The Bull Case For Sociedad Química y Minera de Chile (SQM) Could Change Following Codelco Lithium JV and Analyst Coverage - Learn Why

- Earlier this year, Itau BBA resumed coverage of Sociedad Química y Minera de Chile S.A. (SQM), highlighting that production efficiencies from a new joint venture with Codelco are expected to increase refined lithium output by 300,000 tonnes annually.

- This renewed analyst attention, combined with expectations for higher lithium prices due to regulatory and investment trends, has driven heightened investor interest in SQM’s growth prospects.

- We’ll examine how the lithium-focused joint venture supports SQM’s investment narrative and its outlook amid changing industry conditions.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Sociedad Química y Minera de Chile Investment Narrative Recap

To be a shareholder in Sociedad Química y Minera de Chile (SQM), you need to believe in long-term lithium demand from electric vehicles and energy storage driving both price and volume growth, despite recent revenue declines. The announced joint venture with Codelco could boost production and capital efficiency, directly impacting the near-term growth catalyst, but ongoing regulatory negotiations and state involvement remain the biggest risk; this news increases near-term optimism, but does not remove political and execution uncertainties.

Among recent events, the May 2024 formation of the Codelco joint venture stands out as most relevant, promising a major increase in refined lithium output that supports management's 2025 sales guidance and addresses growth catalysts tied to global supply tightness. This aligns closely with the company's forecasts of at least 10% volume growth in the coming year, though delivery depends on execution and a stable regulatory path.

By contrast, investors should be aware that ongoing government negotiations could still impact profitability and project approvals...

Read the full narrative on Sociedad Química y Minera de Chile (it's free!)

Sociedad Química y Minera de Chile's outlook anticipates $6.5 billion in revenue and $1.9 billion in earnings by 2028. This assumes a 15.4% annual revenue growth rate and an earnings increase of about $1.4 billion from the current $477.5 million.

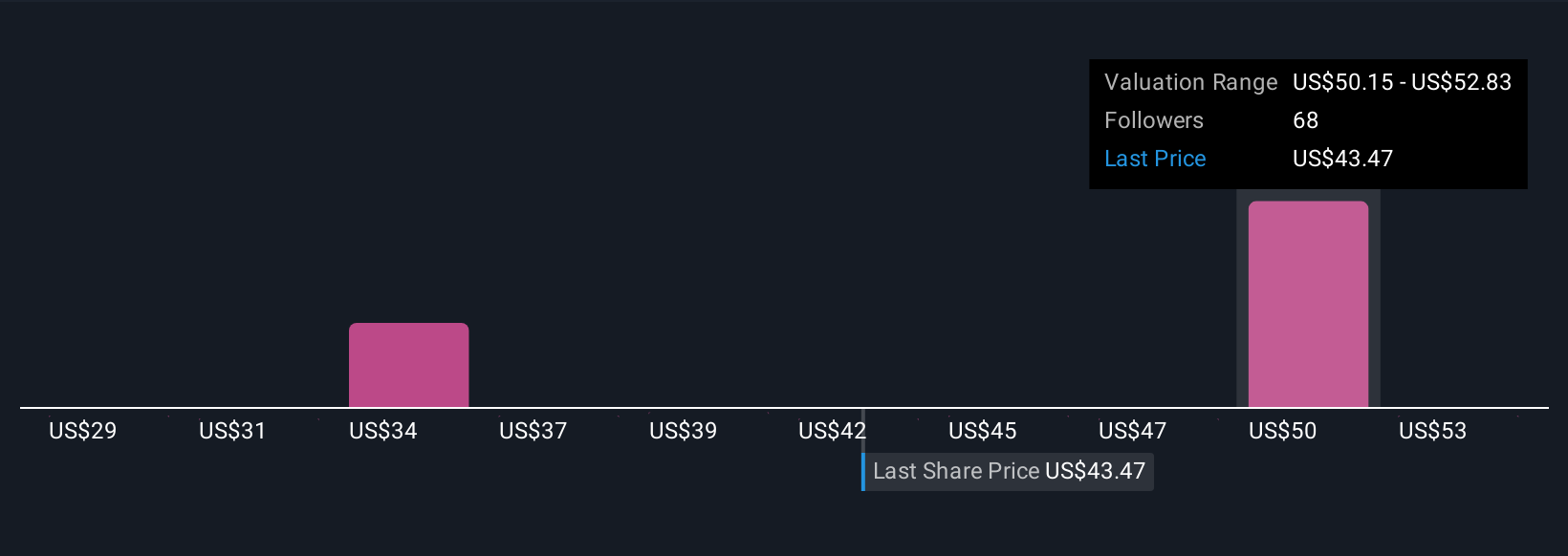

Uncover how Sociedad Química y Minera de Chile's forecasts yield a $50.99 fair value, a 22% upside to its current price.

Exploring Other Perspectives

Community fair value estimates for SQM, based on 11 unique viewpoints, range from US$5.55 to US$55.51 per share. While some see significant upside, keep in mind that many market participants are weighing the risk of increased state control in Chile, which may affect future earnings potential and project approvals.

Explore 11 other fair value estimates on Sociedad Química y Minera de Chile - why the stock might be worth less than half the current price!

Build Your Own Sociedad Química y Minera de Chile Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sociedad Química y Minera de Chile research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Sociedad Química y Minera de Chile research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sociedad Química y Minera de Chile's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal