US Undiscovered Gems To Watch In September 2025

As the major U.S. stock indexes soar to record highs, driven by anticipated interest rate cuts from the Federal Reserve and steady inflation data, investors are keenly watching for opportunities in less-explored corners of the market. In this environment, identifying undiscovered gems—stocks with strong fundamentals and growth potential—can be particularly rewarding for those looking to diversify their portfolios beyond well-known large-cap names.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Oakworth Capital | 87.50% | 15.82% | 9.79% | ★★★★★★ |

| Sound Financial Bancorp | 34.70% | 2.11% | -11.08% | ★★★★★★ |

| Affinity Bancshares | 43.51% | 4.54% | 8.05% | ★★★★★★ |

| FineMark Holdings | 115.14% | 2.22% | -28.34% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| Sound Group | NA | 6.23% | 45.48% | ★★★★★★ |

| Pure Cycle | 5.02% | 4.35% | -2.25% | ★★★★★☆ |

| Linkhome Holdings | 7.03% | 215.05% | 239.56% | ★★★★★☆ |

| Greenfire Resources | 35.48% | -1.31% | -25.79% | ★★★★☆☆ |

| Solesence | 91.26% | 23.30% | 4.70% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Diamond Hill Investment Group (DHIL)

Simply Wall St Value Rating: ★★★★★★

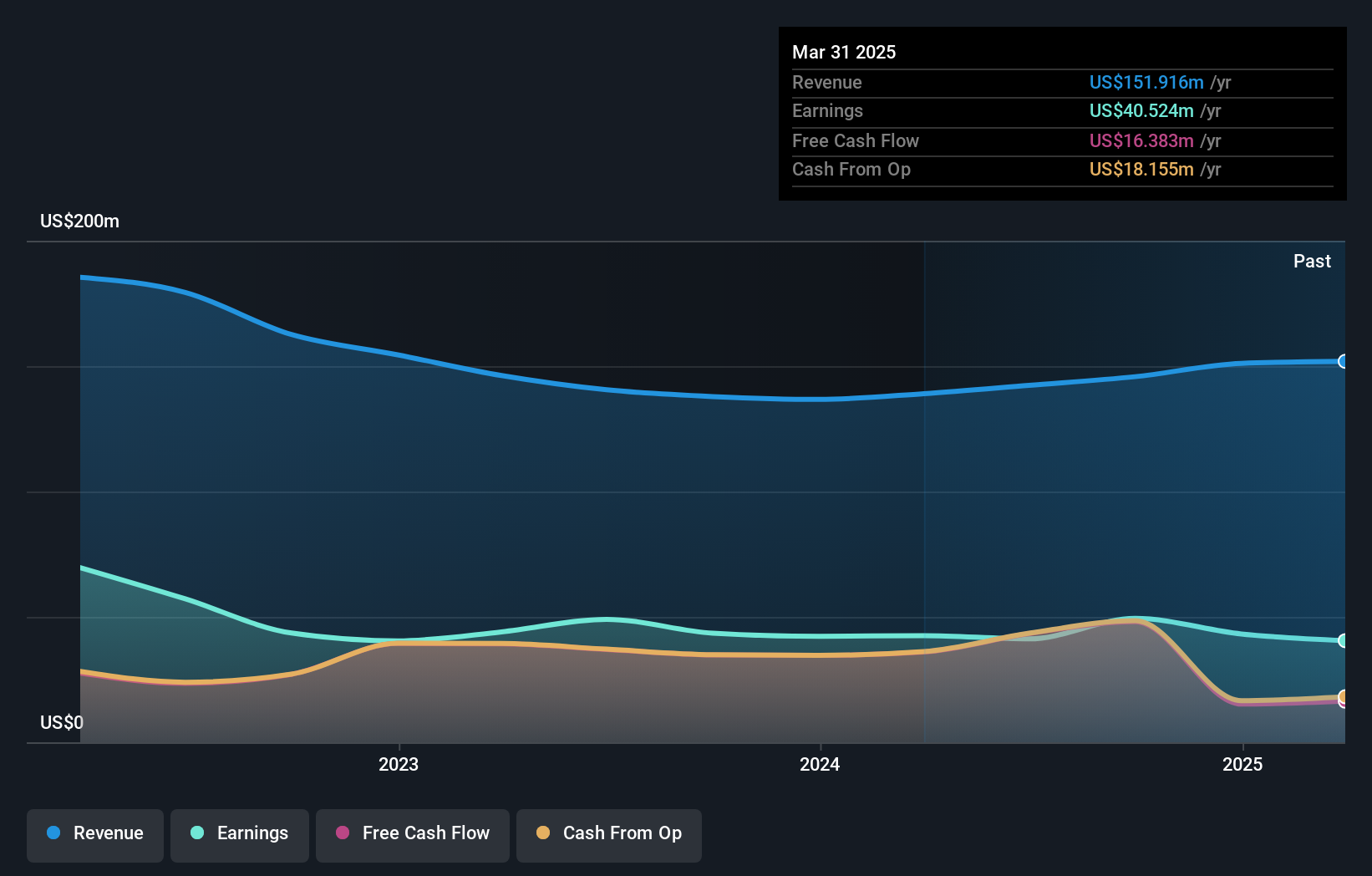

Overview: Diamond Hill Investment Group, Inc., via its subsidiary Diamond Hill Capital Management, Inc., offers investment advisory and fund administration services in the United States with a market capitalization of $381.33 million.

Operations: Diamond Hill Investment Group generates revenue primarily from its investment advisory and fund administration services, amounting to $151.28 million. The company's net profit margin is a key financial metric that reflects its profitability after accounting for all expenses.

Diamond Hill Investment Group is catching attention with its solid financial footing, having no debt for the past five years and trading at 20.7% below its estimated fair value. The company's earnings grew by 16.3% over the past year, surpassing industry averages, although a decline of 3.2% annually over five years raises some eyebrows. Recent activities include repurchasing 136,832 shares for $20.52 million and announcing a quarterly dividend of $1.50 per share, reflecting confidence in cash flow despite significant insider selling in recent months. Earnings per share from continuing operations have more than doubled to $5.73 compared to last year’s $2.93.

Red River Bancshares (RRBI)

Simply Wall St Value Rating: ★★★★★★

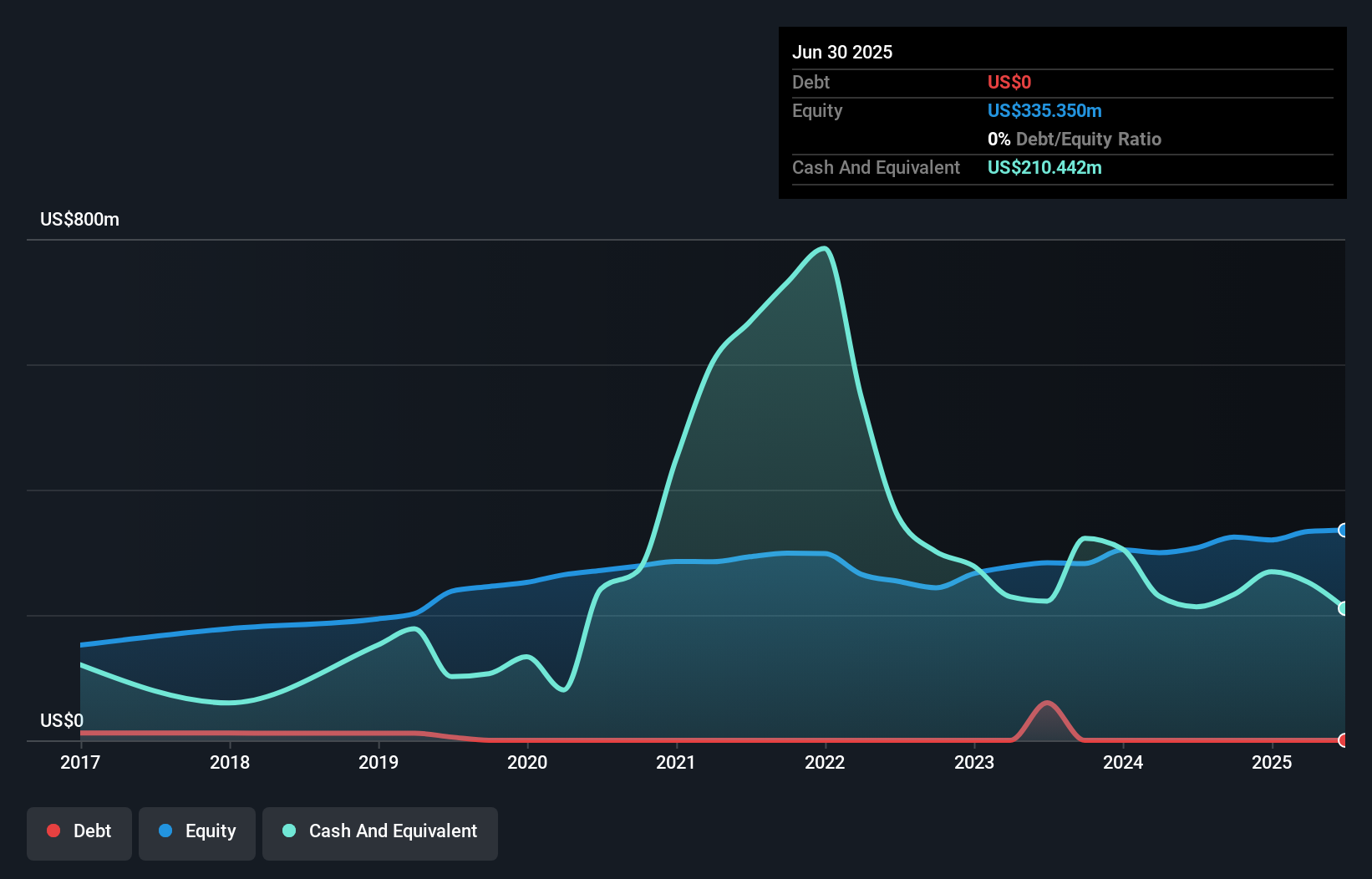

Overview: Red River Bancshares, Inc. is a bank holding company for Red River Bank, offering a range of banking products and services to commercial and retail customers in the United States, with a market cap of $430.64 million.

Operations: Red River Bancshares generates revenue primarily through its financial service operations, amounting to $115.62 million. The company's net profit margin reflects its profitability in managing expenses relative to income.

Red River Bancshares, with assets totaling US$3.2 billion and equity of US$335.4 million, stands out for its robust financial health. Its deposits at US$2.8 billion and loans at US$2.1 billion reveal a solid balance sheet structure, supported by a net interest margin of 3%. The bank's allowance for bad loans is notably sufficient at 0.05% of total loans, reflecting prudent risk management practices. Recent initiatives include a share repurchase plan worth US$5.3 million and an increased quarterly dividend to $0.15 per share, signaling confidence in its growth trajectory and shareholder value enhancement strategies.

- Navigate through the intricacies of Red River Bancshares with our comprehensive health report here.

Assess Red River Bancshares' past performance with our detailed historical performance reports.

Ranger Energy Services (RNGR)

Simply Wall St Value Rating: ★★★★★★

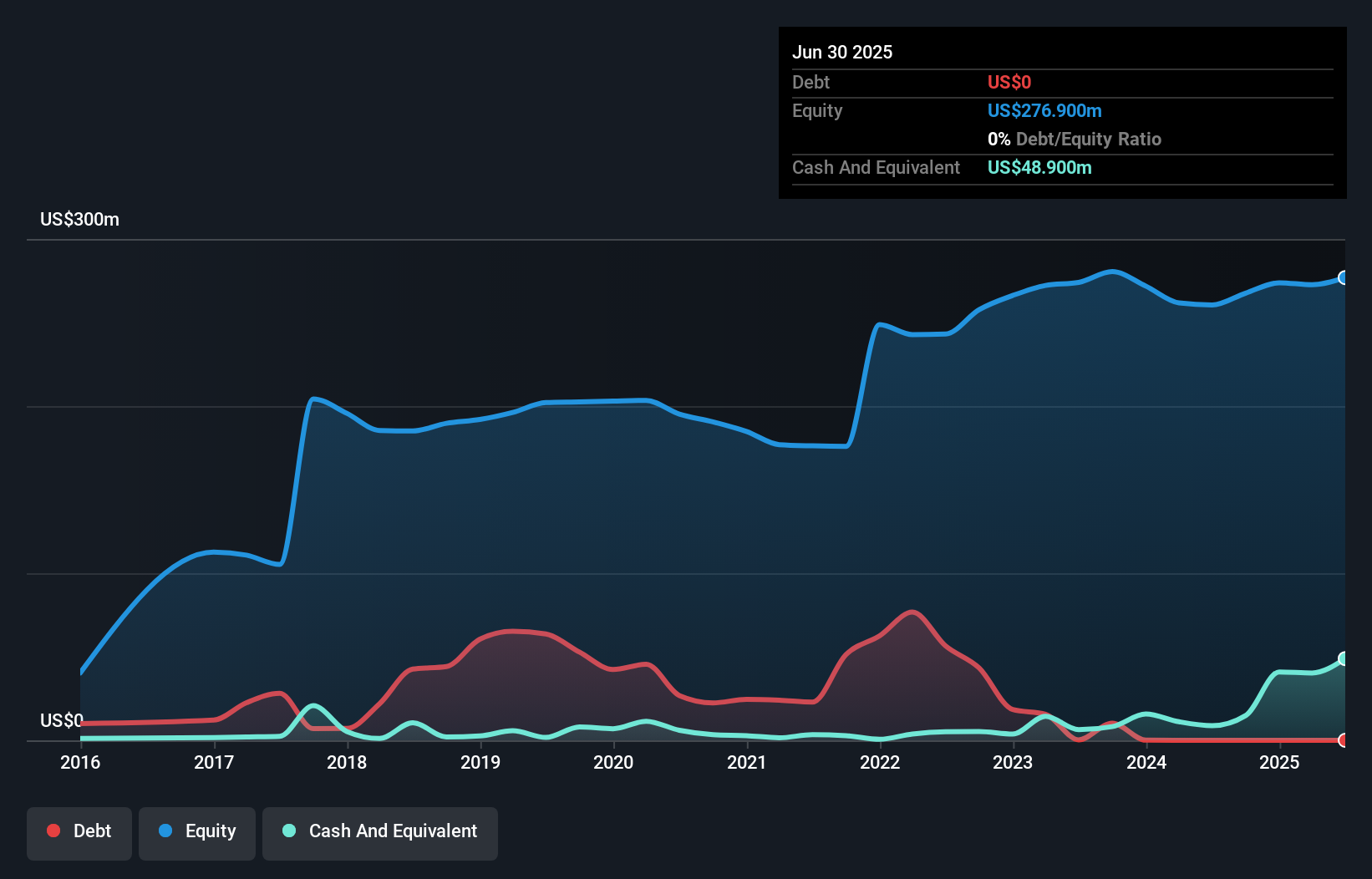

Overview: Ranger Energy Services, Inc. offers onshore high specification well service rigs, wireline services, and complementary services to exploration and production companies in the United States with a market capitalization of $294.01 million.

Operations: Ranger Energy Services generates revenue primarily from high specification rigs ($347.50 million), wireline services ($92.20 million), and processing solutions and ancillary services ($132.20 million). The company focuses on providing specialized equipment and services to exploration and production companies in the U.S., contributing to its financial performance.

Ranger Energy Services is making waves with its innovative Hybrid Double Electric Workover Rig, promising zero emissions and enhanced efficiency. Over the past year, earnings surged by 45.5%, outpacing the industry average of -4.3%. The company operates debt-free, a notable shift from five years ago when it had a debt to equity ratio of 13.7%. Trading at 65.7% below estimated fair value, Ranger's financial health seems robust with free cash flow positive at US$55.9 million as of June 2025. Recent buybacks saw the repurchase of over 3 million shares for US$35 million, reflecting confidence in its growth strategy.

- Delve into the full analysis health report here for a deeper understanding of Ranger Energy Services.

Gain insights into Ranger Energy Services' past trends and performance with our Past report.

Taking Advantage

- Get an in-depth perspective on all 280 US Undiscovered Gems With Strong Fundamentals by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal