Stifel Financial (SF): Is There More Value as Recent Momentum Draws Investor Attention?

Stifel Financial (SF) caught the eye of investors this week, as a recent movement in its share price stirred up conversations about its future potential. While there was no headline-grabbing news behind this latest shift, sometimes it is exactly these quieter moments that make people wonder if the market is signaling a change in outlook for the company. Whether you have followed Stifel Financial for years or are just tuning in, you are probably wondering what is next for this long-running player in the financial services space.

Looking at the bigger picture, Stifel Financial has posted steady performance over the past year. Shares have climbed 37% over the last twelve months, and momentum has especially picked up over the past three months with a 16% rise. This follows revenue and net income growth rates of about 10% and 39% annually, respectively, reflecting strength in both the top and bottom lines. These trends suggest investors have steadily gained confidence in Stifel Financial’s earnings power as the company continues to adapt to changes in the broader financial sector.

The question now is, with the stock’s recent gains and a backdrop of improving fundamentals, does Stifel Financial offer a bargain at current levels or are investors already pricing in the company’s growth prospects?

Most Popular Narrative: 11.2% Undervalued

The prevailing view among analysts suggests that Stifel Financial is currently trading below its fair value, with room for further upside should its earning power materialize as expected.

Stifel's recruitment focus on higher-producing advisers and the addition of new advisers and teams, including 36 from the B. Riley acquisition, is expected to enhance productivity and drive significant revenue growth in Global Wealth Management.

The firm’s strong pipelines in financial advisory and institutional banking, particularly in sectors like technology, industrial services, and a growing appetite for bank M&A, suggest potential for increased investment banking revenue as market conditions stabilize.

Curious how aggressive expansion and future-focused hiring might shape Stifel’s global ambitions? The narrative’s fair value hinges on projections for rising margins and ambitious earnings growth. These numbers may surprise even longtime followers. Will these bold assumptions hold up against real-world results, or is this just the tip of the iceberg? Find out what’s fueling the optimism by exploring the full analyst story behind the target price.

Result: Fair Value of $126.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing legal challenges and persistent market volatility could still derail these optimistic projections, potentially weighing heavily on Stifel Financial’s future performance.

Find out about the key risks to this Stifel Financial narrative.Another View: Our DCF Model Offers a Different Perspective

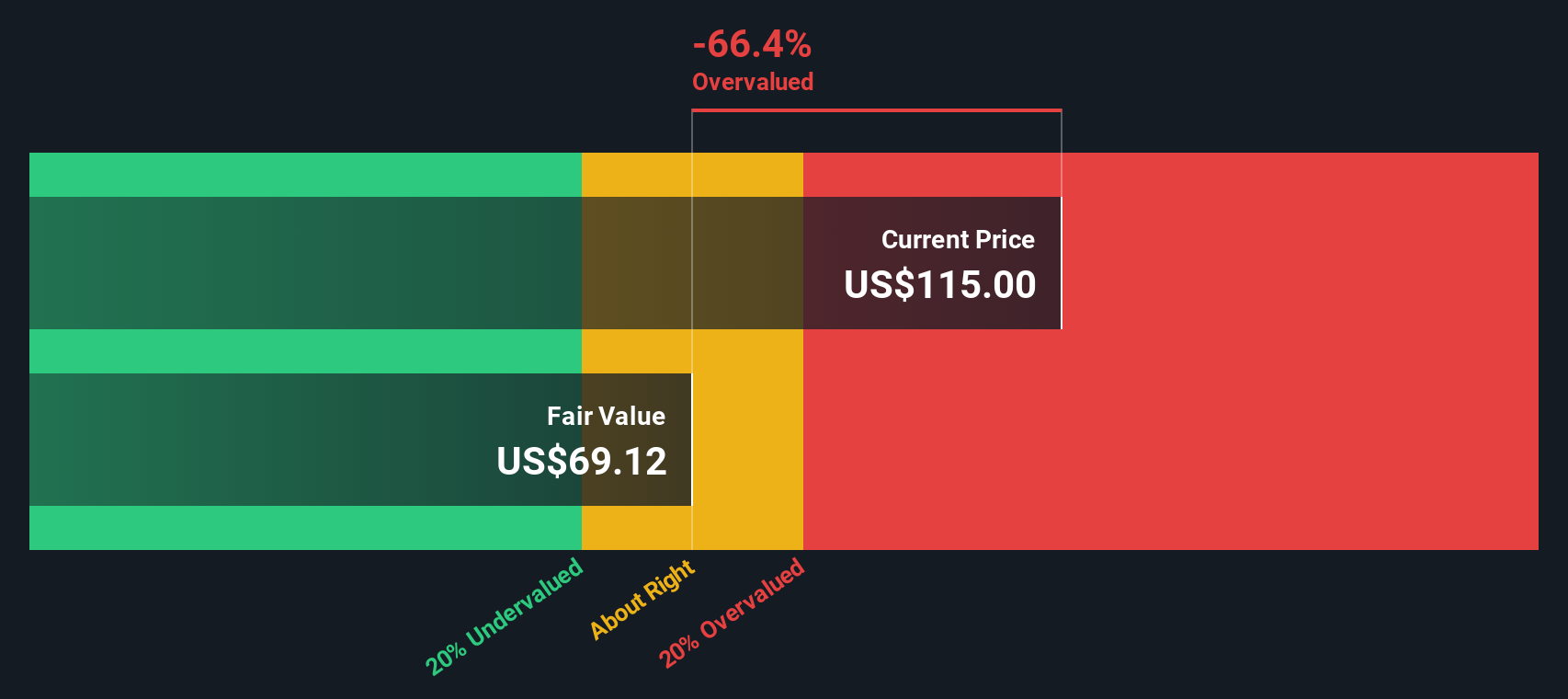

While analysts see value in Stifel Financial based on earnings growth forecasts, our SWS DCF model tells a different story. This alternative method suggests the company may not be as undervalued as many believe. What factors could tip the scale either way?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Stifel Financial Narrative

If you want to dig deeper or craft a story that's all your own, you can dive into the numbers and assemble your perspective in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Stifel Financial.

Looking for More Smart Investment Ideas?

Steer your portfolio toward untapped opportunities. Don’t let tomorrow’s winners pass you by. Let Simply Wall Street’s screener point you to fresh potential today!

- Take charge of your finances and hunt for undervalued gems before the crowd by using our undervalued stocks based on cash flows to spot stocks trading below their real worth.

- Capitalize on rapid breakthroughs at the cutting edge of healthcare by tapping into healthcare AI stocks driving medical innovation and next-generation patient care.

- Secure reliable income streams and aim for stability by targeting dividend stocks with yields > 3% offering robust yields above 3% in today’s market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal