Is Divesting Aerospace and Raising 2025 Guidance Altering the Investment Case for Leggett & Platt (LEG)?

- Leggett & Platt recently finalized the sale of its aerospace unit, expecting after-tax proceeds of around US$250 million, and raised its 2025 earnings guidance with updated sales and EPS ranges.

- This combination of operational refocus and improved profitability outlook suggests the company is actively repositioning its business and future prospects.

- We'll examine how the aerospace divestiture and raised earnings guidance reshape Leggett & Platt’s investment narrative and business outlook.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Leggett & Platt Investment Narrative Recap

To own Leggett & Platt, you need to believe the company can pivot effectively out of slower-growth segments like aerospace and boost profitability in its core bedding and furniture businesses. The recent aerospace divestiture and higher EPS guidance improve short-term earnings visibility, though weak residential bedding demand remains the critical near-term challenge; neither announcement materially shifts the biggest risk, which is ongoing margin pressure from aggressive industry discounting.

The company's latest guidance increase, raising 2025 EPS expectations to US$1.43–US$1.72 from a previous US$0.88–US$1.17, is the most pertinent recent update. This development reflects management's view of improved operational profitability following the aerospace sale, signaling increased confidence in delivering cost savings and margin improvement, which are key to offsetting sector headwinds.

But despite these positive signals, investors should also consider the risk that...

Read the full narrative on Leggett & Platt (it's free!)

Leggett & Platt's outlook anticipates $4.3 billion in revenue and $200.1 million in earnings by 2028. This reflects a 0.7% annual revenue decline and a $57.9 million increase in earnings from the current $142.2 million.

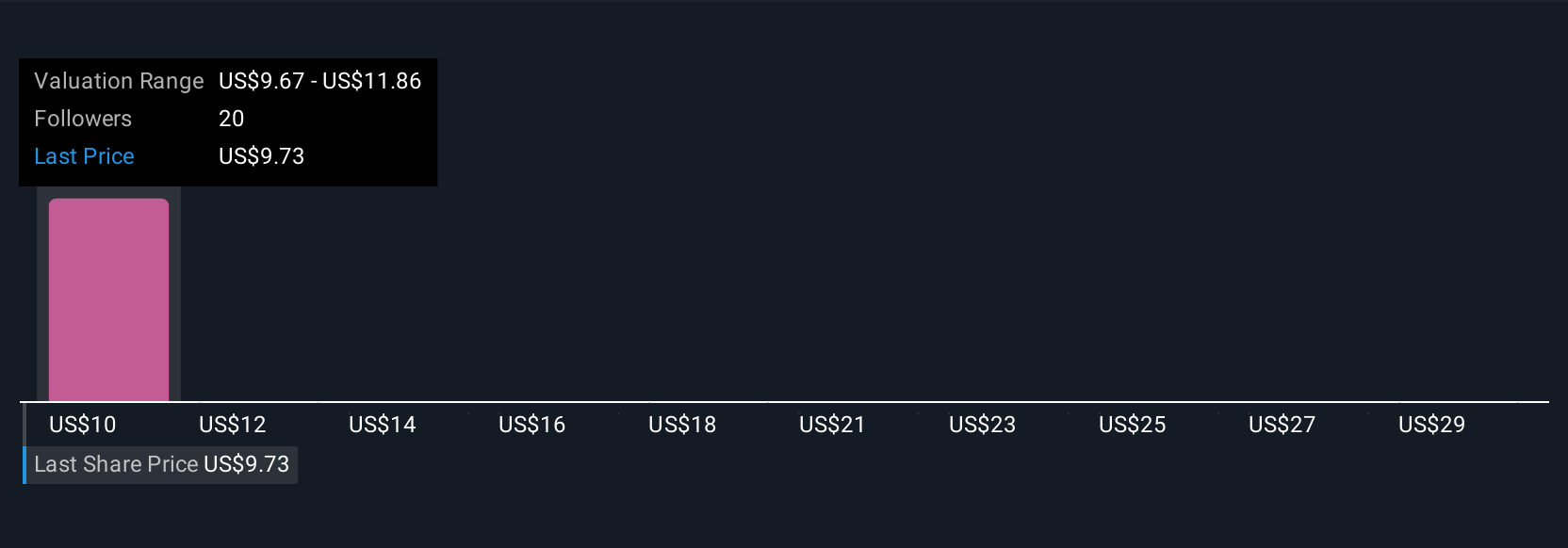

Uncover how Leggett & Platt's forecasts yield a $9.67 fair value, in line with its current price.

Exploring Other Perspectives

Simply Wall St Community members have published seven fair value estimates for Leggett & Platt, spanning from US$9.67 up to US$31.63 per share. While opinions differ sharply, the ongoing uncertainty about volume recovery in bedding products remains a critical theme to watch across these viewpoints.

Explore 7 other fair value estimates on Leggett & Platt - why the stock might be worth just $9.67!

Build Your Own Leggett & Platt Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Leggett & Platt research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Leggett & Platt research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Leggett & Platt's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal