Did Weaker Job Data and Housing Demand Just Shift NVR's (NVR) Investment Narrative?

- In recent days, a significant downward revision in U.S. job market data prompted broad concerns about economic uncertainty, with JPMorgan Chase's CEO noting signs of weakening in the American economy.

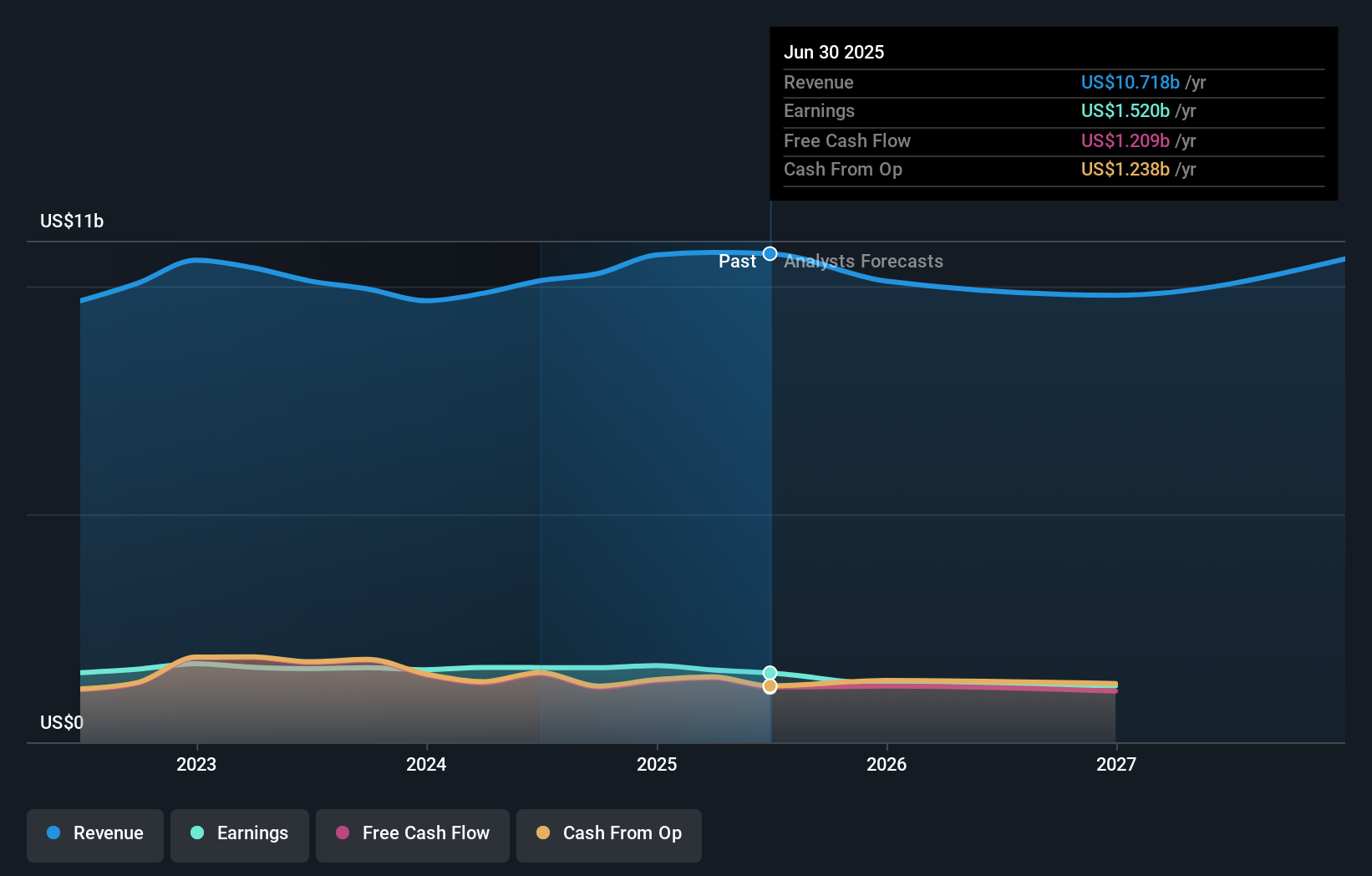

- NVR faces additional headwinds as the company reports weak backlog growth and analysts forecast a 6.9% decline in revenue, underscoring softening demand in the housing sector.

- We'll explore how soft demand and reduced backlog growth may shape NVR's investment story moving forward.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is NVR's Investment Narrative?

For someone to be comfortable as a shareholder in NVR today, they would need to believe the company can weather both near-term and structural pressures in the U.S. housing sector. The most recent economic news, a sizable downward revision in U.S. job market data and commentary from JPMorgan’s CEO about cracks in the economy, has only sharpened focus on existing risks. NVR reported declining backlog growth and revenue, and analysts now forecast a further 6.9% decline, suggesting a tougher climate for new orders. With the share price sliding alongside peers after the jobs data, short-term catalysts like a recovery in demand or strong capital returns from the company’s share buyback program may now carry less weight in the minds of investors. In the near term, the main risk looks increased: weaker economic signals may amplify already soft demand and keep earnings under pressure longer than previously estimated. This recent news event feels material, likely impacting both expected growth and investor sentiment in the months ahead.

But investors should be aware of how quickly economic sentiment now shifts the outlook for core housing demand.

NVR's shares are on the way up, but they could be overextended by 30%. Uncover the fair value now.Exploring Other Perspectives

Explore 3 other fair value estimates on NVR - why the stock might be worth less than half the current price!

Build Your Own NVR Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NVR research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free NVR research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NVR's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 29 companies in the world exploring or producing it. Find the list for free.

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal