Evaluating LGI Homes (LGIH): Is the Recent Stock Movement Signaling a Valuation Opportunity?

Most Popular Narrative: 19% Undervalued

According to the most widely followed narrative, LGI Homes appears significantly undervalued, with its fair value estimated well above the current market price.

"The significant percentage of Millennials and Gen Z entering peak homebuying years provides a durable demand tailwind for LGI's core affordable, entry-level product. This is likely to drive long-term unit growth and revenue expansion as affordability improves and these cohorts return to the market."

Curious how analysts justify a double-digit discount? This valuation is based on a strategic mix of demand forecasts, cost controls, and ambitious expansion assumptions. There are some projected leaps in growth, profitability, and market share that could be surprising. Want to uncover the bold figures and hidden levers that make up this bullish target?

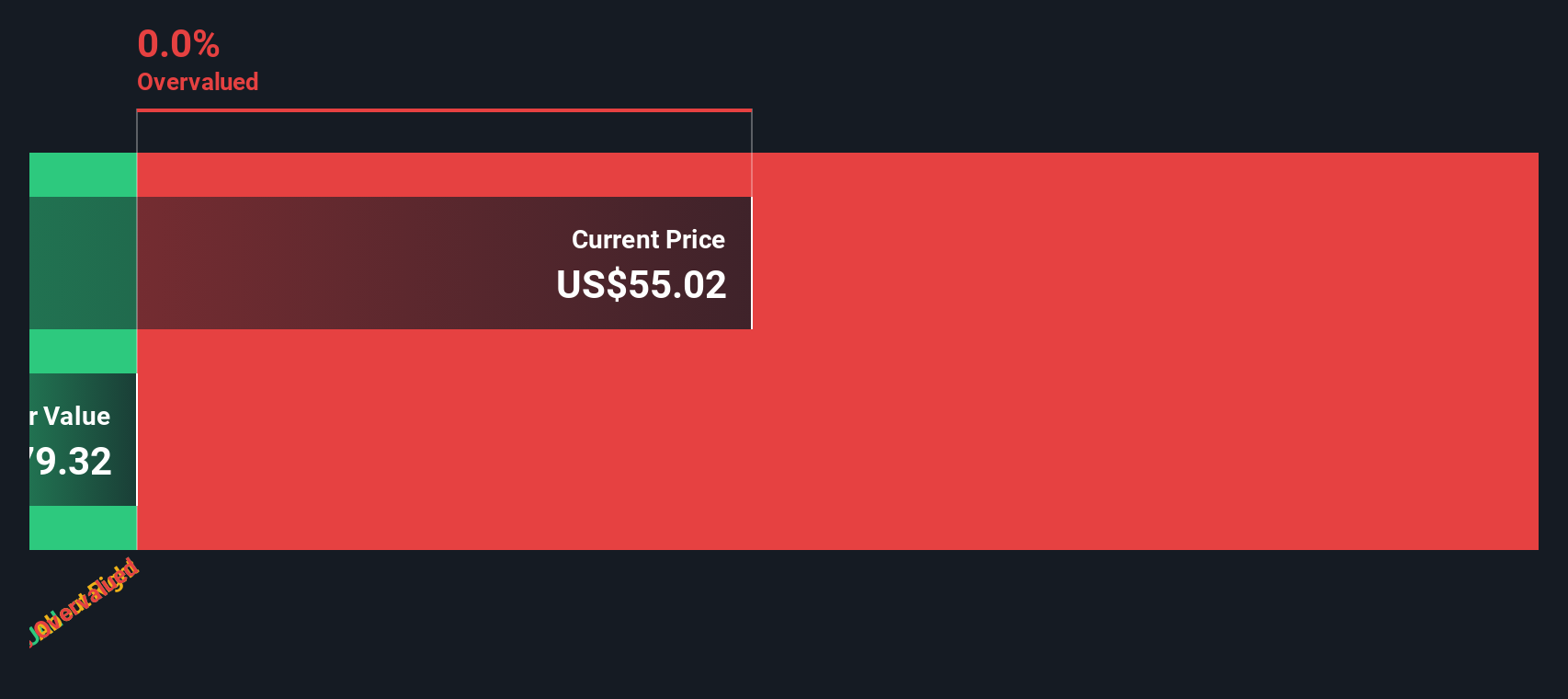

Result: Fair Value of $75.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks remain. Sustained affordability challenges or continued weak demand could derail LGI Homes’ recovery and pressure future earnings growth.

Find out about the key risks to this LGI Homes narrative.Another View: What Does a Cash Flow Model Say?

While the analyst consensus points to undervaluation based on expected growth and earnings, our DCF model lacks enough data to offer a clear fair value. This raises the question of whether the market is aware of factors that models do not capture.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own LGI Homes Narrative

If you see things differently or want to develop your personal perspective, it is quick and easy to start building your own insights. Do it your way.

A great starting point for your LGI Homes research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Take charge of your portfolio by targeting companies with unique advantages, forward-thinking growth, or reliable income streams you might have overlooked. Don’t let great opportunities pass you by. Expand your horizons today with handpicked investment themes below.

- Supercharge your watchlist by targeting undervalued stocks hidden from the mainstream. Use undervalued stocks based on cash flows to potentially uncover tomorrow’s winners.

- Boost your passive income with dependable yield and stability. Start your search for the next big payout through dividend stocks with yields > 3%.

- Spot emerging tech leaders transforming medicine and biotech by leveraging healthcare AI stocks for early opportunities in healthcare innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal