Onto Innovation (ONTO): Assessing Valuation Following FANUC Supplier Approval and New Robotics Integration

Onto Innovation (ONTO) is making waves again, this time through its subsidiary 4D Technology’s partnership with FANUC. The company just notched official approval as a collaborative robot device supplier, rolling out a FANUC-certified plug-in that links 4D’s InSpec Optical Surface Gauge with the CRX series of cobots. For anyone following advanced manufacturing, this move is key as it opens the door to smoother and more accessible automation as well as higher-quality inspections across industries like aerospace and medical devices, where precision is everything.

Zooming out, this news lands during an eventful year for Onto Innovation. Despite a 41% dip in share price year-to-date, investors with a longer horizon have still enjoyed a dramatic turnaround since the company became profitable within the last five years. Long-term performance tells a different story, with returns of 476% over three years and more than tripling over five years. This serves as evidence that momentum and optimism around Onto’s technology are far from fading.

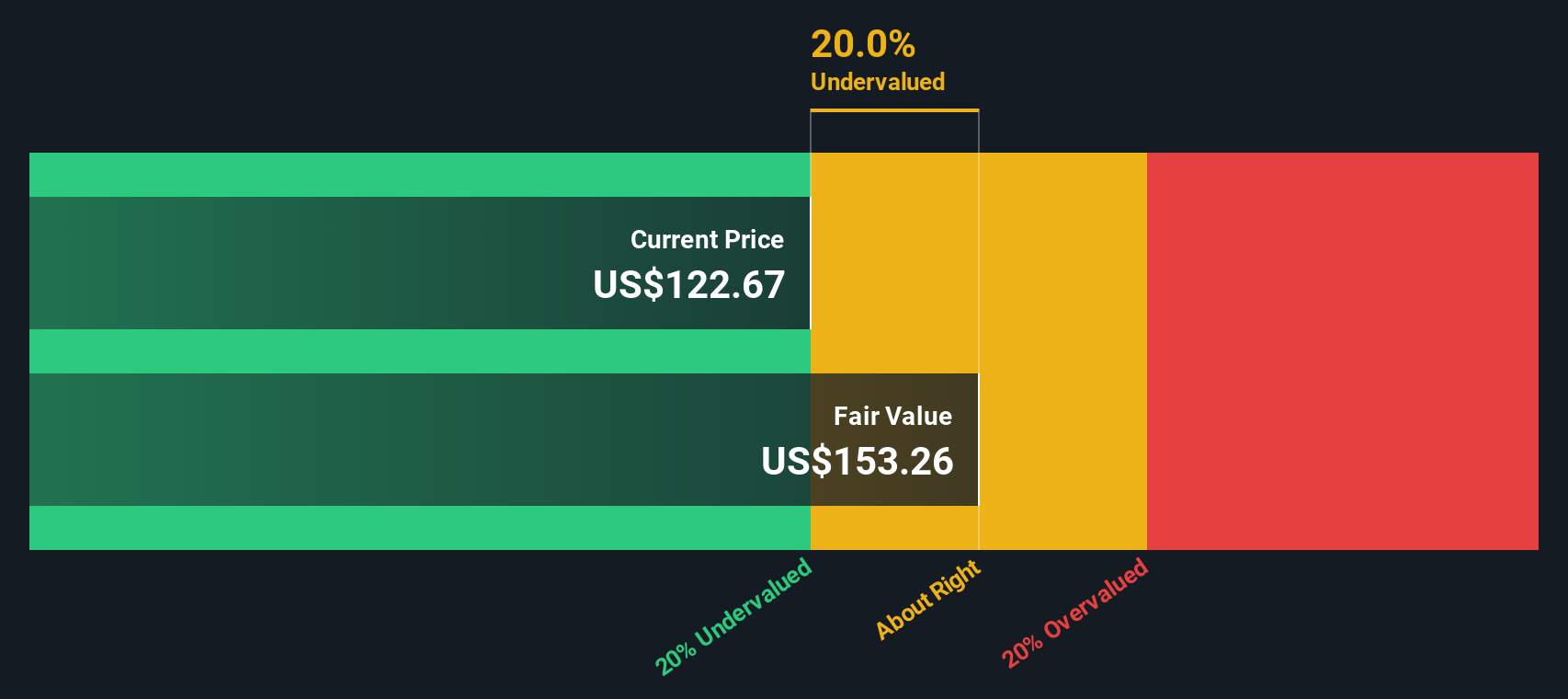

After this year’s drop alongside a promising robotics milestone, is Onto Innovation undervalued right now, or is the market already factoring in its next phase of growth?

Most Popular Narrative: 16.6% Undervalued

According to the most closely followed analyst narrative, Onto Innovation is currently undervalued by nearly 17%. The narrative suggests a notable upside for investors if company performance meets optimistic projections in the coming years.

The pending Semilab acquisition will immediately expand Onto's product portfolio into electrical surface metrology and materials analysis. These capabilities are specifically in demand as the industry transitions to exotic materials and heterogeneous integration. The deal is expected to enable both direct revenue accretion (approximately $130 million annualized) and improvements in gross and operating margins, further increasing earnings per share by more than 10 percent in the first year after the acquisition.

What is fueling the upside case? It is not just buzz; analysts are focusing on a combination of aggressive revenue targets, improving profitability, and a future earnings multiple that rivals sector leaders. Interested in the specifics of which major assumptions could unlock nearly double-digit earnings growth? Explore how a few key changes could reshape Onto Innovation's valuation story.

Result: Fair Value of $125.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks remain if customer demand falters or if the Semilab integration underdelivers. Either scenario could challenge the bullish outlook for Onto Innovation.

Find out about the key risks to this Onto Innovation narrative.Another View: SWS DCF Model Spotlights Further Upside

While analysts see a nearly 17% undervaluation, our DCF model goes further and suggests Onto Innovation may be trading even further below its estimated fair value. Could fundamental cash flows paint a more optimistic story than earnings-based projections?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Onto Innovation Narrative

If you would rather draw your own conclusions or dive deeper into the numbers, it is easy to craft a personal take in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Onto Innovation.

Looking for More Smart Investment Opportunities?

There is no better moment to act. Expand your watchlist and uncover stocks buzzing with potential that others may be missing. With the Simply Wall Street Screener, you can spot industry leaders, emerging trends, and hidden gems primed for growth.

- Capture market upswings by following undervalued stocks based on cash flows that are trading below their true potential, perfect for value-focused investors.

- Accelerate your portfolio’s tech edge with a fresh approach. Track the hottest trends among AI penny stocks reshaping tomorrow’s industries.

- Boost your passive income with proven dividend stocks with yields > 3% and enjoy the confidence of steady yields above the market average.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal