Century Communities (CCS): Revisiting Valuation After $500 Million Refinancing and Debt Restructuring

If you’re watching Century Communities (CCS) for your next move, the company just made a financing play that could shape its future. Century Communities completed a $500 million offering of senior unsecured notes due 2033 and kicked off a plan to redeem its prior 2027 notes. That may sound dry on the surface, but changes to how a homebuilder manages its debt can ripple through its whole business, from flexibility to interest costs and risk.

This refinancing isn’t happening in a vacuum. Over the past year, Century Communities’ shares have drifted down by 27%, lagging sector peers and the broader market. But momentum has picked up in recent months, as the stock climbed 25% over the past 3 months and 12% over the past month. Combined with modest revenue growth but sharply lower net income, investors are clearly re-evaluating the company’s direction, especially as it continues to launch new communities in California and reshuffles its balance sheet.

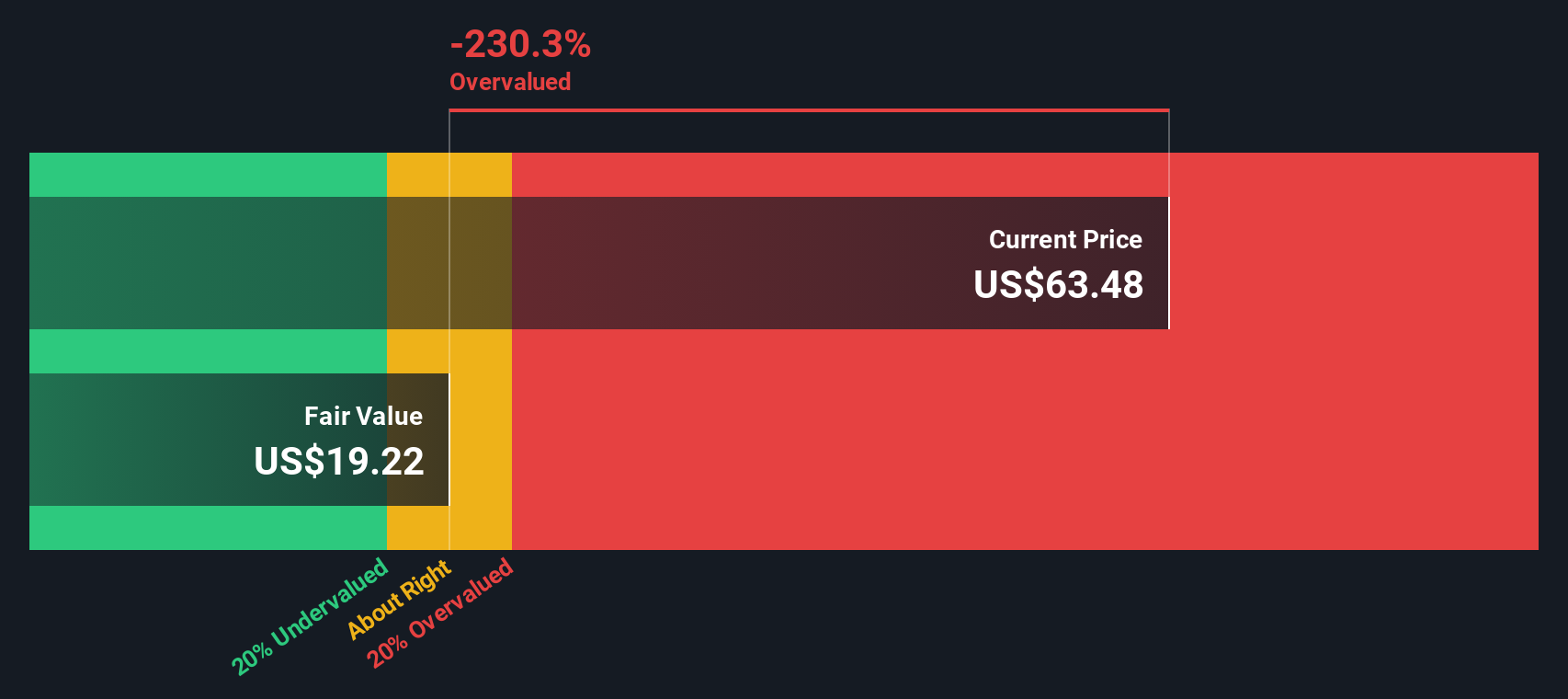

With recent gains on the heels of major refinancing, is Century Communities undervalued after last year’s slide, or is the market already factoring in any benefit from its latest moves?

Most Popular Narrative: 14.2% Overvalued

The leading narrative sees Century Communities as notably overvalued, primarily due to sharply reduced forecasts for revenue growth and profit margins. Analysts now expect the intrinsic value of the stock to be well below recent trading levels, citing both external headwinds and internal pressures.

Ongoing elevated mortgage rates and affordability constraints are dampening homebuyer demand. This is forcing Century Communities to increase sales incentives and accept lower average selling prices, which is already putting downward pressure on gross margins and is expected to weigh further on both revenues and earnings in the coming quarters.

Will the current valuation hold, or is a downside correction waiting in the wings? There are bold financial projections behind this analyst view, involving shifts in sales momentum, margin compression, and long-term earnings power. Want to uncover the figures that have moved consensus fair value down so sharply? Dive into the full narrative for the quantitative drivers and the market logic that underpin this bold call.

Result: Fair Value of $59.50 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, solid underlying demand for affordable new homes and Century's expanding community count could defy expectations and lead to stronger sales than analysts anticipate.

Find out about the key risks to this Century Communities narrative.Another View: Is Market Value Telling a Different Story?

While analyst models see Century Communities as overvalued, a glance at our DCF model tells a different story. This method suggests an even steeper discount to fair value, putting the current price into sharper perspective. Which valuation model should guide your thinking?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Century Communities Narrative

If you want to see what the data says for yourself, or would rather reach your own conclusions, you can generate a personalized narrative in just a few minutes. Do it your way

A great starting point for your Century Communities research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Great investments go beyond a single stock. Get creative with your research and seize fresh opportunities by checking out these unique ideas shaping the next wave of market winners:

- Uncover companies capitalizing on healthcare’s AI transformation and see which innovators could shape tomorrow’s medical breakthroughs with healthcare AI stocks.

- Zero in on hidden gems offering serious yield potential and put your money to work with dividend stocks with yields > 3%.

- Step into the future with emerging leaders in quantum computing and tap into their disruptive growth stories using quantum computing stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal