Does Surging Earnings Growth and Upbeat Forecasts Shift MYR Group’s (MYRG) Long-Term Investment Narrative?

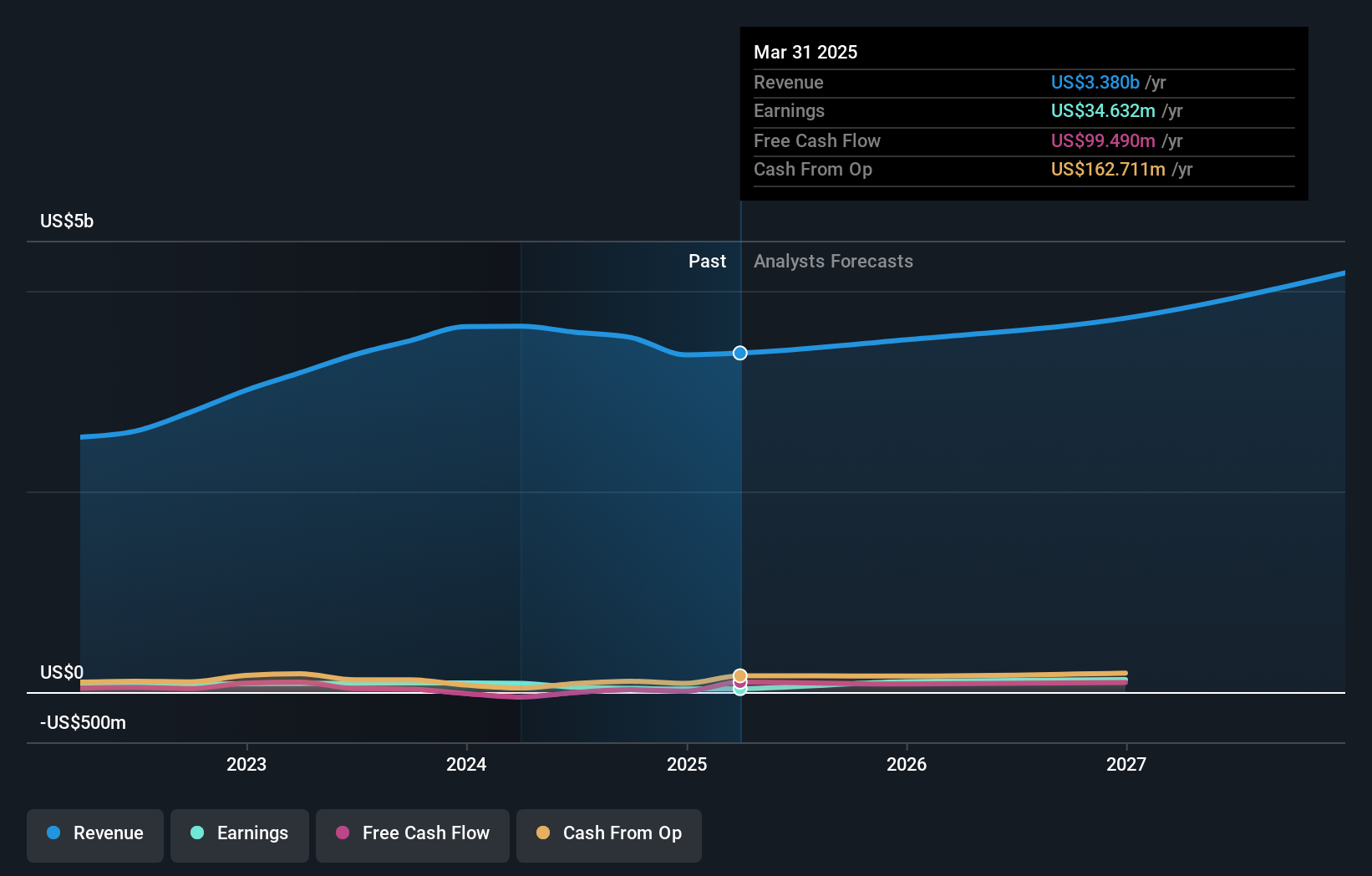

- In the past week, MYR Group Inc. reported a substantial 62% increase in its annual earnings, despite a slight drop in earnings per share over the past three years.

- Analyst forecasts now expect MYR Group's earnings to grow by 26% annually over the next three years, reflecting a higher confidence in the company's growth prospects.

- To assess what this means for MYR Group’s outlook, we’ll explore how accelerating earnings projections could strengthen its long-term investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 29 best rare earth metal stocks of the very few that mine this essential strategic resource.

MYR Group Investment Narrative Recap

To be a MYR Group shareholder, you have to believe in the company’s ability to capture sustained demand for electrical infrastructure services and consistently deliver earnings growth, even as backlogs fluctuate and demand for renewables wanes. The recent earnings surge and raised analyst growth forecasts support optimism, but the greatest near-term catalyst, large multi-year utility contracts, remains unchanged by this news, while the main risk continues to be unpredictable C&I backlog and project timing. No material change to the business’s risk profile appears evident from the latest report.

The recently announced five-year, over US$500 million service agreement with Xcel Energy stands out, anchoring future recurring revenues and bolstering MYR Group’s outlook for steadier earnings. This major contract aligns with the earnings growth narrative and remains a key driver for short- and mid-term performance, reinforcing why long-term investors have focused on ongoing contract wins.

On the other hand, investors should be mindful of how any further sequential decline in C&I backlog could...

Read the full narrative on MYR Group (it's free!)

MYR Group's narrative projects $4.3 billion revenue and $157.2 million earnings by 2028. This requires 8.0% yearly revenue growth and a $80.8 million earnings increase from $76.4 million today.

Uncover how MYR Group's forecasts yield a $209.60 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community contributors estimate MYR Group’s fair value in a tight US$208.51 to US$209.60 range, based on two independent forecasts. This consensus contrasts with the risk that unpredictable C&I backlog and extended project negotiations could still pressure MYR Group’s earnings consistency, pointing to different ways investors weigh growth and stability.

Explore 2 other fair value estimates on MYR Group - why the stock might be worth as much as 18% more than the current price!

Build Your Own MYR Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MYR Group research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free MYR Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MYR Group's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal