Green Brick Partners (GRBK): Assessing Valuation as Strategic Positioning Drives Fresh Investor Optimism

Most Popular Narrative: 19% Overvalued

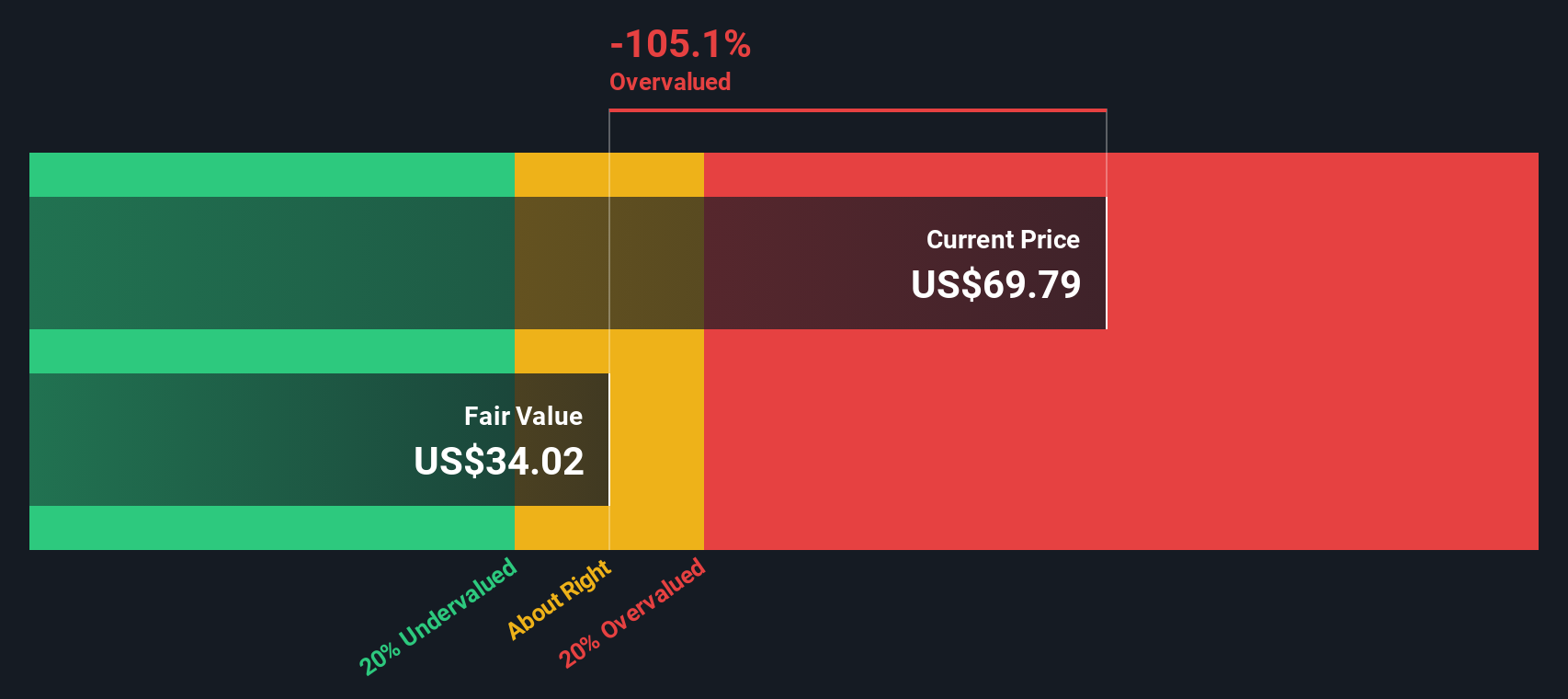

The prevailing narrative sees Green Brick Partners as trading well above its fair value, with analysts expecting future earnings and margins to moderate substantially over the next few years.

Persistent underbuilding in US housing, combined with the millennial cohort entering prime homebuying years, supports a secular supply-demand imbalance that could buoy home prices and unit sales over the coming years. This would benefit Green Brick's revenue outlook.

Green Brick's robust balance sheet (net debt/total capital just 9.4%, significant liquidity, low-cost fixed-rate debt) positions it to capitalize on distressed opportunities and continue share repurchases. This provides downside support to the share price and enhances earnings per share through buybacks.

What is the real story behind this aggressive valuation? The numbers driving this view include ambitious growth targets, margin forecasts, and a premium profit multiple that is far above industry norms. Want to know what assumptions are fueling this high price? Keep digging to uncover how much has to go right for these projections to hold up.

Result: Fair Value of $62 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, record home closings and demographic migration into key markets could still provide a long-term tailwind. This may support revenue growth despite broader headwinds.

Find out about the key risks to this Green Brick Partners narrative.Another View: Our DCF Model Sends a Different Signal

Looking from a different angle, our SWS DCF model does not support the higher valuation suggested by the market. In fact, this approach sees the shares as meaningfully overvalued. Which view will the market agree with in the months ahead?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Green Brick Partners Narrative

If you see things differently or want to dive deeper into the numbers yourself, you can shape a personalized outlook in just a few minutes. Do it your way.

A great starting point for your Green Brick Partners research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't let smart opportunities slip by while focusing solely on Green Brick Partners. Take control of your investing future by actively searching for companies with standout growth, tech, or income potential using our powerful screener:

- Spot high-potential, undervalued companies primed for a bigger move by scanning through undervalued stocks based on cash flows.

- Fuel your portfolio with innovative businesses at the crossroads of AI and healthcare by checking out healthcare AI stocks.

- Target consistent cash flow and stronger income streams by finding dividend stocks with yields > 3% for your watchlist.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal