Credicorp And 2 Other Leading Dividend Stocks To Consider

As U.S. stock markets reach record highs, buoyed by inflation data and hopes of interest rate cuts, investors are increasingly looking for stable income opportunities amidst the economic optimism. In such a climate, dividend stocks can offer reliable returns, providing both income and potential for growth as companies continue to navigate a dynamic financial landscape.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (PEBO) | 5.35% | ★★★★★☆ |

| OTC Markets Group (OTCM) | 4.43% | ★★★★★★ |

| Huntington Bancshares (HBAN) | 3.49% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 5.79% | ★★★★★★ |

| Ennis (EBF) | 5.44% | ★★★★★★ |

| Employers Holdings (EIG) | 3.02% | ★★★★★☆ |

| Douglas Dynamics (PLOW) | 3.56% | ★★★★★☆ |

| Dillard's (DDS) | 4.44% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.48% | ★★★★★★ |

| Banco Latinoamericano de Comercio Exterior S. A (BLX) | 5.17% | ★★★★★☆ |

Click here to see the full list of 121 stocks from our Top US Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

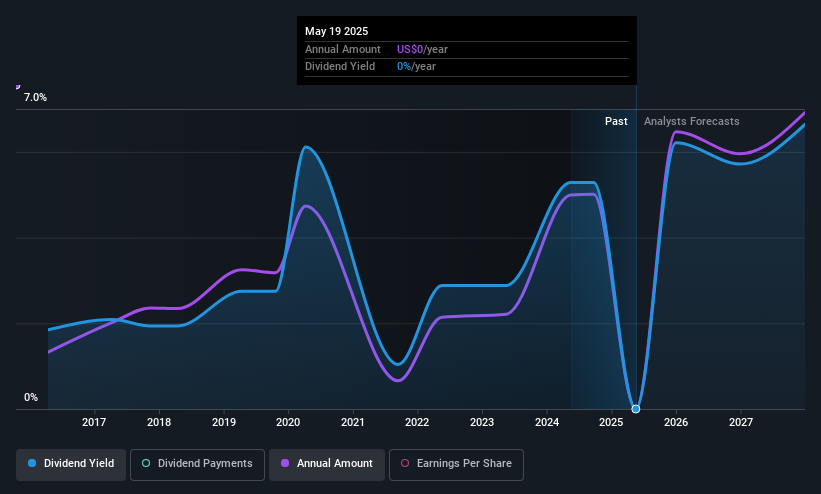

Credicorp (BAP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Credicorp Ltd. offers a range of financial, insurance, and health services in Peru and internationally, with a market cap of $20.97 billion.

Operations: Credicorp Ltd.'s revenue segments include Universal Banking through Banco De Crédito Del Perú at PEN 13.97 billion and Banco De Crédito De Bolivia at PEN 339 million, Microfinance via Mibanco at PEN 1.69 billion and Mibanco Colombia (including Edyficar S.A.S.) at PEN 329 million, Investment Management and Advisory generating PEN 971 million, and Insurance and Pension Funds from Pacífico Seguros and Subsidiaries contributing PEN 1.71 billion along with Prima AFP adding another PEN 469 million.

Dividend Yield: 4.1%

Credicorp trades at 39.7% below its estimated fair value, offering a potentially attractive entry point for dividend investors. While its dividend yield of 4.09% is lower than the top quartile in the US market, dividends are covered by earnings with a payout ratio of 50.8%. However, dividends have been volatile over the past decade. Recent earnings growth and favorable regulatory outcomes provide additional stability to Credicorp's financial outlook amidst high non-performing loans at 5%.

- Navigate through the intricacies of Credicorp with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Credicorp is trading behind its estimated value.

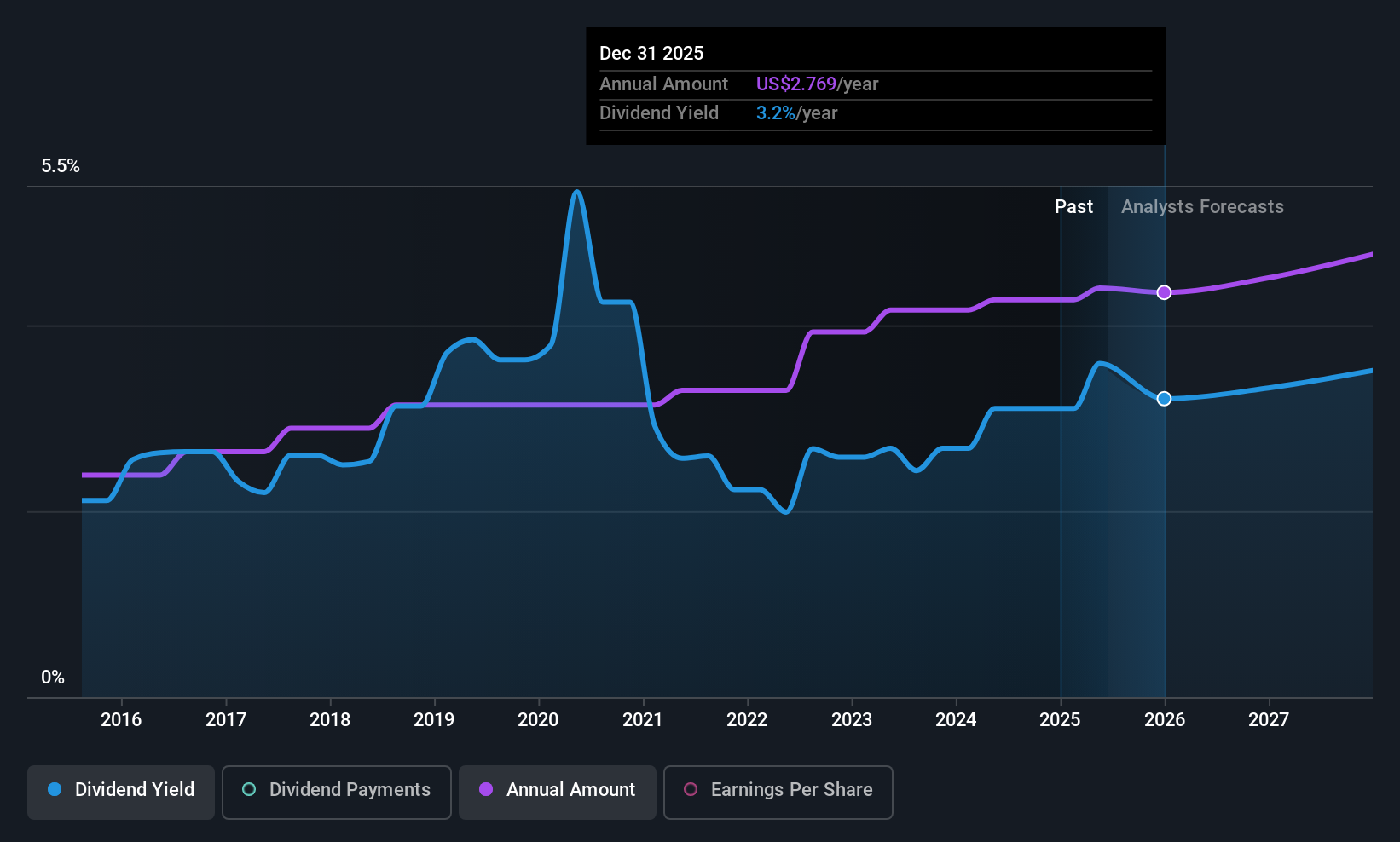

Bunge Global (BG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bunge Global SA is an agribusiness and food company with worldwide operations, and it has a market cap of approximately $16.47 billion.

Operations: Bunge Global SA generates revenue from several key segments, including Agribusiness ($43.73 billion), Refined and Specialty Oils ($13.02 billion), and Milling ($1.64 billion).

Dividend Yield: 3.4%

Bunge Global offers a stable dividend history with consistent growth over the past decade, supported by a low payout ratio of 27.3%. However, its current yield of 3.42% is below the top quartile in the US market and not covered by free cash flows. Recent earnings showed significant improvement, but shareholder dilution and large one-off items impact financial quality. The merger with Viterra aims to enhance Bunge's competitive position in agribusiness solutions globally.

- Dive into the specifics of Bunge Global here with our thorough dividend report.

- Upon reviewing our latest valuation report, Bunge Global's share price might be too pessimistic.

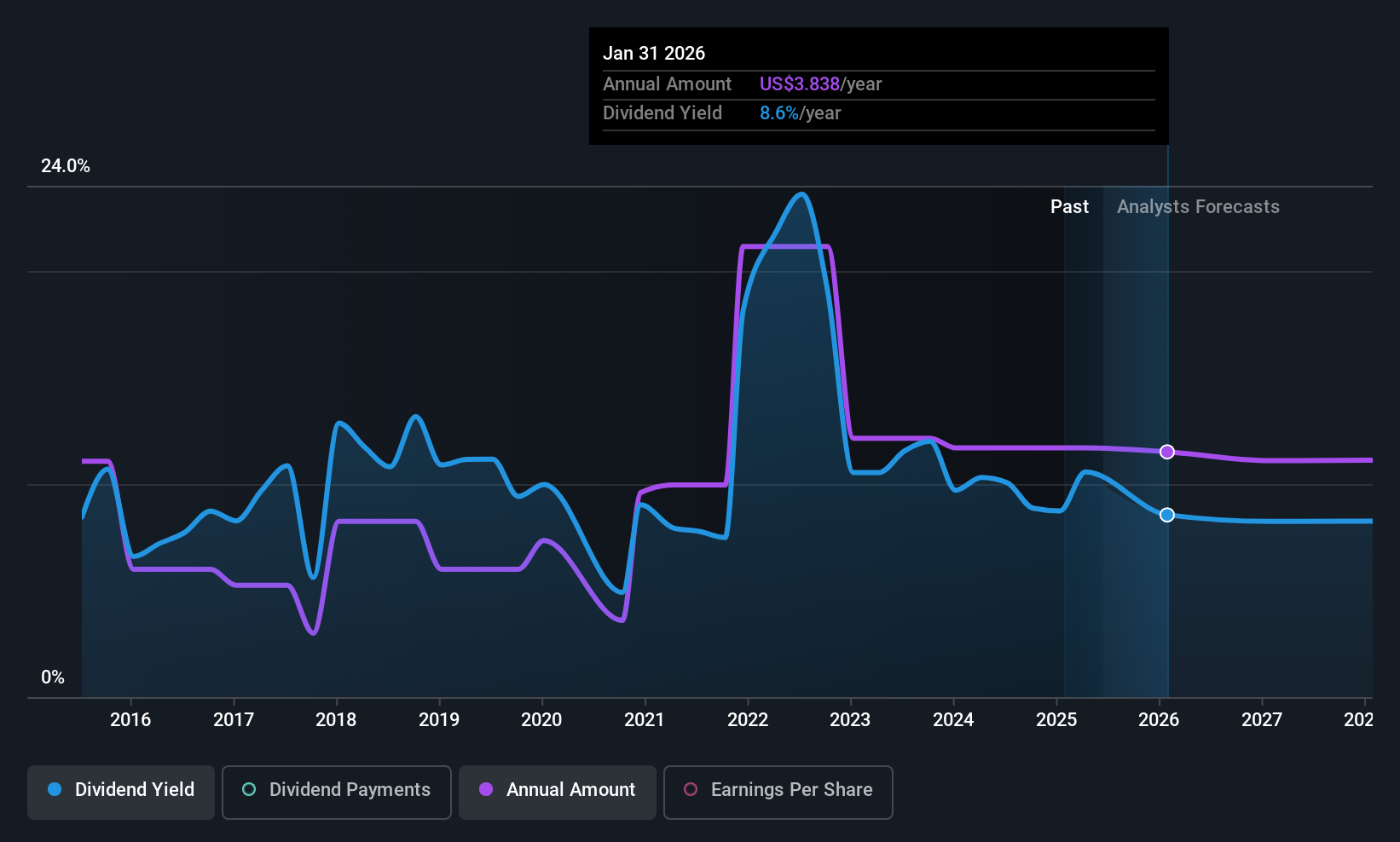

Buckle (BKE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Buckle, Inc. is a U.S.-based retailer specializing in casual apparel, footwear, and accessories for men, women, and kids under the Buckle and Buckle Youth brands with a market cap of $3 billion.

Operations: The Buckle, Inc.'s revenue primarily comes from its sales of casual apparel, footwear, and accessories, totaling $1.25 billion.

Dividend Yield: 6.3%

Buckle's dividend yield of 6.33% ranks in the top 25% of US payers, but its sustainability is questionable due to a high cash payout ratio of 97.8%, indicating inadequate free cash flow coverage. Although dividends have grown over the past decade, they remain volatile and unreliable. Recent sales growth—12.2% for August and a year-to-date increase of 7.2%—reflects positive revenue trends, yet significant insider selling raises concerns about future stability.

- Take a closer look at Buckle's potential here in our dividend report.

- Our valuation report unveils the possibility Buckle's shares may be trading at a discount.

Where To Now?

- Get an in-depth perspective on all 121 Top US Dividend Stocks by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal