Could Walker & Dunlop’s (WD) Latest Seniors Housing Loans Reveal a Shift in Long-Term Strategy?

- In September 2025, Walker & Dunlop announced it had originated US$68,312,000 in HUD 232/223(f) loans to refinance seven skilled nursing facilities in Illinois and Wisconsin, using long-term, fixed-rate, non-recourse financing.

- This transaction highlights how robust demand for seniors housing and limited new supply are enabling operators to secure more stable loan structures.

- Let's explore how this large refinancing in the seniors housing market impacts Walker & Dunlop's broader investment outlook.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Walker & Dunlop Investment Narrative Recap

To own Walker & Dunlop, you need confidence that demand for multifamily and seniors housing financing will keep driving origination volumes, fee revenue, and servicing growth, even as areas like office lending remain pressured. The recent US$68,312,000 HUD refinancing for skilled nursing facilities signals resilience in the seniors housing segment, an encouraging sign for near-term loan growth, but not a material offset to the ongoing risk that high interest rates may continue to restrain broader transaction activity and compress net margins.

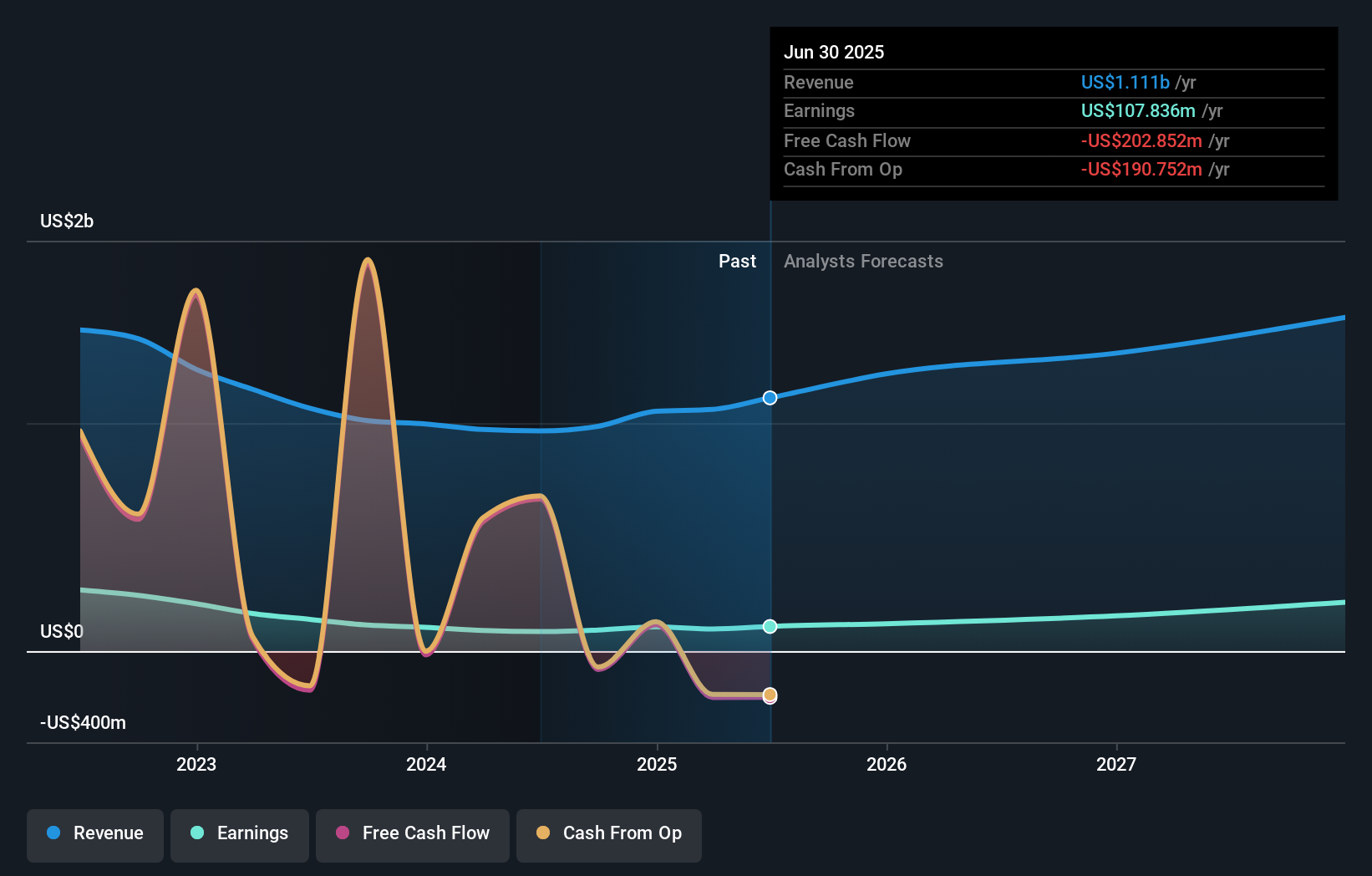

Among recent company announcements, the August 7, 2025, earnings release stands out: Walker & Dunlop reported quarterly revenues of US$319.24 million and net income of US$33.95 million, outpacing the previous year. This performance underscores how healthy origination and refinancing activity, as seen in the latest seniors housing deals, could be supporting revenue momentum for 2025, however, the persistence of wider market risks means investors are still watching catalysts closely.

In contrast, investors should also be aware that continued high or volatile interest rates could reduce transaction and refinancing volumes, and ...

Read the full narrative on Walker & Dunlop (it's free!)

Walker & Dunlop's narrative projects $1.5 billion revenue and $233.2 million earnings by 2028. This requires 11.2% yearly revenue growth and a $125.4 million increase in earnings from $107.8 million today.

Uncover how Walker & Dunlop's forecasts yield a $92.50 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community range widely from US$33.92 to US$92.50 per share. With interest rates remaining a key risk, there is significant debate over the company’s future performance, consider these diverse views closely.

Explore 3 other fair value estimates on Walker & Dunlop - why the stock might be worth less than half the current price!

Build Your Own Walker & Dunlop Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Walker & Dunlop research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Walker & Dunlop research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Walker & Dunlop's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal