Newmark Group (NMRK): Evaluating Valuation After Strategic Leadership Hire and Major Global Expansion Moves

If you’re tracking commercial real estate, Newmark Group (NMRK) just gave investors something to chew on. The company has hired Stefan Burch, a veteran with deep experience across Middle Eastern markets, as Senior Managing Director to build out its operations in the region and launch a new office in Dubai. This move, part of Newmark’s broader global expansion, isn’t just about opening another branch. By recruiting Burch, who has a knack for large-scale development advisory and has held leadership roles at Deloitte and Knight Frank, Newmark is signaling a real intent to capture a bigger slice of lucrative markets beyond North America.

The news comes on the back of several major transactions that underscore Newmark’s scaling ambitions. Within weeks, the company not only arranged a $425 million refinancing for a national self-storage portfolio but was also a key advisor on a $4 billion joint venture focused on an AI data center campus. Despite all this activity, Newmark’s stock has gained 29% over the past year and almost 60% in the past three months, hinting at growing confidence among investors as the company’s momentum builds.

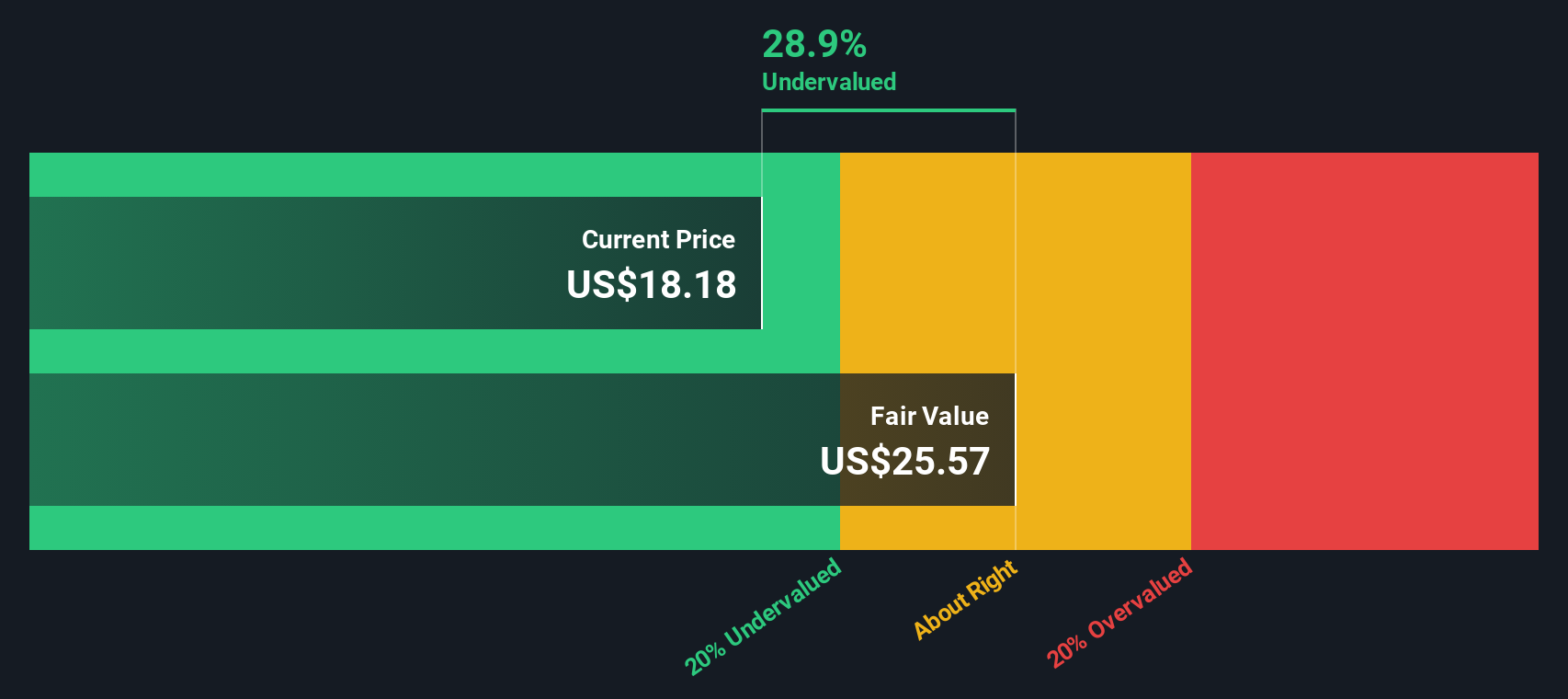

So after this year’s performance and headlines, is there room left for upside due to undervaluation, or is the market already pricing in Newmark’s future global growth?

Most Popular Narrative: Fairly Valued

According to the most widely followed narrative, Newmark Group is considered fairly valued at current prices, with the stock trading just slightly below the consensus analyst target. This suggests that the market is closely aligned with the prevailing outlook on the company’s future growth and profitability.

Enhanced technology integration and the provision of comprehensive client solutions, including valuation, advisory, and flexible workspace consulting, are increasing operational efficiency and enabling margin improvement. This is expected to have a positive impact on net margins over time.

Curious about what keeps this valuation high? Under the surface are game-changing growth assumptions, projected efficiencies, and a unique profit trajectory that challenges industry norms. Want the details on which specific forecast is tipping the scales? The narrative’s boldest numbers and the rationale behind this fair value are available with a closer look.

Result: Fair Value of $18.45 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.However, international expansion and heavy investment in data centers could pressure margins or stall growth if execution stumbles or if market cycles shift unexpectedly.

Find out about the key risks to this Newmark Group narrative.Another View: SWS DCF Model Points to Undervaluation

While most analysts see Newmark as fairly valued, our SWS DCF model leads to a very different conclusion. The model suggests the stock is actually undervalued. Can both approaches be right, or is something being overlooked?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Newmark Group Narrative

If this assessment doesn’t match your view or you’d rather dive into the numbers yourself, it’s simple to craft your own perspective in just a few minutes. Do it your way.

A great starting point for your Newmark Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t just watch from the sidelines. Give yourself a real edge by focusing on hidden gems, powerful industry shifts, and steady income picks. These are opportunities that the most agile investors are always on the lookout for.

- Tap into high-upside potential by searching for penny stocks with strong financials using penny stocks with strong financials.

- Capture the boom in healthcare innovation through companies driving tomorrow’s breakthroughs with healthcare AI stocks.

- Maximize your returns by focusing on stocks offering yields over 3% and consistent dividends with dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal