Will SES AI’s (SES) Board Refresh Signal a New Strategic Direction for Capital Allocation?

- On September 2, 2025, SES AI Corporation appointed Andrew Boyd as a Class II director, filling the vacancy left by Michael Noonen's resignation and assigning Boyd to the audit and compensation committees.

- Boyd's background as a technology-focused fund manager and former Global Head of Equity Capital Markets at Fidelity introduces substantial financial and sector expertise to the SES AI board.

- We'll consider how Boyd's appointment, particularly his extensive capital markets experience, could influence SES AI's investment narrative going forward.

This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

SES AI Investment Narrative Recap

To be a shareholder in SES AI right now, you need to believe in the company’s ability to turn its AI-driven platform for battery development into significant, recurring revenue, especially as customers weigh large-scale adoption and SES executes ambitious expansion plans. The appointment of Andrew Boyd, while it reinforces governance and sector expertise, does not appear to be a major driver for the key near-term catalyst of platform adoption, nor does it directly lessen the most pressing operational and integration risks tied to expansion and new market entries.

Among the recent announcements, SES AI’s July launch of the Molecular Universe MU-0.5 platform stands out for investors closely tracking short-term catalysts. The updated platform's potential to win over enterprise customers and generate higher-margin, software-based revenue could help drive near-term results, making execution and validation against demanding customer requirements even more important if SES AI seeks to outperform peers and meet guidance.

Yet, on the risk side, keep in mind that despite these new products and board additions, the threat of costly integration mistakes from SES AI’s rapid M&A activity remains an important factor that investors should be aware of as...

Read the full narrative on SES AI (it's free!)

SES AI's narrative projects $199.7 million in revenue and $19.9 million in earnings by 2028. This requires 160.0% annual revenue growth and a $119.7 million earnings increase from -$99.8 million today.

Uncover how SES AI's forecasts yield a $1.33 fair value, a 19% upside to its current price.

Exploring Other Perspectives

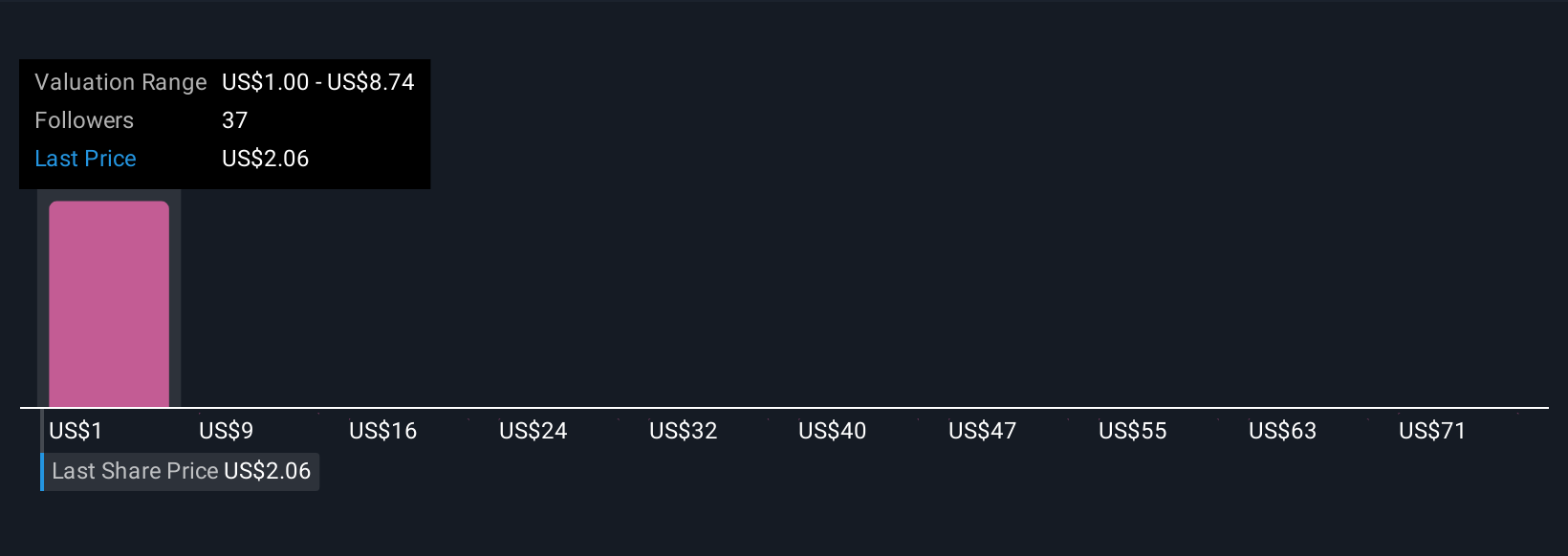

Simply Wall St Community members have produced 9 fair value estimates for SES AI ranging from US$1 to US$78.38 per share. While many expect rapid growth from the company’s platform, some still see risks to achieving that at scale, so explore several viewpoints before you decide.

Explore 9 other fair value estimates on SES AI - why the stock might be worth 11% less than the current price!

Build Your Own SES AI Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SES AI research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free SES AI research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SES AI's overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal