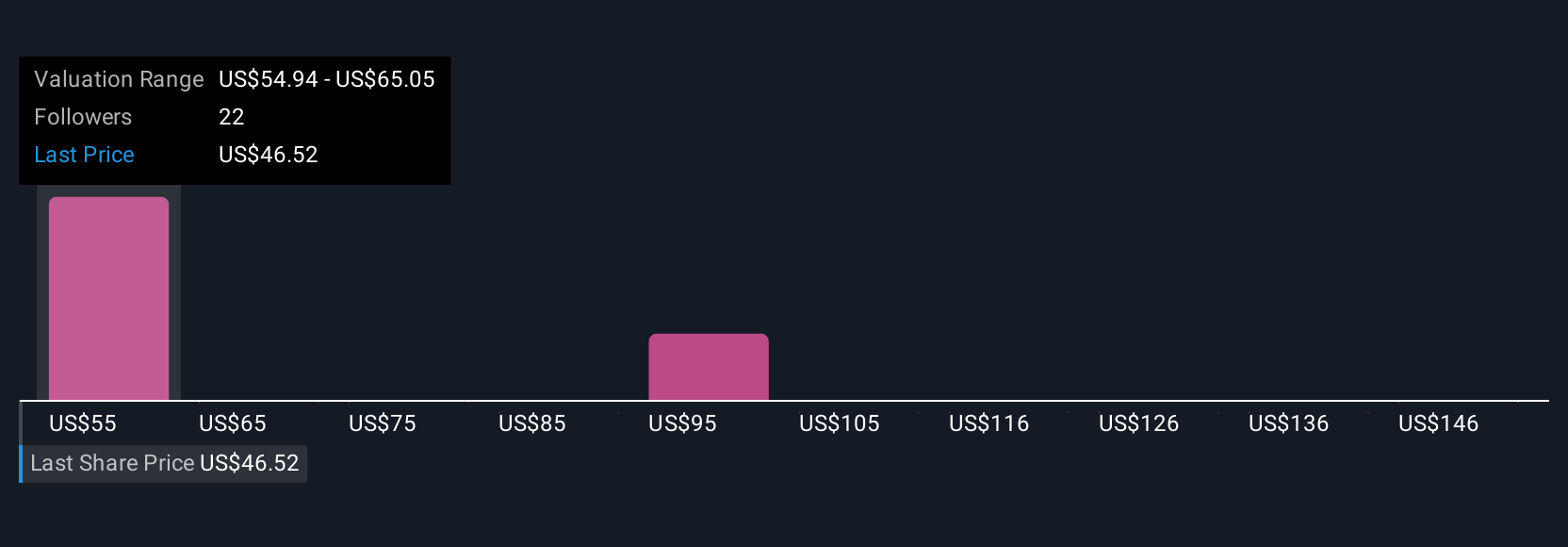

Six members of the Simply Wall St Community value Celanese between US$54.69 and US$156.05 per share, reflecting widespread differences in growth expectations. But with end-market demand risks persisting, you may want to compare your outlook with these varied perspectives.

Explore 6 other fair value estimates on Celanese - why the stock might be worth just $54.69!

Build Your Own Celanese Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Celanese research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Celanese research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Celanese's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 25 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal