Korn Ferry (KFY) Announces Q2 Earnings Outlook and Completes Share Repurchase Program

Korn Ferry (KFY) recently provided guidance for the second quarter of fiscal year 2026, projecting fee revenue between $690 million and $710 million, alongside earnings per share estimates. Concurrently, the company updated its share buyback, having repurchased 145,770 shares from May to July 2025. Over the past quarter, Korn Ferry's shares increased by 5%, which aligns with the overall market trajectory, with the S&P 500 and Nasdaq reaching record highs. Factors like Korn Ferry's positive earnings and significant buyback activities may have reinforced this upwards movement against a favorable market backdrop.

You should learn about the 1 possible red flag we've spotted with Korn Ferry.

The recent developments at Korn Ferry, including its optimistic fee revenue guidance and active share repurchase program, could reinforce its ongoing strategy to enhance revenue growth through strategic transformation and market expansion. These actions might bolster confidence in the company's narrative of sustained revenue and earnings growth, particularly as it continues to invest in AI tools and expand its service offerings.

Over a five-year period, Korn Ferry's total return, encompassing both share price appreciation and dividends, reached 172.8%, indicating a robust long-term performance. Against the backdrop of the last year's market behavior, Korn Ferry outperformed the US Professional Services industry, which posted a return of 2.6%, underscoring its relative strength within the sector. However, it underperformed the broader US market, which saw a return of 20.5% over the same one-year timeframe.

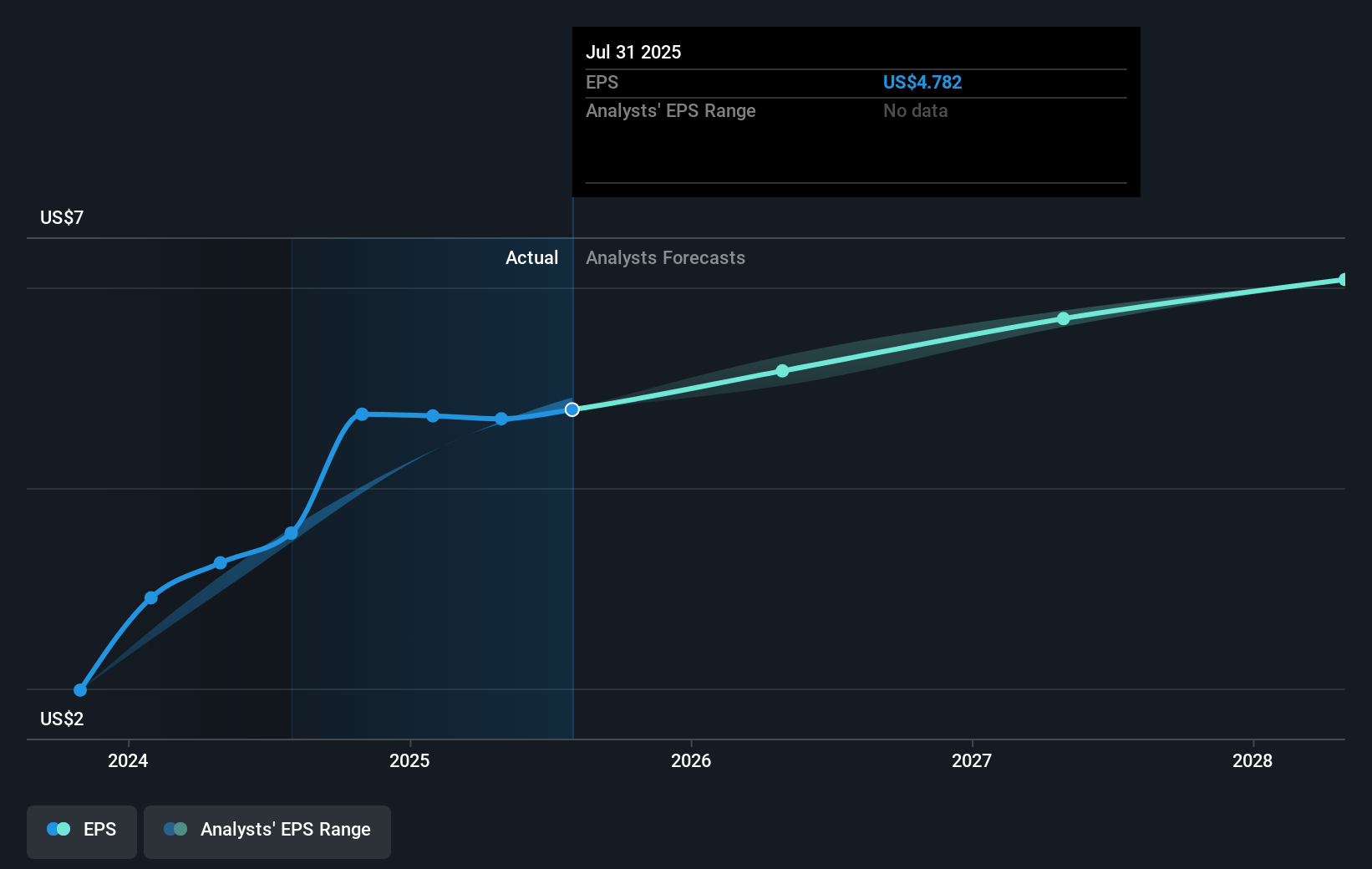

The upward movement in Korn Ferry's share price, although aligned with short-term market gains, remains 12.1% below the consensus price target of US$83.75. This suggests potential growth opportunities for investors who believe in the company's future earnings and revenue prospects. The guidance and buyback activities may lead analysts to fine-tune their revenue and earnings forecasts, factoring in the anticipated improvements in productivity and expanded services. These elements highlight how Korn Ferry's strategic decisions may influence its financial trajectory, aligning it closer to analyst expectations.

Explore historical data to track Korn Ferry's performance over time in our past results report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal