Walker & Dunlop (WD) Expands Board, Appoints Freedman as Independent Director

Walker & Dunlop (WD) recently expanded its Board of Directors, adding Ernest M. Freedman as an independent director, which marked a significant change in its corporate governance. This appointment, along with other recent company activities, may have contributed to WD's notable 28% share price increase over the last quarter. Notably, the company's Q2 2025 earnings report showed substantial year-over-year growth, reinforcing positive investor sentiment despite mixed market performance, including a slight decline in the Dow Jones and gains in the Nasdaq. Walker & Dunlop's refinancing activities and dividend declaration further supported its upward trajectory in a generally bullish market.

The recent appointment of Ernest M. Freedman to Walker & Dunlop's Board of Directors comes amidst a broader focus on enhancing corporate governance and strategic leadership, possibly influencing the stock's rise. Over the last five years, Walker & Dunlop's total shareholder return, including dividends, was 85.30%. This contrasts with its underperformance over the past year compared to both the US Diversified Financial industry and the broader US market, where it lagged with returns of 12% and 19.1% respectively.

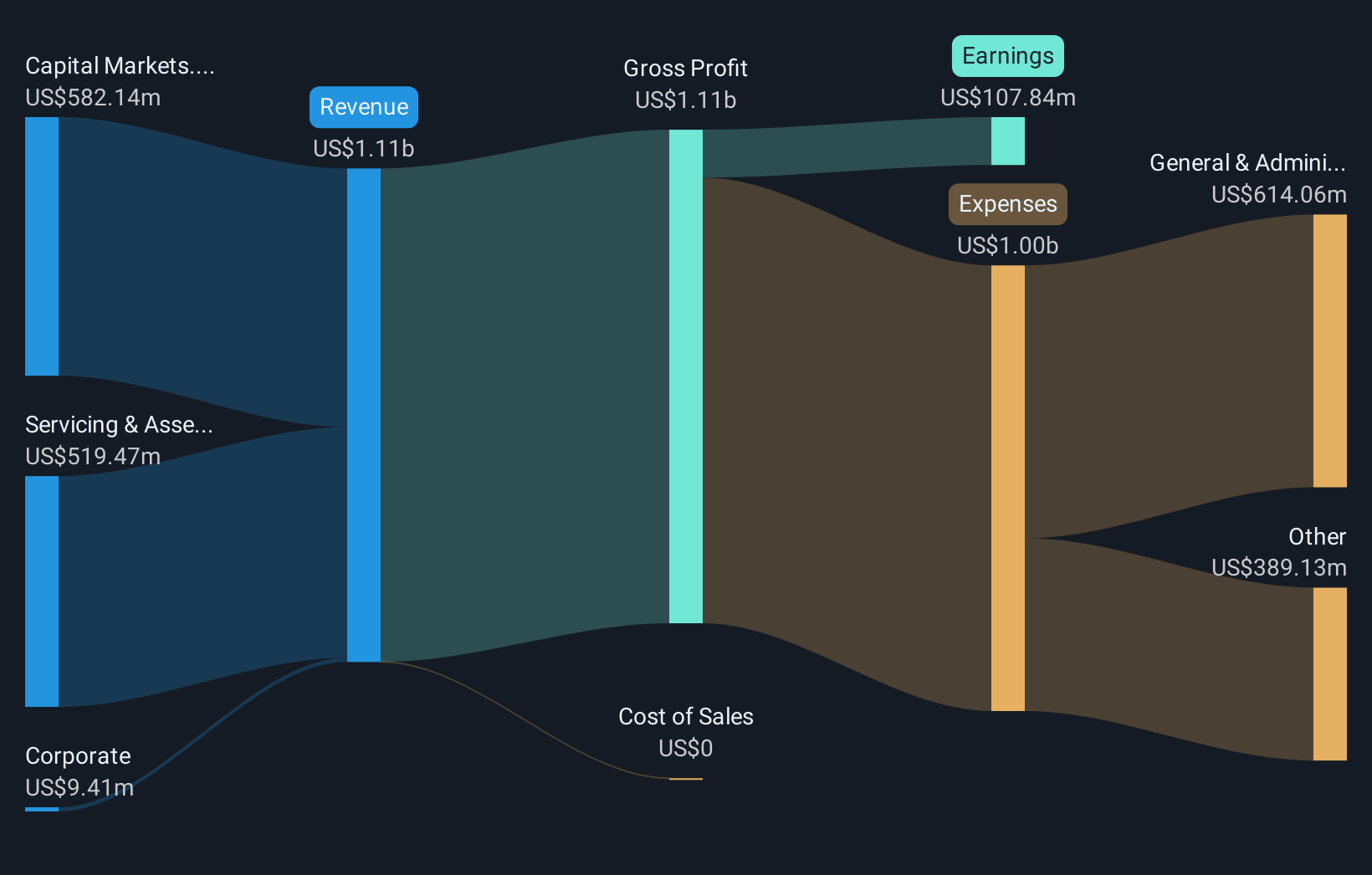

This governance change may bolster the company's efforts to expand in multifamily and affordable housing markets, potentially impacting revenue and earnings positively. The heightened emphasis on technology investments and international growth strategies aligns with investor expectations of revenue growth at 11.2% annually, and margins expected to increase significantly. However, reliance on government-sponsored entities and evolving real estate demands continue to present challenges for Walker & Dunlop.

The company's share price appreciation over the recent quarter positions it close to the consensus analyst price target of US$92.50. With a current share price of US$87.24, the market appears to reflect a balanced view of its near-term prospects against long-term potential. Keeping these moving elements in check will be crucial for realizing the projected improvement in financial metrics and ensuring the company's strategic trajectory aligns with market expectations.

Review our growth performance report to gain insights into Walker & Dunlop's future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal