A Fresh Look at Kirby (KEX) Valuation After Expanded Share Buyback Program

Kirby (NYSE:KEX) just surprised the market by announcing a boost to its buyback program, adding 8 million shares to the total, which now sits at 17 million. This move is usually interpreted as a sign that management sees value in the company’s stock and is ready to put money behind that belief. For investors weighing their next move, a buyback bump can be a meaningful signal, especially when it happens against a backdrop of uncertainty about the stock’s future direction.

Despite the recent news, Kirby’s share price performance over the past year has been challenging. The stock is down 28 percent, and momentum has also softened in the past month and quarter. However, the company has still managed to grow revenue and net income annually, reflecting some resilience in its core business. There is also the company’s strong five-year return, which reminds investors that Kirby has delivered for longer-term shareholders even when recent performance stumbles.

The question now is whether Kirby’s buyback signals a window of undervaluation, or if the market has already priced in future growth expectations. Should you act now, or wait for more evidence?

Most Popular Narrative: 25.6% Undervalued

According to the most widely followed narrative, Kirby is currently undervalued by more than 25% when measured against the consensus analyst price target and fair value model.

Supply constraints and industry-wide aging of the barge fleet are restraining new capacity growth. This positions Kirby to benefit from limited vessel availability, capacity consolidation, and rising charter rates over time, which should support steady revenue growth and expanding net margins.

Curious why analysts think Kirby’s stock could surge from here? The answer lies in ambitious financial assumptions and expectations usually reserved for high-flying sectors. The path to that lofty fair value target is paved with bold forecasts. Only insiders know the numbers, but you can uncover the rationale behind this optimistic outlook by exploring the details that drive this valuation model.

Result: Fair Value of $115.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, softness in chemical markets or persistent cost inflation could limit Kirby's revenue growth and pressure earnings, which challenges the case for undervaluation.

Find out about the key risks to this Kirby narrative.Another View: Are Markets Overlooking Risks?

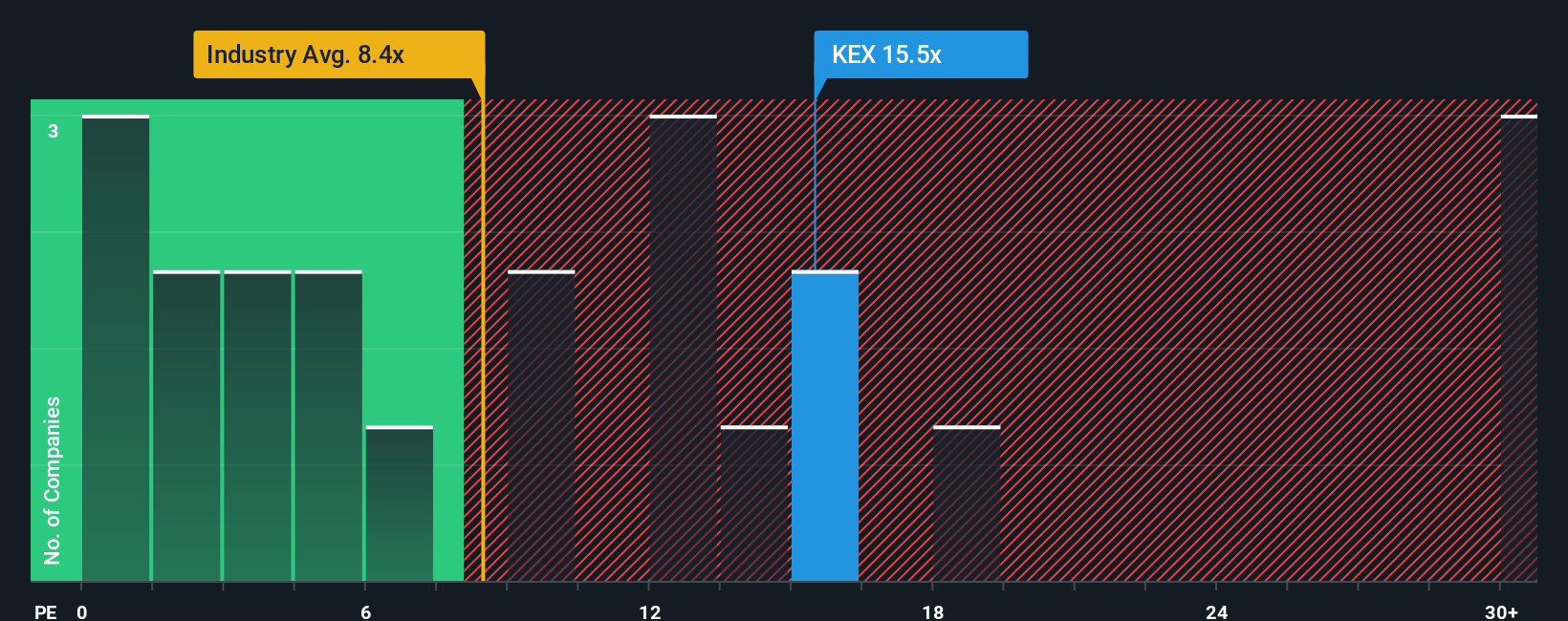

While analyst forecasts point to undervaluation, a second look using current market-based ratios suggests Kirby's shares are actually expensive compared to the rest of the U.S. shipping sector. This could indicate that market optimism is already reflected in the share price.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kirby Narrative

If you want to dig into the numbers on your own or follow a different perspective, you can quickly craft your own take, start to finish, in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Kirby.

Looking for more investment ideas?

Stay ahead of the market by setting your sights on fresh opportunities. Elevate your portfolio and get a step closer to your next winning investment.

- Unlock high-potential companies that are changing the game in artificial intelligence with the help of AI penny stocks.

- Benefit from market mispricings and find genuine bargains that others might overlook by checking out undervalued stocks based on cash flows.

- Tap into explosive breakthroughs in digital finance by tracking the growth leaders from cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal