Wingstop (WING) Shares Dip 13% Over Past Week

Wingstop (WING) recently launched the Smoky Chipotle Rub flavor and a Buy-One-Get-One-Free Tenders promotion, aiming to capitalize on football season excitement. Despite these enticing offers, the company's shares experienced a 13% decline over the past week. This movement contrasts with the broader market trends, where major indexes reached record highs amid optimism surrounding potential Federal Reserve rate cuts. Wingstop's price movement, potentially influenced by factors beyond these product launches, reflects investor caution despite broader market gains. While Wingstop's efforts focused on product innovation, market volatility and external economic factors might have played a role in the stock's performance.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

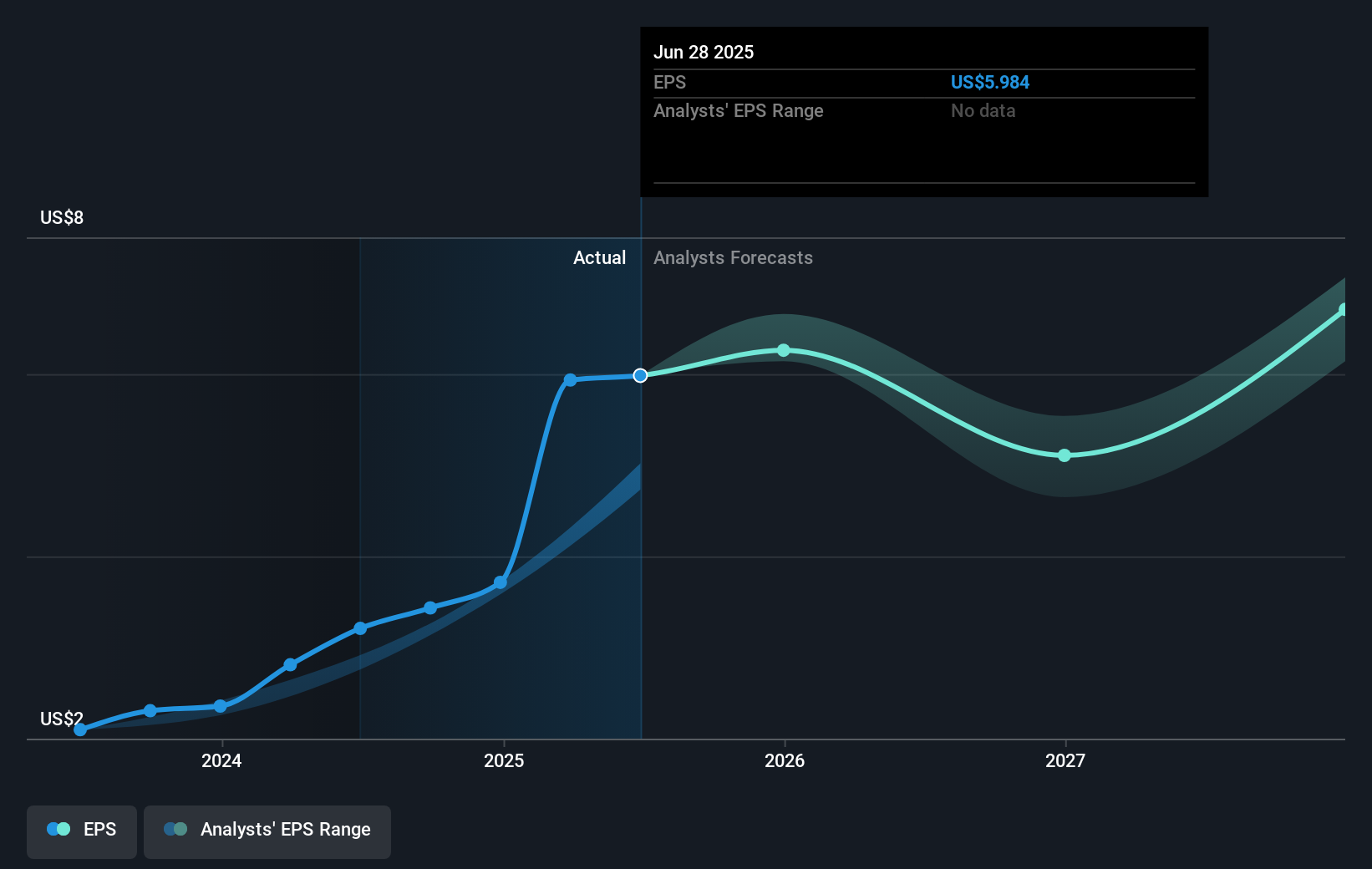

The recent promotions and new flavor launch by Wingstop could influence consumer interest in the short term, but the 13% share price decline indicates other factors may be affecting investor sentiment. Over the longer term, Wingstop has seen a significant total return of 135.8% over the past five years, showcasing substantial shareholder value creation. This is a stark contrast to its one-year performance, where Wingstop underperformed both the US market and the Hospitality industry, with the market seeing a 20% return and the industry enjoying a 31% return.

The recent actions could potentially bolster Wingstop’s revenue and earnings forecasts by attracting more foot traffic and increasing sales volume during peak seasons like football. However, considering Wingstop's share price of US$280.65 against an analyst consensus price target of US$398.55, there remains a notable gap, reflecting skepticism about whether current strategies can meet these ambitious targets. As analysts expect revenue to grow slower than necessary to justify the price target, these promotional efforts might not suffice to bridge this gap in investor expectations.

Evaluate Wingstop's prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal