Groupe Dynamite (TSX:GRGD) Is Up 27.5% After Robust Q2 Results and Share Buyback Announcement Has The Bull Case Changed?

- Groupe Dynamite Inc. recently reported earnings for the second quarter and six months ended August 2, 2025, posting sales of C$326.43 million and net income of C$63.89 million for the quarter, both up from the previous year.

- Alongside strong top- and bottom-line growth, the company completed a share buyback program, repurchasing 524,200 shares for C$9.3 million.

- We’ll examine how the company’s significant earnings growth influences its overall investment narrative and signals improved operational momentum.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Groupe Dynamite's Investment Narrative?

To get behind Groupe Dynamite as a shareholder, you’d need to believe in the company’s ability to sustain its strong operational and financial trajectory, captured by the latest quarter’s robust earnings jump. The second quarter numbers, higher sales and net income year-over-year, show the brand has real momentum, and the completed buyback adds another nod to management’s confidence. This development may shift the focus short term to whether this profitability pace keeps up and if such capital returns will attract more investor attention or pressure margins down the line. Previously, the bigger risks centered around the less experienced management and board, as well as a high price-to-earnings ratio compared to peers, suggesting valuation could get stretched if results waver. After this earnings release and buyback news, those catalysts and risks still matter, but the operational strength just displayed could temper some immediate valuation concerns.

But be mindful, new management’s limited track record remains a watchpoint for shareholders.

Exploring Other Perspectives

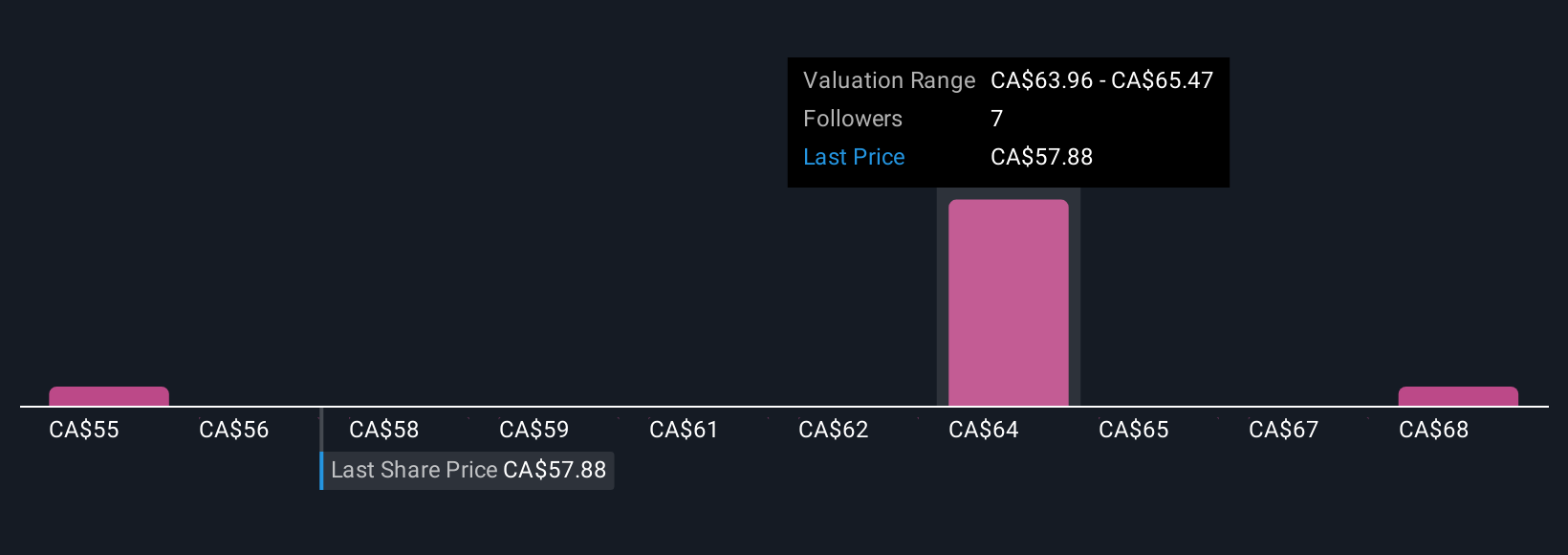

Explore 5 other fair value estimates on Groupe Dynamite - why the stock might be worth 25% less than the current price!

Build Your Own Groupe Dynamite Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Groupe Dynamite research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Groupe Dynamite research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Groupe Dynamite's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 29 companies in the world exploring or producing it. Find the list for free.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal