Ciena (CIEN) Collaborates With REDIMadrid For Quantum Secure Data Project

Ciena (CIEN) recently announced a significant collaboration with REDIMadrid to enhance quantum secure data transport infrastructure. The company's stock price surged 69% in the last quarter, a move that coincides with several positive developments. Ciena reported strong Q3 2025 financials, with notable increases in revenue and net income. Additionally, its share repurchase initiatives may have bolstered investor confidence. This appreciation aligns with broader market trends, as the S&P 500 and Nasdaq achieved all-time highs, driven by lower wholesale inflation expectations. These factors collectively contributed to uplifting Ciena's stock, reflecting both internal successes and a supportive market backdrop.

Buy, Hold or Sell Ciena? View our complete analysis and fair value estimate and you decide.

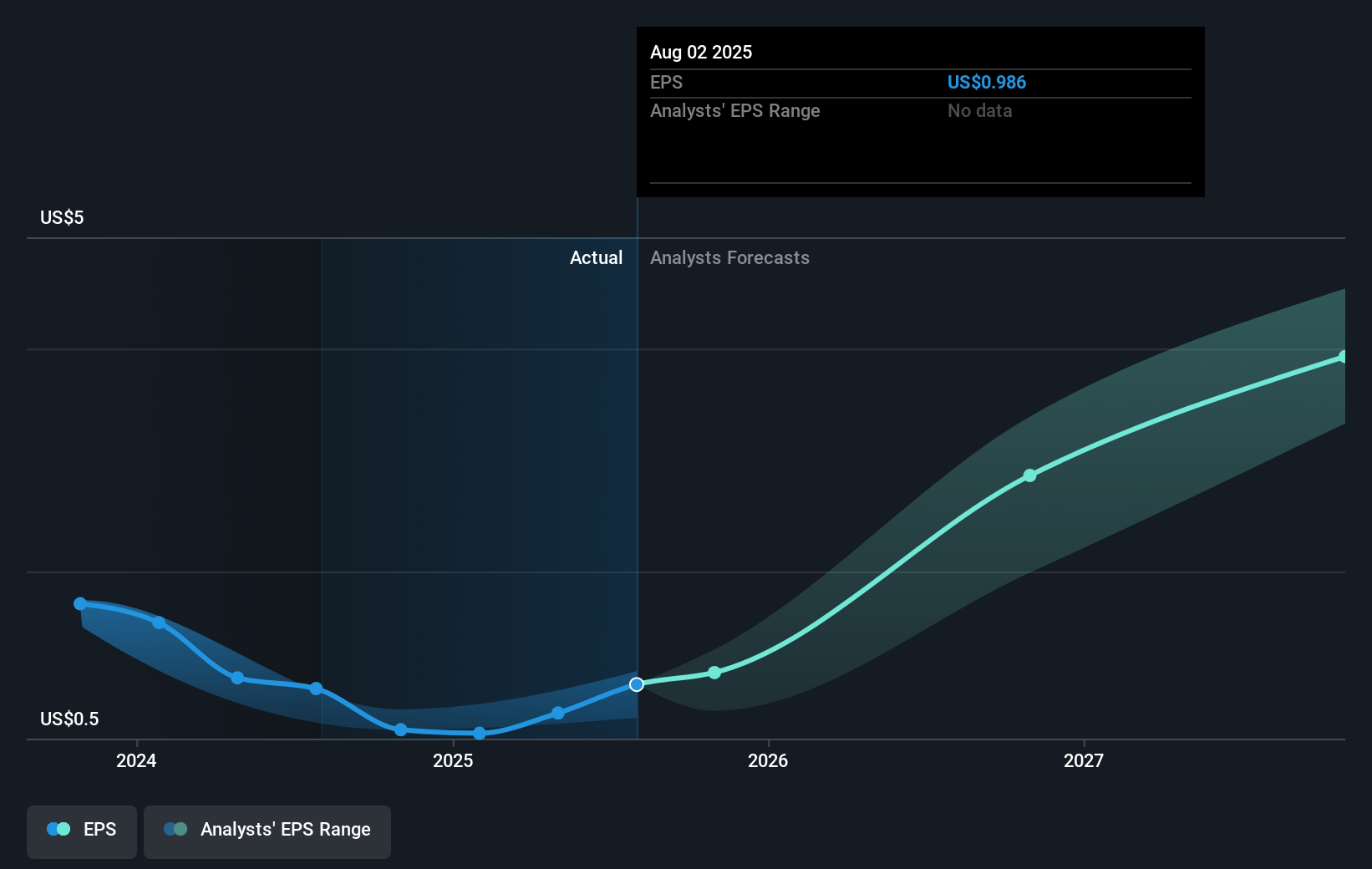

Ciena's recent collaboration with REDIMadrid on its quantum secure data transport infrastructure could potentially enhance its market position, aligning with its narrative of capturing market share through advancing network technologies. The positive news surrounding this partnership complements Ciena's robust financials and could feed into growing demand from cloud and AI workloads, potentially uplifting revenue and earnings projections. Analysts' forecasts already consider a substantial growth trajectory, with earnings anticipated to rise significantly over the next few years, bolstering investor sentiment and market confidence.

Over a five-year period, Ciena's total shareholder returns, including share price and dividends, were a substantial 193.58%. This reflects a strong, long-term performance compared to its peers in the communications industry, which delivered a return of 49.8% over the past year. Despite a recent surge in the share price, up 69% last quarter, the current price of US$122.19 slightly exceeds the consensus analyst price target of US$120.41, suggesting some perceived overvaluation or perhaps anticipation of continued growth driven by its strategic initiatives.

The rise in Ciena’s share price in relation to its price target indicates optimism and confidence among investors about its future prospects, driven by its ability to tap into growing sectors like AI and cloud computing. However, the price target being lower points to potential risks and cautious optimism among analysts. The recent developments and collaborations emphasize Ciena's commitment to innovation, which could support revenue and earnings growth, yet careful monitoring of the broader competitive landscape and risks is essential for investors.

Understand Ciena's earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal