The Analyst Verdict: EMCOR Group In The Eyes Of 5 Experts

Throughout the last three months, 5 analysts have evaluated EMCOR Group (NYSE:EME), offering a diverse set of opinions from bullish to bearish.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 1 | 0 | 0 | 1 |

| Last 30D | 0 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 2 | 0 | 0 | 0 | 0 |

| 3M Ago | 1 | 1 | 0 | 0 | 1 |

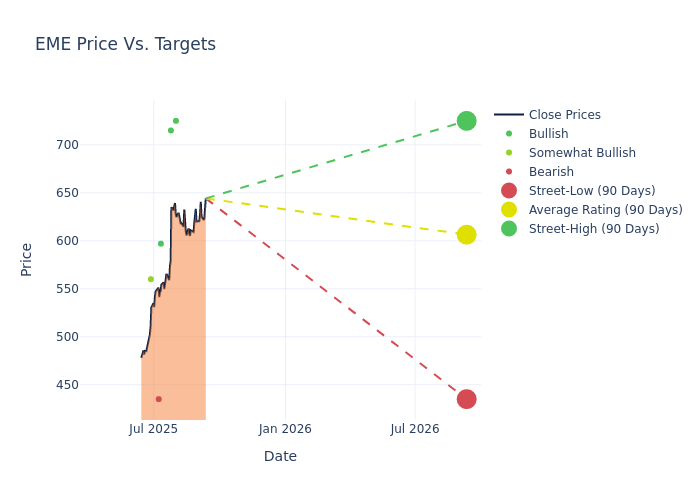

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $606.4, along with a high estimate of $725.00 and a low estimate of $435.00. Marking an increase of 23.0%, the current average surpasses the previous average price target of $493.00.

Decoding Analyst Ratings: A Detailed Look

The perception of EMCOR Group by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Brent Thielman | DA Davidson | Raises | Buy | $725.00 | $515.00 |

| Avinatan Jaroslawicz | UBS | Raises | Buy | $715.00 | $570.00 |

| Brian Brophy | Stifel | Raises | Buy | $597.00 | $503.00 |

| Adam Bubes | Goldman Sachs | Raises | Sell | $435.00 | $384.00 |

| Justin Hauke | Baird | Announces | Outperform | $560.00 | - |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to EMCOR Group. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of EMCOR Group compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for EMCOR Group's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of EMCOR Group's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on EMCOR Group analyst ratings.

All You Need to Know About EMCOR Group

EMCOR Group Inc is a specialty contractor in the United States and a provider of electrical and mechanical construction and facilities services, building services, and industrial services. Its services are provided to a broad range of commercial, technology, manufacturing, industrial, healthcare, utility, and institutional customers through approximately 100 operating subsidiaries. The company's operating subsidiaries are organized into reportable segments: United States mechanical construction and facilities services, which derives key revenue; United States electrical construction and facilities services; United States building services; United States industrial services; and United Kingdom building services. Geographically, its key revenue is derived from the United States.

Financial Insights: EMCOR Group

Market Capitalization: Surpassing industry standards, the company's market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Revenue Growth: Over the 3M period, EMCOR Group showcased positive performance, achieving a revenue growth rate of 17.39% as of 30 June, 2025. This reflects a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: EMCOR Group's net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of 7.02%, the company may face hurdles in effective cost management.

Return on Equity (ROE): EMCOR Group's ROE stands out, surpassing industry averages. With an impressive ROE of 10.07%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 3.67%, the company showcases effective utilization of assets.

Debt Management: EMCOR Group's debt-to-equity ratio is below the industry average. With a ratio of 0.22, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Analyst Ratings: Simplified

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal