Qorvo (QRVO): Evaluating Valuation as Net Debt Stays Manageable but Earnings Slide Raises Balance Sheet Questions

Most Popular Narrative: 8% Undervalued

According to the most widely followed narrative, Qorvo is considered undervalued by about 8% using a discount rate of 10.85%. This story is built on robust growth assumptions and higher margin forecasts, which together elevate the company's intrinsic value above its current market price.

"The proliferation of connected devices in automotive, industrial, and consumer IoT, as shown by new automotive ultra-wideband wins, AR/VR design victories, and enterprise network content gains, positions Qorvo to capture growing semiconductor demand and diversify revenue streams. This reduces dependence on cyclical end-markets and smooths earnings."

Curious how Qorvo’s earnings forecasts and ambitious margin outlook power this intriguing undervaluation call? The analysts behind this narrative are betting on a sharp transformation in profitability and growth. What’s the secret sauce in their fair value math? Find out the figures they believe could turn this semiconductor player into the sector’s next surprise outperformer.

Result: Fair Value of $97.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, heavy reliance on a single major customer and challenges in executing diversification plans could disrupt Qorvo’s positive outlook and investor confidence.

Find out about the key risks to this Qorvo narrative.Another View: The Market's Multiple Tells a Different Story

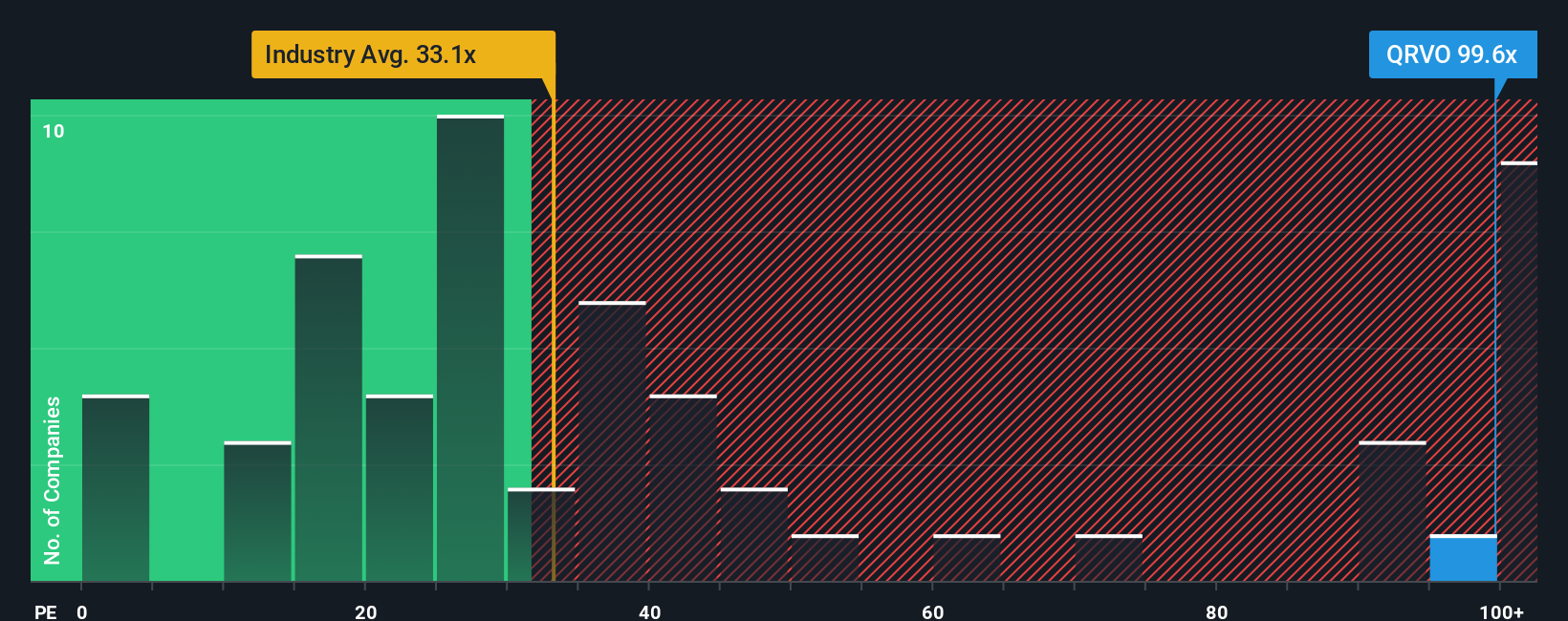

While some see Qorvo as undervalued based on future earnings and growth, a look at its price-to-earnings ratio compared to the industry paints a different picture. It raises the question of whether the market is pricing in more risk than the optimistic forecasts suggest.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Qorvo Narrative

If you see the numbers differently or want to dig even deeper into the data, you can easily craft your own perspective in just a few minutes. Do it your way

A great starting point for your Qorvo research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t pass up smart opportunities that could accelerate your investing journey. The right filters could help you spot tomorrow’s winners before the crowd.

- Tap into stocks with reliable income streams and strong potential by checking out dividend stocks with yields > 3%. These stocks consistently deliver yields above 3%.

- Find innovators blazing a trail in healthcare technology with healthcare AI stocks. These companies are making breakthroughs in artificial intelligence for better patient outcomes.

- Uncover tomorrow’s growth engines trading below their fair value through our easy-to-use list of undervalued stocks based on cash flows, which are backed by robust financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal