How Navios Maritime Partners’ (NMM) Methanol-Ready Fleet Investments Could Shape Its Competitive Edge

- In July and August 2025, Navios Maritime Partners sold a 2009-built transhipper vessel for US$30 million and agreed to sell two additional vessels, while on September 8, 2025, the company announced plans to acquire four new methanol-ready, scrubber-fitted containerships with long-term charters, expected for delivery between the second half of 2027 and the first quarter of 2028.

- These recent transactions highlight Navios' push to modernize its fleet with advanced, environmentally compliant ships, suggesting a focus on long-term competitiveness and operational efficiency.

- To assess how Navios’ investment in methanol-ready containerships impacts its outlook, we'll review the effect on its investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Navios Maritime Partners Investment Narrative Recap

To own Navios Maritime Partners, you need to believe in the company's ability to generate sustainable returns through disciplined fleet renewal and long-term charters, despite a challenging freight market. The recent news of fleet sales and investments in methanol-ready containerships aligns with its modernization strategy, but it does not materially offset the short-term risks of oversupply in the containership market or continued pressure on charter rates, which remain the most important catalysts and risks for the business right now. Of the recent announcements, the sale of a 2009-built transhipper vessel for US$30 million stands out. This transaction frees up capital that could be used to support ongoing newbuild commitments or to strengthen liquidity, both significant as Navios faces elevated capex requirements through 2028 and rising debt costs while seeking to maintain stable cash flows amid forecast net fleet growth in the industry. But investors should not overlook the fact that, even as the company refreshes its fleet, the risk of supply outpacing demand in the containership segment remains a real concern...

Read the full narrative on Navios Maritime Partners (it's free!)

Navios Maritime Partners' narrative projects $1.5 billion revenue and $430.1 million earnings by 2028. This requires 5.7% yearly revenue growth and a $125.9 million earnings increase from $304.2 million.

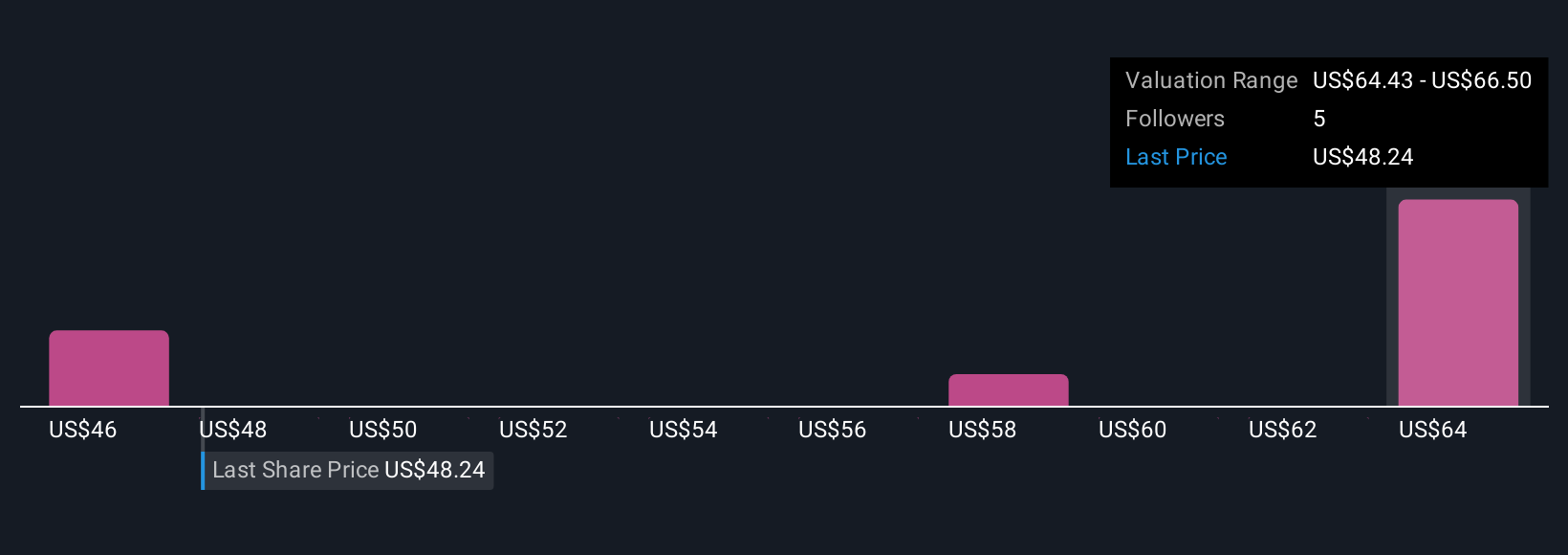

Uncover how Navios Maritime Partners' forecasts yield a $66.50 fair value, a 36% upside to its current price.

Exploring Other Perspectives

Three recent fair value estimates from the Simply Wall St Community span US$46.76 to US$66.50 per unit. While investor opinions differ, potential headwinds from net fleet growth highlight the importance of understanding a range of scenarios for Navios Maritime Partners.

Explore 3 other fair value estimates on Navios Maritime Partners - why the stock might be worth as much as 36% more than the current price!

Build Your Own Navios Maritime Partners Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Navios Maritime Partners research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Navios Maritime Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Navios Maritime Partners' overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal