Newmark Group (NMRK) Expands in Middle East with Senior Managing Director Hire

Recently, Newmark Group (NMRK) announced the appointment of Stefan Burch as Senior Managing Director to lead expansion in the Middle East, which marks a significant step in its strategic growth efforts. Over the last quarter, the company's stock price surged 59%, a notable movement influenced by multiple factors. The broader markets have witnessed record highs, with indexes like the S&P 500 and Nasdaq reaching unprecedented levels amidst robust AI demand and inflation data easing, which may have boosted investor sentiment generally. Newmark's initiatives, such as share buybacks, strategic partnerships, and increased earnings guidance, likely played an influential role in supporting this upward trajectory.

Be aware that Newmark Group is showing 1 possible red flag in our investment analysis.

The appointment of Stefan Burch as Senior Managing Director to lead Newmark Group's expansion in the Middle East aligns with the company's ongoing efforts in international market growth, as highlighted in the narrative. The focus on global expansion and integration into alternative assets, paired with management's talent acquisition, underscores a proactive approach to fostering superior revenue growth and operational resilience. These elements could further amplify revenue and earnings forecasts, with potential reductions in long-term risks associated with sector cycles and urban market dependencies.

Newmark Group's shares have experienced a substantial increase over the past five years, with a total return of over 320%. This substantial growth reflects the company's effective strategies and market positioning, which outpaced the broader US market's 20.5% return over the past year. Comparatively, Newmark matched the US Real Estate industry's 28.4% return in the same year, showcasing its strong market presence, particularly in the last year.

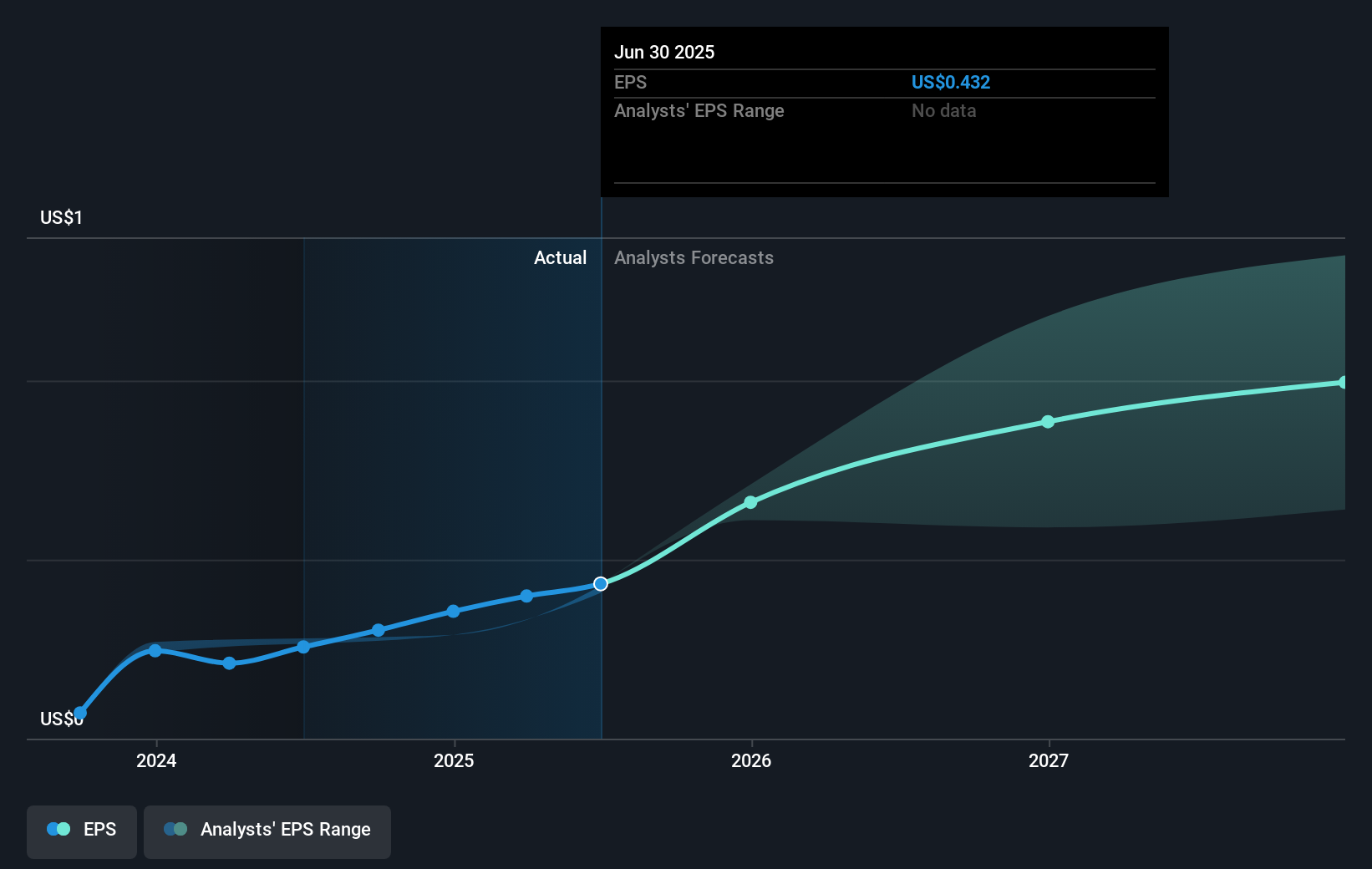

Despite the recent share price surge to $18.70, the current price remains marginally above the consensus analyst price target of $18.45, indicating expectations of market alignment. The strategies outlined, such as international expansion and technological integration, may positively impact future revenue and earnings, potentially bringing the stock closer in line with higher price targets. It's essential for investors to evaluate if these growth drivers align with their expectations and investment objectives, considering the company's current valuation and future prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal