A Fresh Look at Advanced Drainage Systems (WMS) Valuation After Notable Investor Interest

Advanced Drainage Systems Catches Investor Attention After Recent Moves

Sometimes a stock’s shift in momentum makes you pause and wonder if something is happening beneath the surface. Advanced Drainage Systems (WMS) has been on that radar lately, with investors keeping a close watch even without a clear news trigger. Whether you have held shares for years or are just considering an entry, the stock’s current trajectory is hard to ignore.

Looking at the bigger picture, Advanced Drainage Systems posted modest losses this week but has still delivered an 18% gain over the past three months. Its year-to-date return sits over 20%, while performance over the past year has slightly dipped into negative territory. Longer-term shareholders are, however, still comfortably ahead. This blend of recent growth and longer-term volatility is raising questions about what the market is expecting next.

So, is this a tempting value entry point, or are today’s prices already reflecting all the growth Advanced Drainage Systems can deliver?

Most Popular Narrative: 10.6% Undervalued

According to the most widely followed narrative, Advanced Drainage Systems appears undervalued by over 10% relative to its fair value, factoring in a discount rate of 8.34%. The valuation is anchored by projections of steady growth in both revenue and profit margins in the years ahead.

Ongoing climate change and increasing frequency and severity of extreme weather events are driving up the necessity for advanced stormwater management and resilient drainage infrastructure, underpinning structural, long-term volume growth, and supporting sustained revenue acceleration.

Want to find out what is fueling this bullish valuation? The narrative leans heavily on a blueprint of expanding margins and ambitious earnings growth, with expectations usually reserved for top-performing sectors. If you are curious about the bold financial projections justifying the price target, and what it would take for the market to agree, this is one story you will want to explore.

Result: Fair Value of $154.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks such as choppy end-market demand and surging raw material costs remain real catalysts that could challenge Advanced Drainage Systems’ bullish outlook.

Find out about the key risks to this Advanced Drainage Systems narrative.Another View: How Do Valuation Ratios Stack Up?

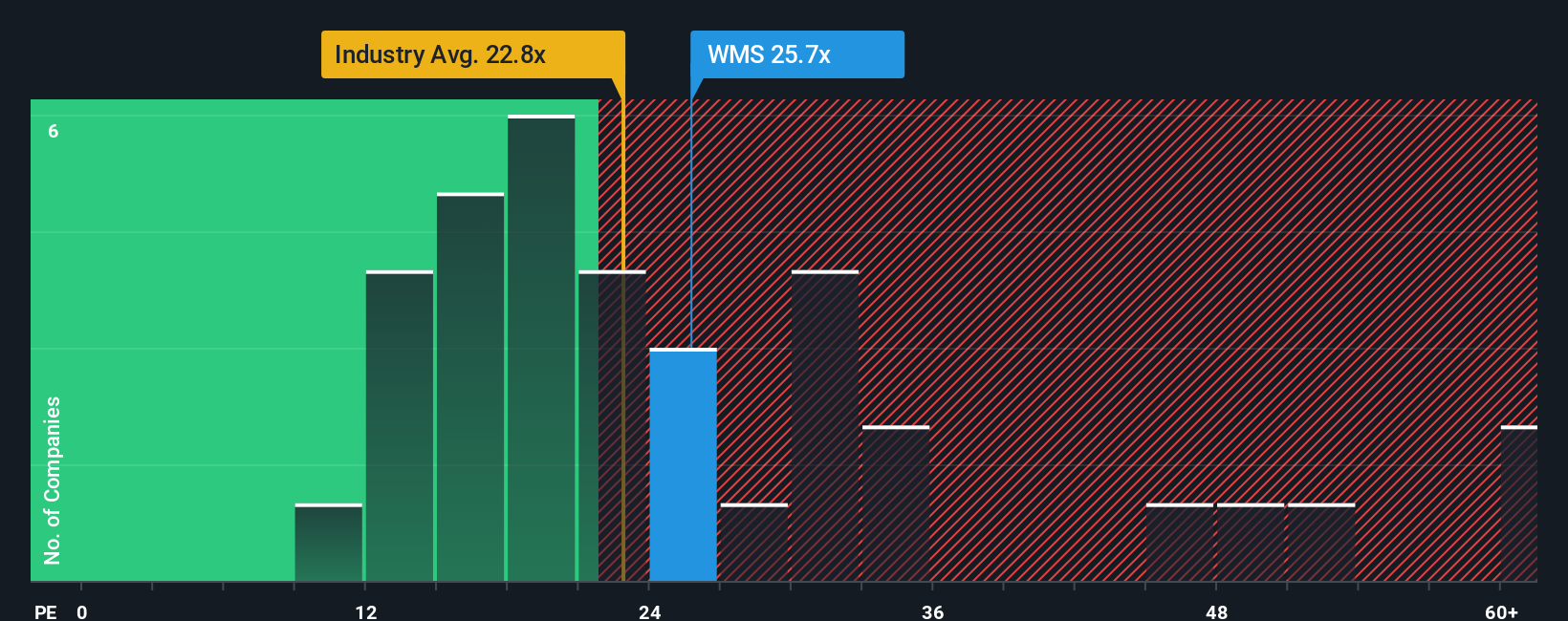

While the analyst consensus points to an undervalued stock, a look at industry ratios offers a different perspective. Advanced Drainage Systems currently trades at a higher valuation compared to sector averages, which raises questions about how much potential is already reflected in the price. Which view will ultimately prove correct?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Advanced Drainage Systems Narrative

If you are interested in drawing your own conclusions, you can review the numbers and highlight a personal narrative in under three minutes. Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Advanced Drainage Systems.

Ready for More Winning Ideas?

Now is the perfect time to take your investing journey further. Get ahead of the curve by checking out these unique opportunities curated by Simply Wall Street.

- Supercharge your watchlist with growth potential by reviewing AI penny stocks, which are shaping tomorrow’s markets with cutting-edge artificial intelligence breakthroughs.

- Uncover high-yield opportunities by using dividend stocks with yields > 3%, designed for those seeking steady income from reliable and robust companies.

- Tap into undervalued gems waiting to be noticed with undervalued stocks based on cash flows and position yourself for smarter, data-driven gains.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal