Robust Enrollment Growth and Efficiency Gains Could Be a Game Changer for Adtalem Global Education (ATGE)

- Adtalem Global Education recently reported fourth-quarter fiscal 2025 earnings and revenues that surpassed consensus estimates, fueled by strong student enrollment growth and increased operational efficiency.

- Significant gains in enrollment, especially at Chamberlain and Walden universities, supported the results even as margin pressures in the Medical and Veterinary segment and higher expenses remain ongoing concerns.

- Let's explore how Adtalem's robust enrollment growth and efficiency gains could shape the company's future investment narrative.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Adtalem Global Education's Investment Narrative?

To see value in Adtalem Global Education, shareholders need to believe the company can sustain growth by converting rising student enrollment into consistent revenue and earnings gains, even as sector and budget challenges persist. The recent upside surprise in fourth-quarter earnings and revenues suggests momentum is building, fueled by double-digit increases in student numbers at Chamberlain and Walden universities and improved operational efficiency. Short-term catalysts, such as further enrollment growth and cost management, may become more influential given the strong results and improved analyst sentiment. On the risk side, ongoing margin pressure in the Medical and Veterinary segment could weigh on profit expansion, despite the latest upbeat trends. If those margin issues worsen or expenses continue to climb, it could mute the benefits of recent gains. Overall, while the Q4 beat shifts attention to operational strengths, margin and expense challenges deserve careful monitoring in the months ahead.

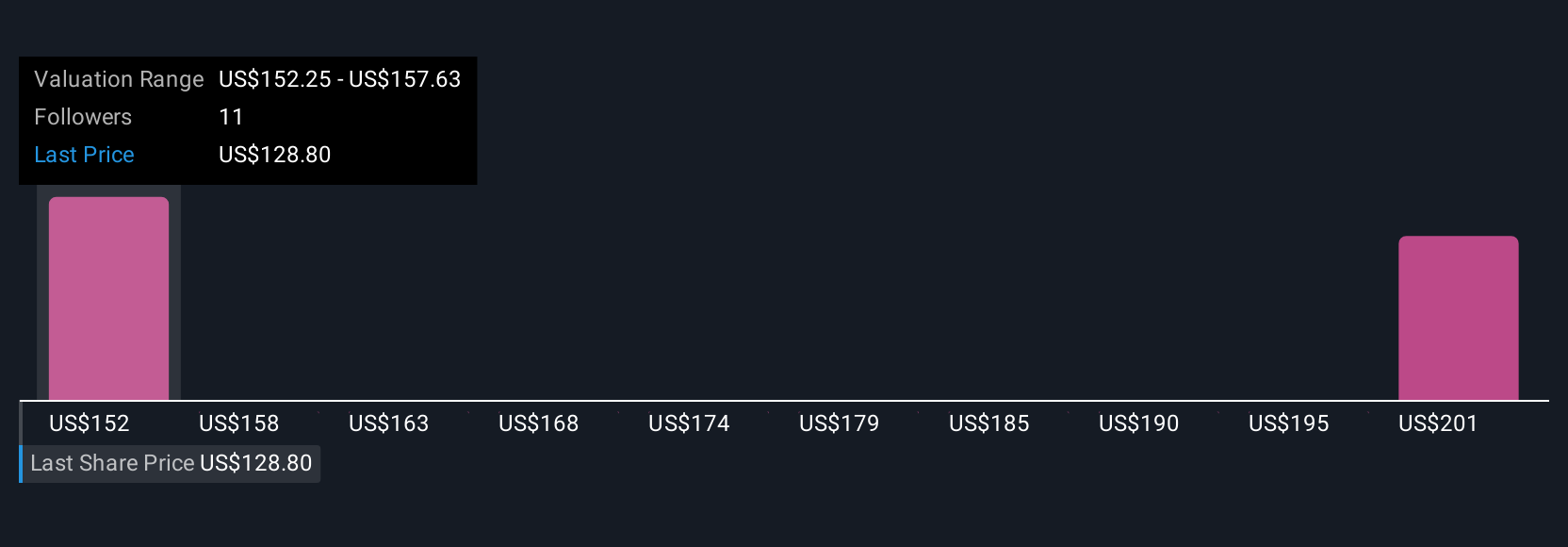

But looming margin pressure in key segments remains something investors should keep top of mind. Adtalem Global Education's shares have been on the rise but are still potentially undervalued by 37%. Find out what it's worth.Exploring Other Perspectives

Explore 2 other fair value estimates on Adtalem Global Education - why the stock might be worth as much as 59% more than the current price!

Build Your Own Adtalem Global Education Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Adtalem Global Education research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Adtalem Global Education research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Adtalem Global Education's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal