Bioceres Crop Solutions (NasdaqGS:BIOX): Evaluating Valuation Following Q4 Losses and Leadership Changes

Bioceres Crop Solutions (NasdaqGS:BIOX) has recently come under the spotlight after announcing its fourth quarter results. This event is significant for shareholders trying to make sense of the numbers. Sales dropped sharply to $74.4 million from $124.3 million a year ago, and the company posted a net loss of $44.3 million, a stark contrast with last year’s break-even result. Adding to this shakeup, the Chief Commercial Officer and board member, Mr. Milen Marinov, stepped down just ahead of the announcement. No public disagreement was cited, but the departure still creates another layer of intrigue for those tracking company leadership.

Big swings like these naturally raise eyebrows, especially when looking at how Bioceres Crop Solutions’ stock has performed over the past year. The share price has declined significantly, and recent market momentum continues to cool. Investors have seen a steady slide since the start of the year, with performance lagging even further over the past month and three-year stretch. Meanwhile, that leadership transition may spark questions about strategy and execution, potentially weighing further on investor sentiment at a time when clarity is most needed.

With shares trading far below previous levels and the latest results out, some may be wondering whether this is the moment to pick up a turnaround story at a discount or if the market could be pricing in additional challenges ahead.

Most Popular Narrative: 67% Undervalued

The most closely followed narrative sees Bioceres Crop Solutions as significantly undervalued, with expectations of major upside if strategic changes succeed. Current pricing leaves a wide discount to future value estimates built on a very different earnings profile for the company.

Bioceres Crop Solutions is transitioning to a capital-light business model by exiting breeding, seed production, and seed commercialization. The company is partnering instead with leading seed companies. This should reduce operational costs and improve net margins by focusing on higher-margin royalty income.

Want to know why this turnaround valuation stands out? The narrative bets on sharply rising margins and a leap in earnings power that could rewrite the company’s story. Curious about which bold future assumptions create such a big gap with today’s share price? Read the full narrative to uncover the key financial drivers and the strategy at the heart of this undervaluation claim.

Result: Fair Value of $6.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing economic instability in Argentina and the loss of operational control from new partnerships could pose challenges to the turnaround story investors are hoping for.

Find out about the key risks to this Bioceres Crop Solutions narrative.Another View: What Does the SWS DCF Model Say?

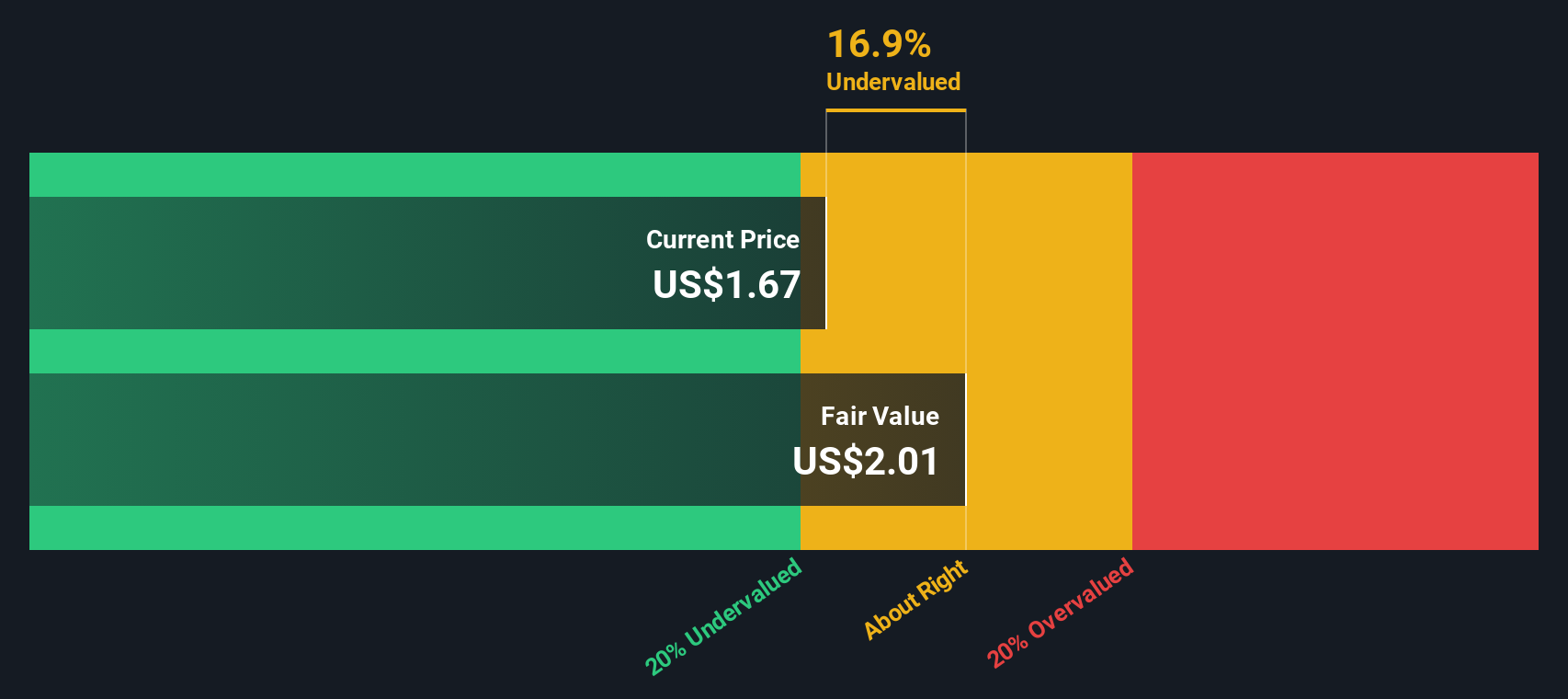

Stepping back from analyst estimates, the SWS DCF model also suggests that Bioceres Crop Solutions may be undervalued. However, every model relies on its own assumptions. Which outlook do you trust?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Bioceres Crop Solutions Narrative

If you have a different perspective or want to dig into the details yourself, you can easily craft your own take on Bioceres Crop Solutions in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Bioceres Crop Solutions.

Looking for More Great Investment Opportunities?

Smart investors always keep an eye out for new trends and market shifts. Don't miss out on other top opportunities you can spot right now using our handpicked screens below.

- Boost your search for high-yield cash flows with a list of stocks primed to be undervalued gems by heading to our undervalued stocks based on cash flows.

- Spot the most promising up-and-coming tech innovators in artificial intelligence by following leads from our AI penny stocks.

- Unlock the potential of future market leaders in healthcare technology by exploring the breakthroughs highlighted in our healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal